Centralised vs Decentralised Exchange: What is the Difference?

The cryptocurrency market is constantly evolving, and with the rise of digital assets, it's important to have secure and efficient platforms for cryptocurrency trading. Decentralised (DEX) and centralised (CEX) exchanges are two popular types of platforms for trading cryptocurrencies, but they differ in many ways. In this article, we'll explore the difference between centralised and decentralised exchanges (CEX vs DEX) and help you understand which type of crypto exchange may best fit your needs.

What are centralised exchanges?

Centralised crypto exchanges are online platforms where users can buy, sell and trade cryptocurrencies. These exchanges act as intermediaries between buyers and sellers and hold users' assets in centralised accounts, which means that the exchanges have control over their users' assets.

Advantages of CEX

CEXs have achieved their current popularity for a reason. They have a number of advantages that make them very attractive in the eyes of crypto traders:

- Ease of use. CEXs typically have user-friendly interfaces that make it easy for even novice traders to buy and sell cryptocurrencies.

- Liquidity. CEXs often have high trading volumes, leading to lower slippage and better prices.

- Fiat integration. Many CEXs allow users to deposit and withdraw funds using fiat currencies, acting as a gateway between fiat currencies and cryptocurrencies and making it easier for people to enter and exit the crypto market.

- Advanced trading tools. CEXs usually offer advanced trading tools, such as margin trading and stop-loss orders.

- Faster transactions. Because CEXs have centralised systems, transactions can be processed faster than on DEXs. This opens up the possibility of high-frequency trading (HFT), which is not possible on DEXs in most cases.

- Lower chance of running into fraudulent assets. Reputable CEXs usually audit assets before listing them.

- Customer support. CEXs typically have customer support teams that can assist users with issues or questions they may have.

- Additional earning options. Some CEXs offer additional earning options such as staking, lending, etc.

CEX disadvantages

Despite such compelling benefits, CEXs have several drawbacks that have led many crypto traders to opt for DEXs:

- Security. Because CEXs hold users' assets in centralised accounts, they can be vulnerable to hacking and other security breaches.

- Lack of privacy. CEXs typically require users to provide personal information and go through know-your-customer (KYC) and anti-money-laundering (AML) procedures.

- Limited control: Users don't have full control over their assets when they are stored on a CEX account.

- Single point of failure. CEXs may shut down, go bankrupt or be hacked, which can cause users to temporarily or permanently lose access to the platform and their assets.

- Geographical restrictions. Some CEXs may not be available for residents of certain countries or regions.

- Risk of unethical practices. Because CEXs control the order book and have access to users' trading data, they may be able to engage in insider trading or other unethical practices.

- Risk of government intervention. CEXs may be subject to government intervention or restrictions, which can impact the ability of users to access the platform or trade certain assets.

What are decentralised exchanges?

Decentralised exchanges are online platforms for buying, selling and trading cryptocurrencies that operate on a blockchain network. Unlike CEXs, which hold users' assets in centralised accounts and act as intermediaries, DEXs use smart contracts to facilitate peer-to-peer trading without needing an intermediary. This means that users have full control over their assets at all times, and the exchange doesn't have access to the user's private keys. Instead, the trading account on a DEX is the user's crypto wallet, which the user connects to the platform.

You can find out more about how DEXs work in our previous article.

Advantages of DEX

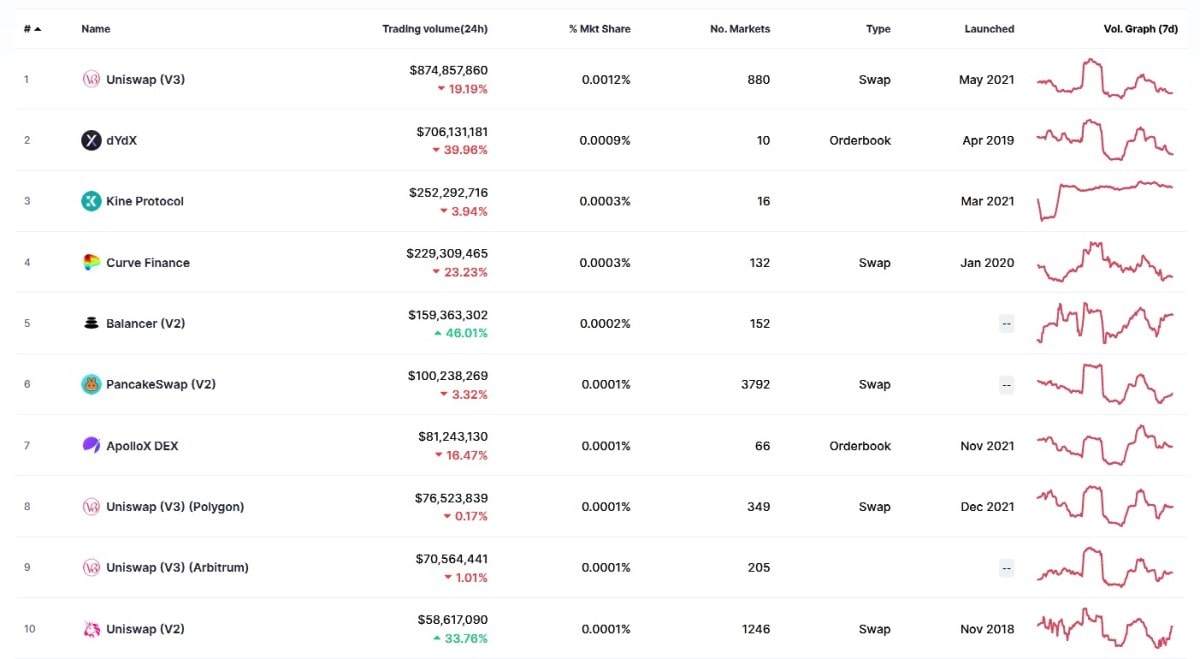

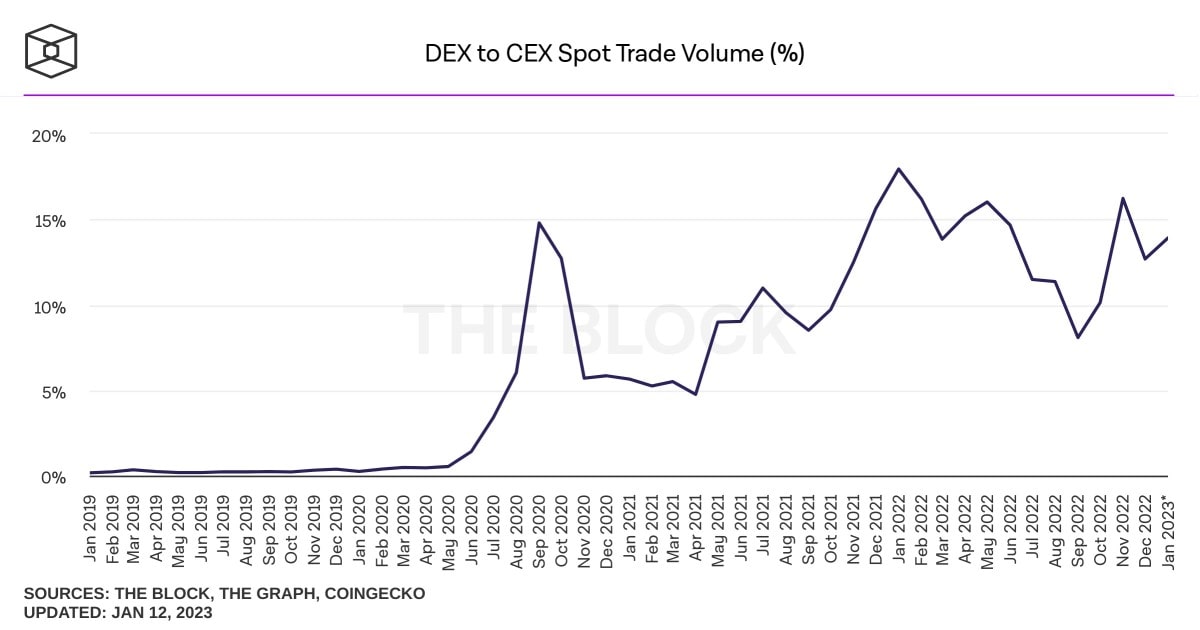

Despite strong competition from CEXs, DEXs continue to grow in popularity, and for many reasons:

- Privacy. DEXs typically do not require users to provide personal information or go through KYC and AML procedures, which provides users with a higher degree of privacy.

- Censorship resistance. Because DEXs are decentralised and operate on a blockchain, they are resistant to censorship and government intervention.

- Security. DEXs can be more secure than centralised exchanges because they do not hold users' assets in centralised accounts and users retain control of their private keys.

- Control over funds. Users have full control over their assets at all times.

- No single point of failure. Because DEXs operate on a decentralised network, there is no single point of failure. This means that if one or more nodes in the network go down, the network will continue to operate, and trades can still be executed.

- Rapid asset listing. When the relevant liquidity pools are filled, new crypto assets are immediately available for trading on DEX.

- Accessibility. DEXs can be accessible to anyone with an internet connection, which makes them accessible to people in countries with strict capital controls or where some or all crypto exchanges are banned.

DEX disadvantages

DEXs are still a relatively new concept and have a number of drawbacks:

- Complexity. DEXs often have less user-friendly interfaces and can be more complex to use than CEXs.

- Low liquidity. DEXs often have lower trading volumes and liquidity compared to CEXs, which can make prices less favourable and the execution of trades slower. It's worth noting, however, that with the increasing popularity of DEXs, this problem has gradually become less acute.

- No fiat integration. DEXs typically do not support fiat currencies.

- Limited features. DEXs typically have fewer features and advanced trading tools compared to CEXs.

- Slower transactions. Because of the dependency on transaction confirmation speed on the blockchain, transactions on DEXs tend to be slower than on CEXs.

- Fraudulent assets. DEXs do not audit assets before listing; anyone can list a token on a DEX.

- Smart contract risks. DEXs rely on smart contracts, so if there's any bug in the smart contract code, it can lead to the loss of funds.

- Lack of customer support: DEXs typically don't have customer support teams, which can make it more difficult for users to resolve issues or get help with questions.

It's worth noting that DEXs are now actively evolving and improving in an attempt to solve these problems.

Difference between CEX and DEX

While both CEXs and DEXs allow users to trade cryptocurrencies, they have several major differences. Let's summarise the most notable of these differences in the table.

Key differences between DEX and CEX

CEX/DEX differences | CEX | DEX |

Acts as an intermediary | Yes | No |

Location of user funds | Centralised account | User's crypto wallet |

Users' control over their funds | Limited | Full |

Single point of failure | Yes | No |

Privacy | Low | High |

Censorship resistance | No | Yes |

Fiat integration | Typically yes | No |

Speed of trading transactions | High | Typically low |

Audit of assets before listing | Yes | No |

Risk of loss of funds due to hacking | Low to Medium | Low |

Risk of unethical practices | Yes | No |

DEX vs CEX: which crypto exchange to choose?

The choice between a CEX and a DEX depends on an individual's preferences and needs.

Both CEXs and DEXs have their own advantages and disadvantages, and both types of exchanges have their own unique use cases and can be suitable for different types of traders.

CEXs are generally more user-friendly, have higher trading volumes and liquidity, and offer advanced trading tools, customer support and fiat integration. These features make CEXs more suitable for novice traders and those looking for a more traditional trading experience.

On the other hand, DEXs are more suitable for those who value decentralisation, privacy, censorship resistance and control over their assets. DEXs can also be more suitable for experienced traders and those who are more technically savvy.

Moreover, given the advantages of DEX and CEX in different situations, it's also worth considering using both types of exchanges for different purposes.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.