The Purpose of Bitcoin ETF: Everything you need to know

Bitcoin has gained a notable place in the financial landscape, and the arrival of Bitcoin exchange-traded funds (ETFs) sparked significant interest. In this article, we'll explain Bitcoin ETFs, their purpose and the other things investors need to know about them.

What is a Bitcoin ETF?

An ETF is a type of investment fund similar to a mutual fund. However, unlike mutual funds, ETFs are traded on an exchange. An ETF holds an asset or portfolio of assets formed according to certain criteria. It may include securities, commodities, bonds, currencies, stock indices and more. Each ETF share is backed by a certain share of the fund's assets. Thus, an ETF investor invests in the fund's portfolio but doesn't own its assets directly.

Bitcoin ETFs are investment vehicles that track the price of Bitcoin. Because ETFs are traded on traditional stock exchanges, this makes them accessible to investors who may not want to buy and hold real bitcoins.

The structure of a BTC ETF allows investors to gain exposure to the price movements of Bitcoin without having to buy, store, and manage the cryptocurrency themselves directly. Instead, investors can buy shares of the ETF through their brokerage accounts, and the ETF's value is typically tied to the value of Bitcoin.

What is the purpose of the Bitcoin ETF?

At its core, the primary objective of a Bitcoin ETF is to streamline and regulate investor access to the cryptocurrency market. These ETFs cater to traditional market participants, providing a structured investment vehicle that enables exposure to Bitcoin without the need to navigate the intricacies of digital wallets and crypto exchanges.

Are Bitcoin ETFs backed by Bitcoin?

Not necessarily so. There are two main types of Bitcoin ETFs:

- Spot Bitcoin ETFs hold actual bitcoins as their underlying assets. When investors buy shares of a spot Bitcoin ETF, they indirectly own a proportionate amount of bitcoins held by the ETF. The ETF aims to track the performance of the spot price of Bitcoin.

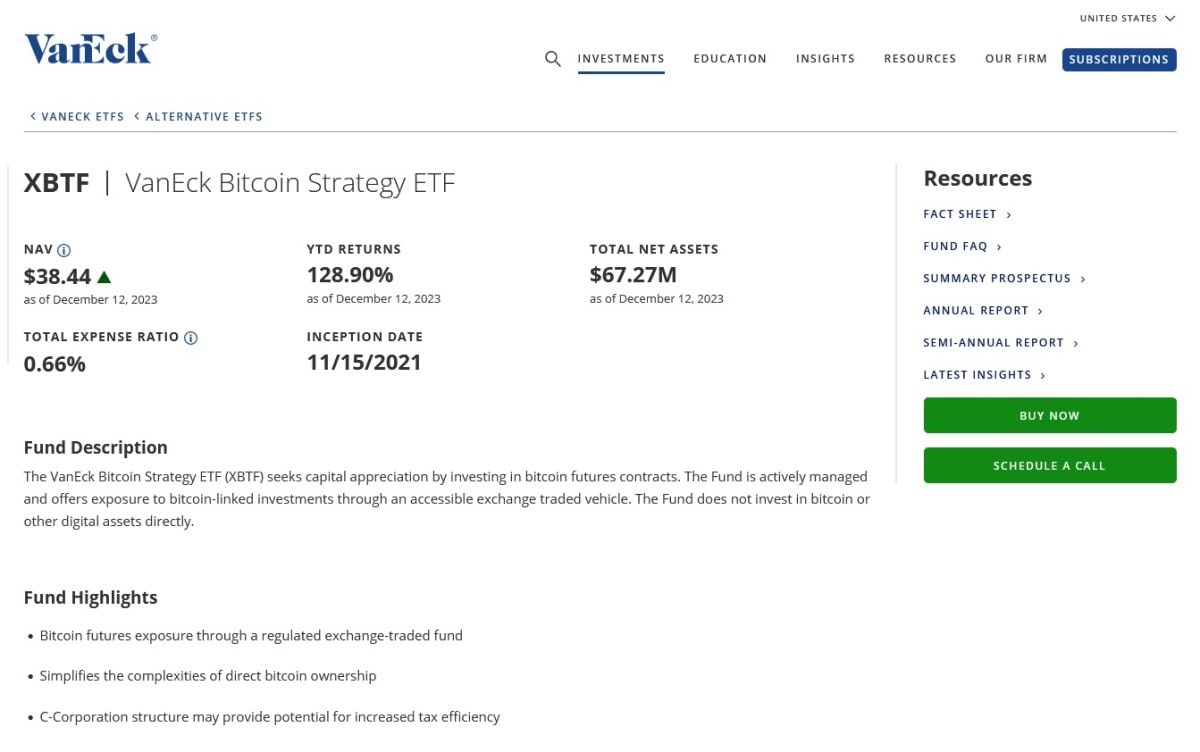

- Bitcoin futures ETFs invest in Bitcoin futures contracts rather than holding actual bitcoins. These futures contracts derive their value from the expected future price of Bitcoin. Investors in Bitcoin futures ETFs are essentially betting on the future price movements of Bitcoin.

At the moment, spot Bitcoin ETFs only exist outside of the United States. The US Securities and Exchange Commission (SEC) has approved the creation of several futures-based Bitcoin ETFs. As for spot Bitcoin ETFs, the first applications for their creation were submitted about 10 years ago but were rejected by the SEC. Factors such as volatility, the unregulated nature of Bitcoin markets and the tendency for market manipulation were cited as reasons for the rejection.

At the moment, multiple companies, including BlackRock, have applied for approval of a spot Bitcoin ETF. And while the BlackRock spot Bitcoin ETF's approval date is not yet known, judging by many indications, it's very likely to be approved.

What will happen if spot Bitcoin ETF is approved?

The approval of spot Bitcoin ETFs can have several potential impacts on the cryptocurrency market and the broader investment landscape.

- Increased institutional participation. The approval of a spot Bitcoin ETF may attract more institutional investors to the cryptocurrency market. Institutional investors, such as hedge funds or pension funds and asset managers, often prefer regulated investment vehicles like ETFs. Increased institutional participation can bring additional liquidity to the Bitcoin market.

- Broader investor access. Spot Bitcoin ETFs will provide a more accessible and familiar way for a broader range of investors, including retail investors, to gain exposure to Bitcoin. Investors can buy and sell shares of the ETFs on traditional stock exchanges without the need to interact directly with cryptocurrency exchanges or manage private keys.

- Price impact. The approval of spot Bitcoin ETFs can potentially have an impact on the price of Bitcoin. Increased demand for the ETF can lead to increased demand for Bitcoin itself, affecting its price dynamics. However, the exact impact on prices is uncertain and can depend on various factors, including market sentiment, macroeconomic conditions, regulatory developments and many others.

- Market maturity and credibility. Spot Bitcoin ETFs can be seen as a sign of increasing market maturity and credibility. Regulatory approval implies that authorities are comfortable with the level of oversight and investor protections provided by the ETF structure. This increased regulatory acceptance can contribute to a positive perception of the cryptocurrency market.

- Regulatory precedent. The approval of a Bitcoin spot ETF can set a regulatory precedent for other cryptocurrency-related financial products. It might pave the way for the approval of additional cryptocurrency ETFs or other investment vehicles, potentially expanding the range of crypto-based financial products available to investors.

What are the benefits of a Bitcoin ETF?

Bitcoin ETF can offer several benefits to investors and the broader financial markets.

- Accessibility. A Bitcoin ETF provides a more accessible and familiar investment vehicle for a wide range of investors. Traditional investors who may be hesitant to navigate cryptocurrency exchanges or manage private keys can easily buy and sell shares of a Bitcoin ETF through traditional brokerage accounts.

- Regulatory oversight. Bitcoin ETFs are subject to regulatory oversight, providing a level of investor protection and compliance with financial regulations. Regulatory approval can enhance the credibility of the investment product, which may attract institutional investors who require a higher level of regulatory scrutiny.

- Simpler custody solutions. For investors concerned about the security and custody of physical bitcoins, a Bitcoin ETF eliminates the need for them to handle these aspects directly. The ETF provider typically manages custody arrangements, ensuring secure storage of the underlying bitcoins. This is particularly important for large institutional investors.

Is it better to invest in a crypto ETF?

The decision to invest in a cryptocurrency ETF depends on various factors, including your investment goals, risk tolerance, and preferences.

Is Bitcoin ETF risky?

Despite regulatory oversight, investing in Bitcoin ETFs involves certain risks that should be considered before making any investment decisions:

- Volatility. Bitcoin and other cryptocurrencies are known for their price volatility. Prices can experience significant fluctuations over short periods, leading to both potential gains and losses.

- Regulatory risks. The regulatory environment for cryptocurrencies and related financial products is still evolving. Regulatory decisions can impact the approval, operation, and market conditions for Bitcoin ETFs.

- Custodial risk. The custody of the underlying bitcoins is a critical aspect of Bitcoin ETFs. Any issues related to the custody of the underlying asset may pose a risk to the fund and its investors.

- Operational risk. Issues related to the operation of the ETF, such as technology failures or errors, could impact the fund's performance.

Is my money safe in an ETF?

While investing in an ETF can be a relatively safe and transparent way to gain exposure to various assets, it's important to understand that no investment is entirely risk-free.

Is Bitcoin ETF a good investment?

A Bitcoin ETF can offer several advantages to retail investors, making it a potentially attractive investment option:

- User-friendliness. A Bitcoin ETF offers a familiar investment vehicle for investors who may be more comfortable with traditional brokerage accounts and stock exchanges.

- No need for a crypto wallet. Investors can gain exposure to Bitcoin without the need to create and manage a cryptocurrency wallet, which can be complex for those unfamiliar with digital assets.

- Professional custody services. The custody of bitcoins is typically managed by the ETF provider, offering professional custodial services. This eliminates the need for investors to secure and manage private keys, reducing the risk of loss or theft.

Why is a Bitcoin ETF not a good investment?

While Bitcoin ETFs offer certain advantages, they may not align with every investor's goals. Compared to more traditional investment vehicles, their disadvantages are partly the same as those of investing in Bitcoin. But they also have a number of disadvantages compared to buying Bitcoin directly:

- Control and ownership. When you buy Bitcoin directly, you have direct ownership and control over the digital asset. You hold the private keys, which gives you the ability to manage and transfer your Bitcoin independently.

- Fees. Bitcoin ETFs typically come with fees, including management fees and expense ratios.

- Market access. Buying Bitcoin directly allows for immediate access to the cryptocurrency market. You can buy, sell, or transfer your Bitcoin at any time without being subject to market hours or potential delays associated with ETF transactions.

Conclusions: Bitcoin ETF opportunities

The decision to invest in a Bitcoin ETF versus directly buying Bitcoin depends on various factors, and there is no one-size-fits-all answer. Both approaches have their advantages and disadvantages, and individual investors may have different preferences and considerations.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.