How to calculate ROI

Every investor wants to know how profitable their investments are. One of the most informative indicators that can answer this question is return on investment (ROI). In this article, we'll look at the meaning of ROI in cryptocurrency, how to calculate the ROI of an investment, calculate ROI formula, and consider ROI calculation with examples.

First, only invest in companies that have the potential to return the value of the entire fund. — Peter Thiel, entrepreneur and venture capitalist

What is Return on Investment (ROI)?

Let's begin with the meaning of ROI in cryptocurrency.

Simply put, ROI is the ratio of money earned to money spent. It's an indicator that allows you to measure an investment's profitability and shows whether it has paid off. Because it's so simple to calculate ROI and understand it, this indicator is very popular among investors and business owners. ROI calculation applies to trading, investing and any business or purchase.

ROI is usually expressed as a percentage for ease of understanding and clarity. If the number is positive, the investment has made a profit. If it's negative, the investment turns out to be a loss.

How to calculate Return on Investment

There are different methods for calculating ROI. The simplest ROI calculation formula is:

ROI = Net Return on Investment / Cost of Investment * 100% |

To determine the Net Return on Investment, you need to subtract Total Costs from Total Returns. If you are analysing investments in assets that bring dividends, such as shares, Total Returns is the sum of the dividends and the value of the shares at the time of sale. For investments in cryptocurrencies that do not bring dividends, you only consider the selling price. Total Cost is the asset's initial cost plus any other costs you incur in acquiring and owning the asset.

Other formulas used to calculate the ROI are derived from this basic formula.

ROI calculation with example

Consider the following calculate ROI example. Let's say you purchase 1,000 shares of company X at $20 per share. A year later, you sell them at a higher price of $24 per share. On top of that, you earn $700 in dividends. You also spend a total of $250 in commission when buying and selling shares.

In this case, here is how to calculate ROI:

ROI = ((($24 - $20) * 1000 + $700 - $250) / ($20 * 1000)) * 100 = 22.25% |

We see that your investment turned out to be profitable, with an ROI of 22.25%.

ROI is calculated similarly for investments in other asset types. It's worth noting that the calculation will be a little more difficult for some assets, such as real estate, due to the larger number of expense items. When calculating ROI, it's important to consider all costs. Otherwise, the result will be inaccurate and probably misleading. On the other hand, when investing in cryptocurrencies, the calculation is more straightforward since investments in them don't bring dividends, and the only type of income received by a crypto investor is capital gain.

How to calculate annualised and monthly Return on Investment

The basic formula for calculating ROI has one significant limitation: it doesn't take into account the length of time the asset was owned. The Annualised ROI indicator allows us to correct this shortcoming.

How do you calculate ROI? The formula for calculating it is:

Annualised ROI = ((1 + ROI / 100%) ^ 1/n − 1) * 100 |

Where n = number of days the asset was owned / 365

Monthly ROI is calculated in the same way. You only need to substitute the number of months instead of the number of years the asset was owned.

Why you need to know ROI

Regular analysis of ROI is important for any investor. It helps determine the profitability of investments in different assets and how much sense it makes to continue holding these assets. ROI allows you to assume the expected profitability of investments, assess the investment portfolio's composition and compare different assets in terms of investment attractiveness. In addition, ROI can be calculated both for an asset as a whole and for each specific transaction with the asset.

Advantages and disadvantages of ROI

ROI is an extremely popular metric because it's:

- Easy to calculate. The formula for calculating ROI is simple and doesn't require any special knowledge to use it.

- Easy to understand. This indicator's simplicity and clarity make it readily understandable to almost anyone, and it's used universally.

At the same time, ROI has several disadvantages to bear in mind when using it.

- Vulnerability to errors and manipulation. When calculating ROI, all costs may not be included. Moreover, this can be done by mistake or deliberately with the aim of misleading potential investors.

- Risk not factored in. One of the most important patterns inherent in investments is that the return on investment is directly proportional to risk. The higher the yield, the higher the risk, and vice versa. ROI doesn't measure risk in any way. Therefore, for any serious assessment of investments, additional research has to be done.

- Currency exchange rate changes not factored in. Over time, the price of the assets and the currency in which the assets are valued both change. ROI doesn't factor in the change in the exchange rate. Therefore, its results are inaccurate.

- Time not accounted for. As mentioned above, ROI doesn't consider the length of time an asset is held. Annualised ROI is used to correct this.

We can draw the following conclusion about ROI: it's an excellent option for quickly assessing an investment, which allows you to weed out unprofitable options immediately. However, you should never use ROI as the sole source of data for decision-making. This indicator reveals its potential only in conjunction with other indicators used in financial analysis.

Return on Investment calculators

Because ROI is a popular indicator that may also be inconvenient to calculate manually, it's no surprise that many ROI calculators have popped up.

Free online ROI calculators

There are now many online ROI calculators available for UK residents (and the rest of the world). They can be used both for financial assets and other property. Here are some of those ROI calculators.

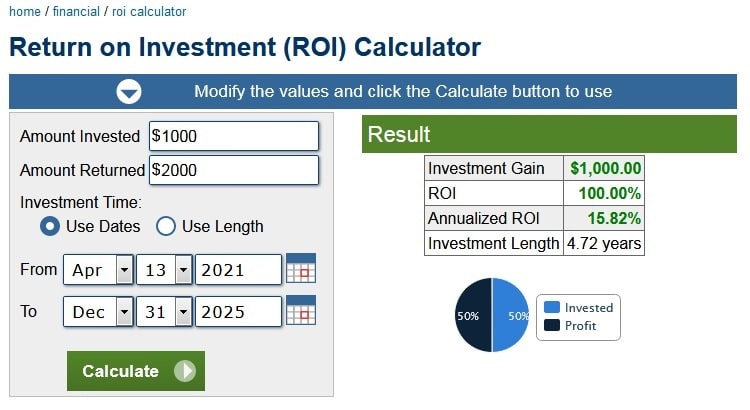

- ROI calculator on Calculator.net. A convenient calculator that computes both the Total and Annualised ROI, as well as Total Investment Gain.

- ROI calculator on Financial-calculators.com. Unlike the previous calculator, this one features a different interface and lets you print the result.

Alt4: ROI calculator on Financial-calculators.com

Calculating ROI in Excel

If you're an Excel user, you can easily use the formula and create your own Return on Investment calculator, taking into account all income and costs associated with your assets.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What is the meaning of ROI in cryptocurrency?

Speaking about the meaning of ROI in cryptocurrency, it's important to emphasise its value for investors. Return on investment assesses the effectiveness and profitability of an investment, enabling comparison between different investment opportunities. ROI quantifies the return on a specific investment relative to its cost.

Can ROI be negative, and what does it indicate?

After you calculate the ROI formula, you can get a negative result. A negative ROI indicates that the investment has incurred a loss. This happens when the total costs associated with the investment exceed its total returns. In simpler terms, when an investor faces losses, it leads to a negative ROI.

How often should I recalculate ROI for my investments?

The frequency of recalculating ROI for investments can vary based on factors such as the type of investment, investment goals, and market conditions.

- Different types of investments may necessitate varying frequencies of ROI calculation. You need to calculate ROI more frequently for stocks or mutual funds due to the volatile nature of the stock market. Conversely, long-term investments like real estate or bonds may warrant less frequent ROI calculations.

- If your investment goal is short-term, you may need to calculate ROI more frequently. Conversely, for long-term investment goals, less frequent calculations could suffice.

- In a volatile market, checking ROI more frequently can aid in making timely decisions.

- It's essential to remember that investing is generally a long-term endeavour and daily or weekly ROI fluctuations may not accurately reflect long-term performance. While staying informed about investments is beneficial, it's advisable not to overanalyse short-term fluctuations.

What are some common mistakes to avoid when calculating ROI?

- Confusion often arises when comparing the initial cash investment with gains measured in profit or revenue. The correct approach is to base gains on the cash flow received, whether in profits or revenue.

- Many businesses make the mistake of underestimating initial costs when they calculate ROI formula, leading to potential underestimation of these costs.

- ROI should encompass out-of-pocket costs and operational costs like labour. Yet, some fail to consider the value of their own time or employees when calculating ROI.

- It's essential to be aware of the minimum ROI that your company requires, considering relative risks, cost of capital, and opportunity costs.

- Aligning the metrics to calculate ROI with your business goals is crucial. For instance, likes, followers, and votes may not be suitable measurements for ROI if they don't lead to increased sales.

- In data-rich environments, losing focus on the most relevant metrics is easy. Understanding your business's Key Performance Indicators (KPIs) before calculating ROI is essential.

How can I use ROI to inform my investment strategy?

ROI is a crucial tool for shaping your investment strategy. You can use it to compare investments, evaluate profitability, identify trends, inform budget decisions, and assess risk. Comparing the ROIs of different investments helps determine the best returns, while a positive ROI signifies profitability, and a negative one indicates a loss. Tracking ROI over time allows for identifying trends, and if a specific investment consistently yields a high ROI, you may choose to allocate more budget to it. Additionally, ROI can be a basic gauge of an investment's risk level.