ICO vs IEO: What's the difference?

An ICO is a relatively new way for blockchain startups to raise funds. However, after a rapid rise in popularity, ICOs began to lose momentum. The lack of regulation led to the emergence of many fraudulent ICOs, and the collapse of the cryptocurrency market in 2018 prompted investors to lose interest in new blockchain projects. In an effort to bring investors back to the blockchain industry, new fundraising methods, such as IEOs and STOs, were created. In this article, we'll take a closer look at the difference between these fundraising methods and try to identify which one is more promising: an IEO, ICO or STO?

There needs to be some standards around launching an ICO and investing in ICOs in the space, and I caution all to tread carefully until those standards emerge. — Nick Tomaino, Founder of 1confirmation.

The difference between an ICO and an IEO

Many fraudulent ICOs and the uncertain prospects for even those startups that aren't scams present a serious problem inherent in ICOs. One method of solving these problems was to involve a third party that could weed out fraudulent ICOs and help promising startups attract investments. Crypto exchanges took over this third-party role. That's how Initial Exchange Offers (IEO) first appeared.

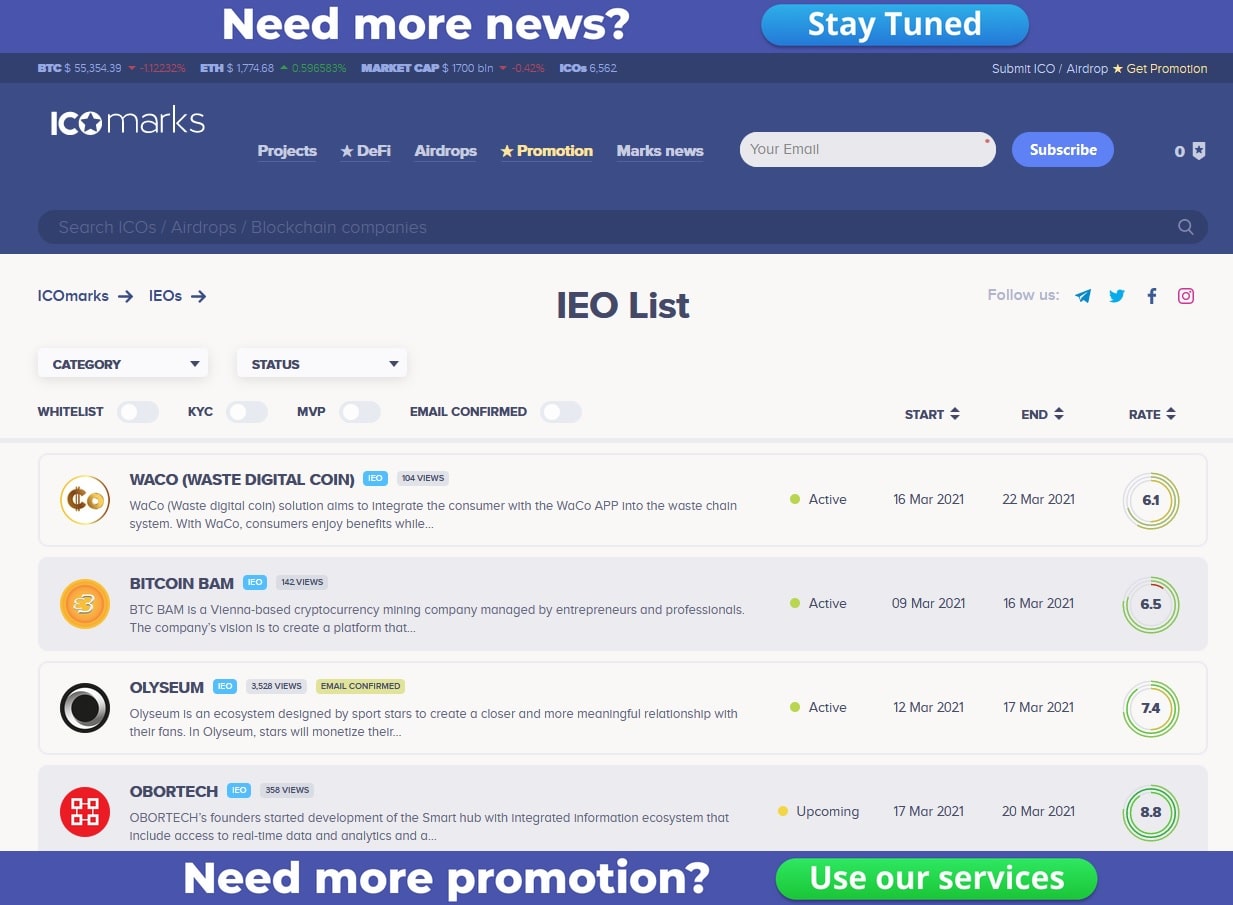

What is an IEO?

An IEO is a fundraising method in which a crypto exchange undertakes the responsibility for evaluating the project, attracting investors and managing the distribution of tokens. You can find more details about what an IEO is and how it works in our article.

ICO vs IEO - The difference

Although an IEO is a type of ICO, there are several significant differences between the two fundraising methods.

- The main difference between ICO and IEO crypto is that a startup trying to raise funds through an IEO has a key partner, i.e., a crypto exchange that acts as an intermediary between the project's developers and investors. The crypto exchange evaluates startups that have applied for an IEO and manages the sale of tokens.

- An exchange's preliminary evaluation of projects significantly reduces investors' risk since fraudulent and unpromising projects are most likely to be excluded by exchange analysts. This, in turn, increases investors' confidence in verified startups and has a beneficial effect on the blockchain industry's development.

- Tokens are listed on the exchange within a few days after tokens are sold. With an ICO, tokens are very often not listed on the cryptocurrency exchange immediately. Instead, they are listed months after the token sale ends. In some cases, the listing never takes place, and the project collapses.

- Since the sale of tokens for an IEO occurs through a crypto exchange, only users who have an account on the exchange and have been verified can become investors.

- With an ICO, developers conduct a marketing campaign. To do so, they use paid advertising, forums and social networks. With an IEO, the exchange takes over this role.

- An IEO is run by a central authority: an exchange. It increases the process's centralisation, which goes against decentralisation, one of the blockchain ecosystem's basic principles.

An IEO vs ICO comparison table

ICO | IEO | |

Third party | No | Exchange |

Risk of fraud | High | Low |

Delay before listing | Unpredictable | Very low |

Investors | Anyone | Exchange users |

Marketing promotion | By the developers | By the exchange and developers |

Centralisation | No | Yes |

Where do STOs come into play?

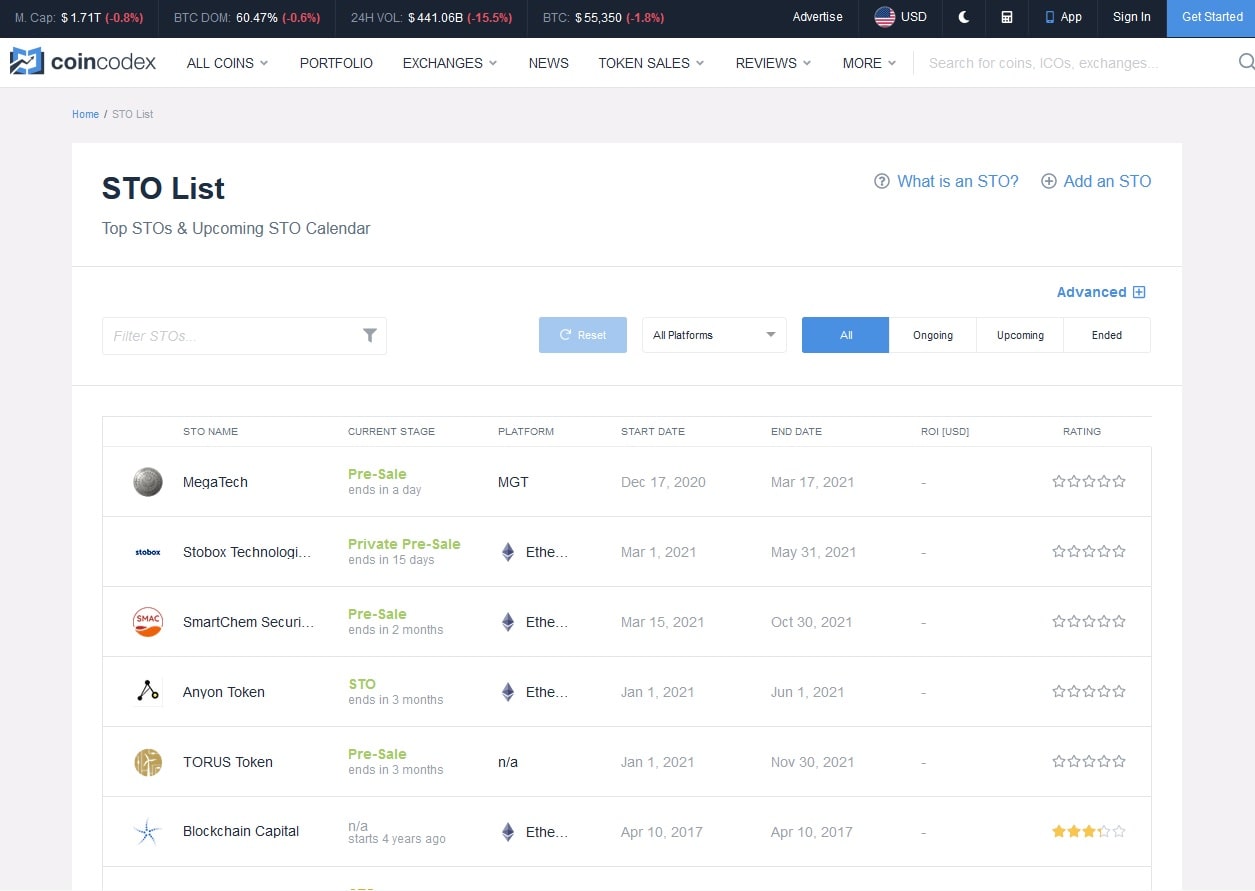

The Security Token Offering (STO) model has also recently emerged as another alternative to ICOs. It differs from an IEO in that it doesn't involve a third party. Instead, it tries to turn tokens into real financial instruments. This model partially resolves the problem of crypto tokens' legal compliance with stock market requirements.

What is an STO?

An STO is a method of selling digital tokens on a blockchain that meets the characteristics of securities. This means that the token's owner receives the same set of rights as a stock owner, including the right to a share in the company, part of its profits, and decisions about business changes. Considering all this, security tokens are completely legal assets from the point of view of most legal frameworks on par with securities. This also means that the distribution of such tokens complies with the strict requirements that ICOs fail to comply with.

An STO vs ICO comparison table

ICO | STO | |

Project evaluation | No | Government agencies |

Risk of fraud | High | Very low |

Launch cost | Low | High |

Investors | Anyone | Accredited investors |

Investor rights | No | As with stocks |

Conclusions

The blockchain industry currently uses all three of the previously mentioned fundraising methods. As you can see, each one has its own set of advantages and disadvantages, so which method is the best? The answer to the question is not as simple as it may seem at first glance.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What do ICO and IEO mean in cryptocurrency?

ICO and IEO are two methods used in the cryptocurrency industry for fundraising. An ICO allows a company to raise funds by launching a new coin, app, or service. An IEO is a method of fundraising where a cryptocurrency exchange oversees the token sale.

What is the main difference between ICO and IEO?

The primary ICO vs IEO crypto difference lies in who oversees the fundraising and the extent of investor safeguarding. During an ICO, the project team leads the fundraising process, taking charge of marketing, token distribution, and investor relations.

An IEO is carried out under the supervision of a cryptocurrency exchange. The exchange evaluates projects and only features those that meet its criteria, offering investors an extra layer of protection. The exchange manages the token sales and distribution, streamlining the process.

What are the advantages of ICO and IEO crypto?

ICO and IEO crypto offer various advantages to investors.

Advantages of ICO:

- Investing early in ICOs often means purchasing lower-priced tokens, potentially leading to significant profits if the cryptocurrency performs well.

- ICOs are open to anyone interested in participating.

- Tokens from ICOs can be traded and sold globally, providing a broad market reach.

- ICOs typically involve fewer entry barriers for investors.

Advantages of IEO:

- Hosting an IEO on a reputable crypto exchange can enhance the project's credibility and investor trust.

- IEO platforms often support marketing and development, contributing to the successful operation of IEO projects.

- IEOs are conducted by trusted third parties that carefully select token issuers, reducing the risk of scams.

- IEOs offer regulatory compliance, access to an established investor base, liquidity, token price stability, and overall credibility, making them an appealing fundraising option.

- Investors participating in an IEO gain early access to tokens at a lower price compared to when they are listed on the open market.

Can anyone participate in ICOs and IEOs?

Yes, anyone can participate in ICO and IEO, but certain conditions and limitations must be considered.

Individuals with an active internet connection and some cryptocurrencies (such as Bitcoin or Ether) can join an ICO. However, in certain jurisdictions, there may be restrictions. For instance, in the United States, only accredited investors can participate in private placements of securities.

To participate in an IEO, you must have an account on the cryptocurrency exchange that is hosting the IEO. Some exchanges may require you to fulfil extensive Know Your Customer (KYC) requirements to verify your identity.

How are tokens allocated in ICOs vs IEOs?

In both ICOs and IEOs, tokens are allocated among various entities, such as the project team, investors, advisors, and others. However, the allocation process and considerations differ between the two.

During an ICO, the project team determines the token allocation, balancing maximising proceeds by issuing more tokens to the public and retaining enough tokens to incentivise current and future stakeholders for network growth.

In an IEO, the project team decides on token allocation, but the sale occurs on a cryptocurrency exchange platform.

Are ICOs and IEOs regulated?

Yes, ICOs and IEOs can be regulated. ICOs are largely unregulated and do not come under the oversight of regulatory bodies like the SEC or their equivalents in other jurisdictions.

An IEO is a fundraising event conducted on a cryptocurrency exchange platform. Similar to ICOs, depending on the specific details and circumstances of the offering, it may involve the offer and sale of securities. As a result, the IEO may be subject to registration requirements that apply to offerings under federal securities laws.

Examples of successful ICOs and IEOs

ICOs:

- Ethereum

- NEO

- Alias

- Stratis

IEOs:

- Celer Network (Binance)

- Fetch.AI (Binance)

- TOP Network (Huobi)

- LEO (Bitfinex)

- BlockCloud (OKEx)

- MultiVAC (Kucoin)

Is an IEO better than an ICO?

Although IEOs enjoy higher investor confidence, they have several disadvantages compared to ICOs. Firstly, when pursuing their own commercial interests, exchanges can filter out projects with good potential simply because the developers couldn't provide an attractive commercial offer to the exchange. Secondly, by being more expensive to run than ICOs, IEOs raise the barrier to entry for startups. Thirdly, IEO participants are limited to those who are willing to register on the exchange.

Finally, although investment security may increase when an exchange selects a project, it is by no means fully guaranteed. The risk of fraud still exists under this model.

Is an STO better than an IEO and an ICO?

While safer for investors than IEOs and ICOs, the STO fundraising model has its own set of problems. A developer must invest time and money to comply with legal requirements. While an ICO can be carried out with low costs, an STO may cost as much as a stock's initial public offering (IPO), which negates the blockchain's advantage. In addition, the big problem with STOs is that only accredited investors can participate, which automatically makes them inaccessible to the general public.

As such, we can conclude that it's hard to single out any one of these three fundraising methods as the 'best'. All three have their own unique features and suit different types of investors. IEOs and STOs will most likely steal ICOs' current dominant position, but they're unlikely to replace it completely anytime soon.