Is staking crypto safe?

Crypto staking is one of the few ways to generate passive income from cryptocurrencies beyond capital gains. It's, therefore, not surprising that its popularity is growing. However, what about the risks? Does staking crypto have risks, and what are the risks of crypto staking? Let's find out.

What is crypto staking?

The term "staking" has emerged in the crypto industry following the launch of Peercoin, the first cryptocurrency to use the Proof-of-Stake consensus mechanism.

The meaning of crypto staking

Crypto staking is a way of making a blockchain network run that is also a tool for passive earning. It's used in blockchain networks with Proof-of-Stake (PoS) algorithms and completely replaces mining, allowing new blocks to be created and transactions to be processed without the use of powerful computing hardware.

How does cryptocurrency staking work?

In the Proof-of-Stake consensus mechanism, the right to generate new blocks, verify transactions and include them in the blockchain is given randomly to a node based on a certain algorithm, taking into account how much of a given blockchain's coins they stake for that purpose. Other parameters, such as the age of the stake, can also affect the chance. After winning the right to generate a block, a node (called a validator or a forger) creates the block and is rewarded for doing so.

The terms and conditions for participating in staking may vary. The general mechanism is to buy native tokens of the respective blockchain and lock them for staking yourself (e.g., through a wallet) or transfer them to a validator.

Is staking crypto worth it?

The goal of Proof-of-Stake is to be the most efficient way to keep a public blockchain validated, not to maximise rewards for a specific use case. — Vitalik Buterin

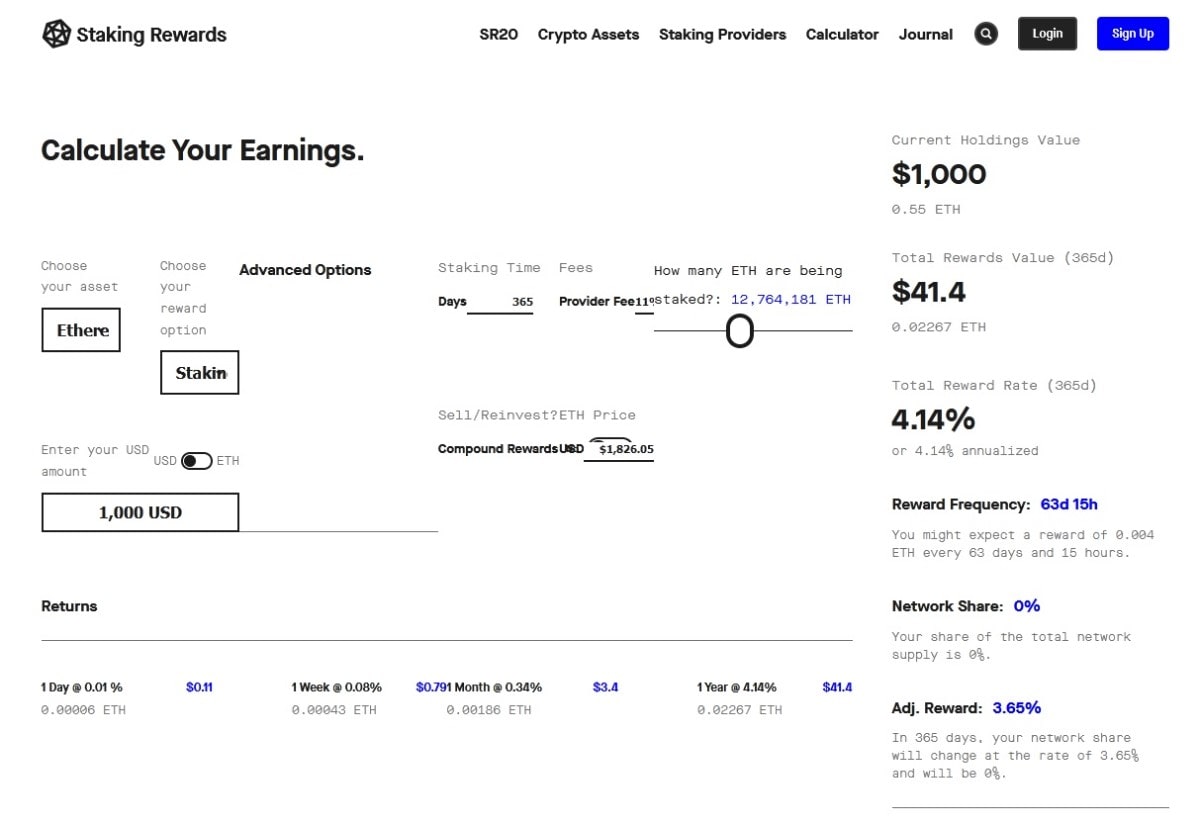

Staking rewards are usually low and rarely exceed 15% APY. The reason for this is simple: the staking reward is directly related to the volume of new coins issued. The higher it is, the higher the inflation of that crypto asset will be. So, if your income from token operations, such as trading, exceeds this value, staking is probably not worth the effort for you. However, if you're just holding tokens, staking is a good choice as it allows you to earn additional income.

Advantages of cryptocurrency staking

Staking as a way of generating income has a number of advantages that make it popular:

- Passive income. Once staking is up and running, it requires little to no attention.

- Low entry threshold. Staking doesn't require you to buy expensive hardware or pay electricity bills. Although you need to meet certain requirements to start a node, it's not necessary to have a node to start earning from staking.

- No specialised knowledge is required. You don't need any specialised technical knowledge or skills to start staking cryptocurrency.

- Blockchain security. Proof-of-Stake cryptocurrencies are thought to be much better protected from a 51% attack.

- Environmental friendliness. Staking requires a lot less electricity than mining.

- Large selection of assets. There is a large selection of coins for staking, each with its own conditions and returns, so you can choose the ones that suit you.

Is crypto staking safe?

Is crypto staking risk-free? No, it's not. It has its own risks, which should be considered by anyone who plans on using this method of earning money.

Main cryptocurrency staking risks

Staking is a profitable and relatively safe alternative to simply holding cryptocurrencies in a wallet that promises additional income without much effort. However, there are a number of crypto staking risks that can significantly reduce expected returns and even lead to losses:

- Market risk. This is probably the biggest risk in staking. Cryptocurrency prices are very volatile. And if the price of your coins falls significantly, you could lose a lot more than you earn from staking.

- Lockup period. This risk is related to the previous one and increases it. In many cases, to stake coins, you need to lock them up for a certain period of time when you will not have access to them. And if the price of that cryptocurrency drops during that time, you won't be able to respond quickly.

- Liquidity risk. This risk is specific for coins with a small market cap. Since you're rewarded in the same currency that you stake, you may find it difficult to sell the received staking reward when it comes to coins with a small market cap.

- Risk of fraud. Staking cryptocurrencies using staking providers carries all the risks associated with trusting a third party that could misappropriate your assets. Therefore, when choosing a staking provider, you need to check its legitimacy carefully.

- Validator risk. If you run your own node, you may be denied rewards due to accidental node disconnection or unintentional misbehaviour.

The safest crypto staking with the StormGain platform

One of the safest ways of staking crypto is with the StormGain crypto platform. StormGain has recently launched a new option for its users: Unlocked staking. Unlike traditional staking, unlocked staking lets you stake your cryptocurrencies without locking them. This allows you to earn passive income from staking and still use your crypto assets for something else, like trading, at any time.

To use this option, you need to select 'Unlocked Staking' in the 'Wallets' section and then click 'Stake' in the window that appears. The funds in your account will then start to generate passive income. The resulting income can be used for trading.

Protection and security

StormGain's built-in multi-currency wallet offers a high level of security. Industry-leading security protocols, strong encryption and storing part of the funds in cold wallets allow platform users not to worry about the safety of their crypto assets.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.