How to stake crypto for passive income

One serious disadvantage of investing in cryptocurrencies is that this investment method lacks the effect of compound interest. Unlike other investment assets, such as stocks, owning cryptocurrency doesn't generate an income. Cryptocurrencies do not pay dividends, and to make passive income from crypto, you need to sell coins for more than you bought them for. However, this has started to change with the advent of Proof-of-Stake cryptocurrencies. In this article, we'll talk about cryptocurrency staking as the best way to make money on crypto. So, if you want to learnhow to stake your crypto, this article is for you. We will discuss why passive income is important and how to generate passive income with crypto.

What is crypto staking?

Staking is a mechanism that replaces mining in cryptocurrencies based on Proof-of-Stake (PoS) and similar consensus algorithms. It's the process of storing funds in a cryptocurrency wallet to provide validation for transactions on a blockchain. Essentially, it consists of locking in a certain amount of cryptocurrency for a period of time, to receive rewards. Thus, by staking crypto, you earn a passive income daily.

How crypto staking works

In PoS cryptocurrency networks, the chance of being allowed to add a new block to the blockchain and being rewarded for this is proportional to the number of coins that the validator locks in for this purpose as a stake. This chance may be influenced by additional parameters, such as the age of the stake. The reward for adding a block in PoS networks usually includes commissions for all transactions included in that block.

It's worth noting that unlike Proof-of-Work (PoW) cryptocurrencies, where validators are called miners, in PoS cryptocurrency networks, they are called forgers.

Staking is more affordable than mining. It is the easiest way to earn crypto. Essentially, the user only needs to buy a PoS cryptocurrency and lock it on a wallet that supports staking.

How to earn with crypto staking

The following are the main ways to make money from staking:

- Become a validator to start making money with cryptocurrency through staking. This is the most effective – but also one of the most difficult – ways to earn a passive income from crypto. Not only does it require some IT knowledge, but it also has a higher financial entry threshold, as many cryptocurrencies have restrictions on the minimum amount of coins to be staked.

- Join a staking pool. This is simpler than becoming a validator. Essentially, a staking pool is a PoS version of a mining pool. In order to start staking cryptocurrency this way, all you need to do is find a reliable staking pool and link your cryptocurrency wallet to it.

- Register on a cryptocurrency exchange that supports staking. Probably the easiest way to earn passive income from crypto mining. You need to find a cryptocurrency exchange that supports staking, create an account there and transfer the cryptocurrency you are going to stake. The downside is the fees charged by the exchange and the fact that storing cryptocurrency with exchanges is traditionally considered less secure than storing it in your own crypto wallet.

In general, the sequence for staking is as follows:

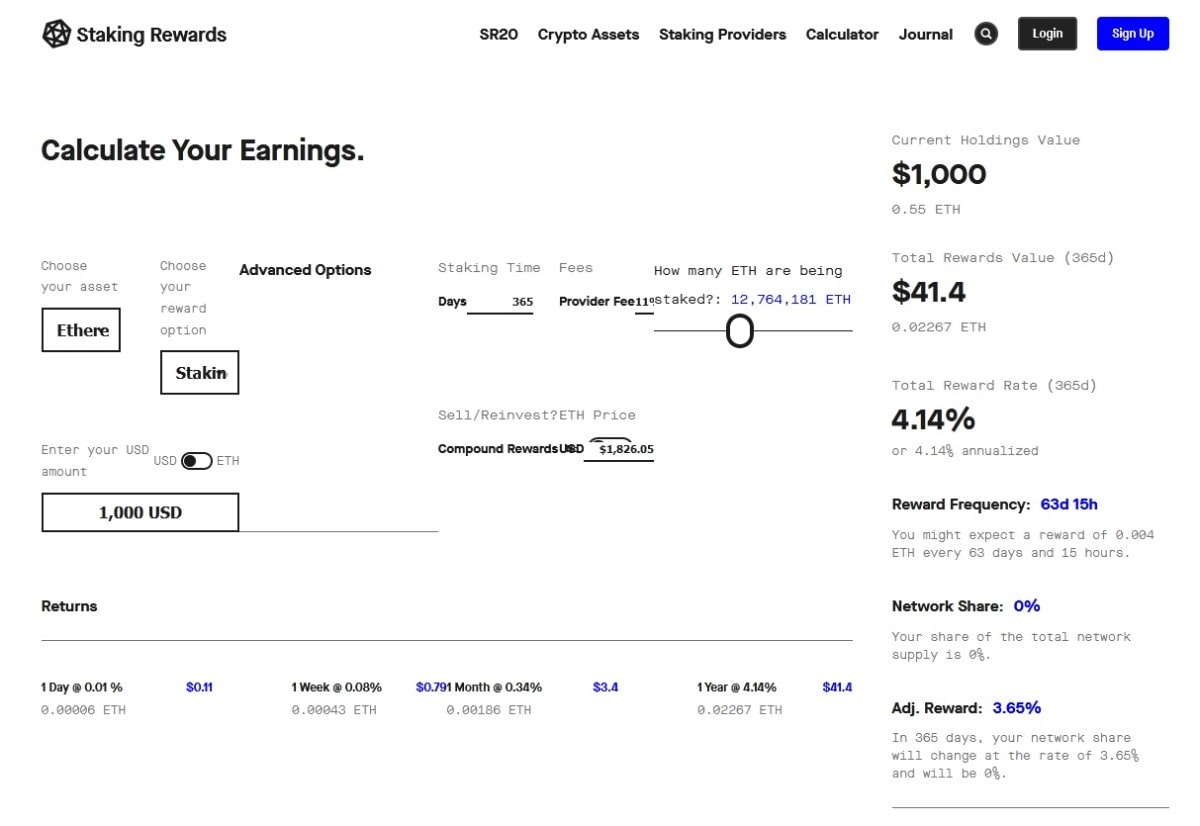

- Explore the best passive income crypto projectsand choose the one that suits you best. This is the most difficult part of the process, because a mistake can be costly. Avoid choosing a cryptocurrency based solely on the size of the reward. Remember: the main passive income in cryptousually comes from capital gain, not from rewards for staking. On top of that, a high reward is no good to you if the drop in the price of the cryptocurrency itself causes you to lose more than you earn by staking. So, as with simple cryptocurrency investments, research the crypto passive income opportunities to buy for staking carefully. As for staking rewards, you can find them at www.stakingrewards.com.

- Buy the cryptocurrency of your choice. This is probably the easiest part of the process. There are many ways to make money from crypto today. One of the most reliable is buying on a cryptocurrency exchange.

- Stake your cryptocurrency. This part depends on which staking method you choose. If you choose to use a staking pool, select one, make sure it's legitimate, connect your crypto wallet to it and follow the pool's instructions. If you prefer to use a crypto exchange for staking, find one that has a staking option for the cryptocurrency you are interested in, create an account and transfer your cryptocurrency there. You will then need to find a staking page or something similar. If you're having trouble, check out the help section and FAQs.

Risks of crypto staking

Of course, staking as an income-generating method carries its own risks.

- One of the main risks of staking is the high volatility of cryptocurrencies. A fall in the price of a cryptocurrency can not only offset all of the profits from staking but actually lead to considerable losses.

- The risk of fraud. When choosing a staking pool, check its legitimacy carefully. Otherwise, you could run into scammers.

- Regulatory risks. Regulatory decisions can not only cause cryptocurrency prices to fall but can also have a whole range of negative effects on the entire crypto industry.

Risks of crypto staking

Of course, staking as an income-generating method carries its own risks.

- One of the main risks of staking is the high volatility of cryptocurrencies. A fall in the price of a cryptocurrency can not only offset all your profits from staking but actually lead to considerable losses.

- The risk of fraud. When choosing a staking pool, check its legitimacy carefully. Otherwise, you could run into scammers.

- Regulatory risks. Regulatory decisions can not only cause cryptocurrency prices to fall but can also have a whole range of negative effects on the entire crypto industry.

The best cryptocurrencies for staking

As you have probably understood from the above, the answer to this question is not as simple as it first appears. Nevertheless, we have prepared you a list of the best passive income crypto projects.

Asset | Ticker | Estimated reward per year | Total value of tokens participating in staking |

Ethereum 2.0 | ETH | 2.86% | $34.8B |

ADA | 2.04% | $18B | |

SOL | 5% | $39.5B | |

AVAX | 8.51% | $9.5B | |

DOT | 6.92% | $6.8B | |

BNB | 13% | $64.14B | |

TRX | 4.15% | $6.3B | |

NEAR Protocol | NEAR | 9.03% | $2.3B |

ALGO | 4.75% | $462.8M | |

Flow | FLOW | 8.99% | $ 1.86B |

How to stake crypto on StormGain

If you want to earn passive income from cryptocurrencies, it's worth checking out the cryptocurrency platform StormGain. StormGain customers can earn up to 8% in annual interest (APY) on the cryptocurrency stored in their crypto wallets. Unlike classic staking, this interest applies to any cryptocurrency, not just PoS cryptos.

Here’s how to get passive income from crypto on StormGain:

- Deposit a minimum of $50 and a maximum of $2 million.

- Start earning interest and withdraw funds whenever you want.

- Rest easy with a secure crypto app.

In addition, the platform provides a handy crypto interest calculator, letting you check how much crypto earnings you will make in a specific period.

If you want to earn passive income from cryptocurrencies, it's worth checking out the cryptocurrency platform StormGain. StormGain customers can earn up to 12% in annual interest (APY) on the cryptocurrency stored in their crypto wallets. Unlike classic staking, this interest applies to any cryptocurrency, not just PoS cryptos.

In addition, the platform will also launch a classic stacking option soon.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

How to get passive income in crypto?

You can get rich in crypto without active involvement. In the world of cryptocurrencies, various methods, such as staking, lending, and mining, exist to achieve this. The potential returns from generating passive income with cryptocurrencies can differ significantly. Staking and lending offer regular interest payments, while mining provides rewards in newly minted coins. The returns depend on factors like cryptocurrency price movements, network demand, and individual level of participation.

Is it possible to earn passive income through crypto mining?

Earning passive income from crypto mining requires setting up mining equipment, such as specialised hardware or rigs, to authenticate transactions on a blockchain network. Miners receive newly created cryptocurrency coins and transaction fees as rewards for their contributions.

Nevertheless, it's crucial to recognise that while crypto mining can serve as a source of passive income, it comes with inherent risks and challenges. These encompass the initial investment in mining hardware, the continuous electricity expenses, and the fluctuating nature of cryptocurrency prices.

Is crypto considered passive income?

Yes, cryptocurrency is a form of passive income. There are several ways in which this is possible:

- Cryptocurrency Interest Rewards. Numerous cryptocurrency exchanges provide interest rewards on holdings. For instance, Coinbase offers rewards exceeding 4% for USDC holders.

- Crypto Lending. You can earn interest by lending your crypto to borrowers such as traders and businesses. This process is managed by lending platforms and DeFi protocols, making it convenient for users to earn rewards.

- Staking. Cryptocurrency staking entails locking up a specific amount of a particular cryptocurrency to support the operations of the underlying blockchain network.

- Mining. Miners worldwide compete against each other to discover the encrypted solution to blocks, with winners earning cryptocurrency rewards.

- Yield-Farming. Making passive income with DeFi platforms enables users to generate earnings akin to traditional banking systems by participating directly in lending processes.

- Play-to-Earn Games. Passive income can also be earned by engaging in online games with cryptographic incentives.

Why is passive income important in crypto?

Passive income in the crypto space is significant for several reasons. It enables individuals to leverage their cryptocurrency holdings rather than leaving them dormant. Participating in cryptocurrency exchanges or decentralised protocols are among the best crypto passive income sources. This steady stream of earnings can be crucial in achieving financial independence within crypto assets.

Why is passive investing better than crypto trading?

Passive investing is often considered superior to crypto trading for several reasons:

- Passive investing prioritises the long-term growth potential of a cryptocurrency. Investors opt to purchase and retain cryptocurrencies with solid fundamentals, anticipating their value will appreciate over an extended period.

- Passive investing generally involves lower risks than trading. Trading demands speculating on short-term price movements to generate quick profits, which can be precarious due to the volatility of the crypto market.

- Passive investing demands less time and effort compared to trading. Traders must continuously monitor market trends and make timely decisions, whereas investors can adopt a 'set and forget' approach.

- Trading often incurs transaction fees each time you buy or sell, which can accumulate over time. Conversely, passive investing entails fewer transactions, potentially resulting in fee savings.

- Passive investment permits returns to compound over time, leading to substantial long-term growth potential.