The Graph (GRT) price prediction 2022-2030

Despite the transparency of blockchains, it can be quite hard to get the information you want that is stored in it. Yes, the basic data stored in the blocks are easily accessible, but what if you have a more complex query? Getting aggregated and filtered information from a blockchain is much more difficult. For example, if you want to find out how many NFTs with a particular characteristic are owned by a particular address, you would have to do a huge amount of work. Indexing blockchain data is very difficult. And it often requires resorting to centralised solutions that lack the reliability and security of decentralised systems. The Graph project aims to solve these problems. In this article, we'll tell you about The Graph and its tokenGRT, as well as examine the token's price predictions.

What is The Graph (GRT)?

The Graph is a decentralised blockchain data indexing protocol. It allows developers of decentralised applications (dApps) to efficiently access blockchain data, making the process of retrieving information from the blockchain cheaper and easier. At the moment, The Graph only fully works with the Ethereum blockchain, but integration with other blockchains is already underway.

The funny thing about blockchain data is that even though in theory everything is transparent and accessible, in practice, it has historically been very opaque. The Graph has done great work so far in making smart contract data easy to monitor and use. Once we know more, we can build better. — Hayden Adams, founder of Uniswap

The history of The Graph

The Graph was founded by Yaniv Tal, Brandon Ramirez and Jannis Pohlmann. The founders all have engineering backgrounds. Work on the project started back in 2017, and in October 2020, a public ICO was held, resulting in the sale of GRT worth roughly $12 million.

In December 2020, the platform was launched on the Ethereum mainnet.

The Graph's features

The Graph protocol is designed to organise blockchain data and provide easy access to it. You could say that The Graph does for blockchains what Google does for the current iteration of the internet. That is why many refer to it as the "Google of blockchains".

Essentially, The Graph is an intermediary between blockchains and dApps. It allows dApps to send queries to a blockchain using a special query language called GraphQL. Any user can create and publish open APIs called subgraphs that define how to retrieve and index blockchain data in a verifiable way. As new blocks containing new transactions constantly appear on the blockchain network, Graph nodes constantly scan the blockchain and update the subgraphs that store all this data.

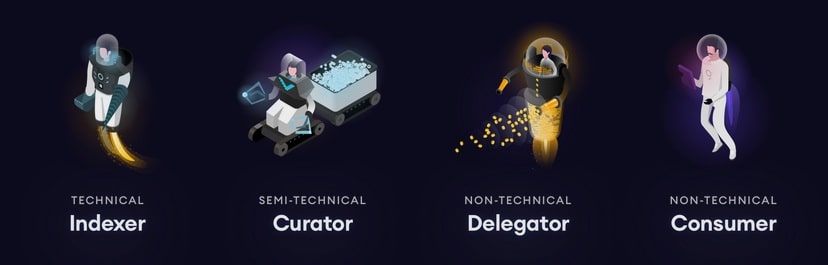

There are four types of participants in the protocol:

- Indexers are node operators in The Graph network that stake Graph Tokens (GRT) to provide indexing and query processing services. Indexers receive a commission for their services.

- Curators are users who signal to indexers which subgraphs should be indexed. Curators contribute GRT to point to a particular subgraph and earn a share of the commission for querying the subgraphs they point to. The curators are usually the developers of the subgraphs, but they can also be end-users who maintain an important service for them or community members.

- Delegators are users who would like to contribute to the network's security (and make money from it) but do not have the ability or desire to run the Graph node themselves. Delegators delegate GRT to existing indexers and, in return, receive a portion of the query fees.

- Consumers are the end-users of the protocol who submit queries to subgraphs and pay query fees to indexers, curators and delegators.

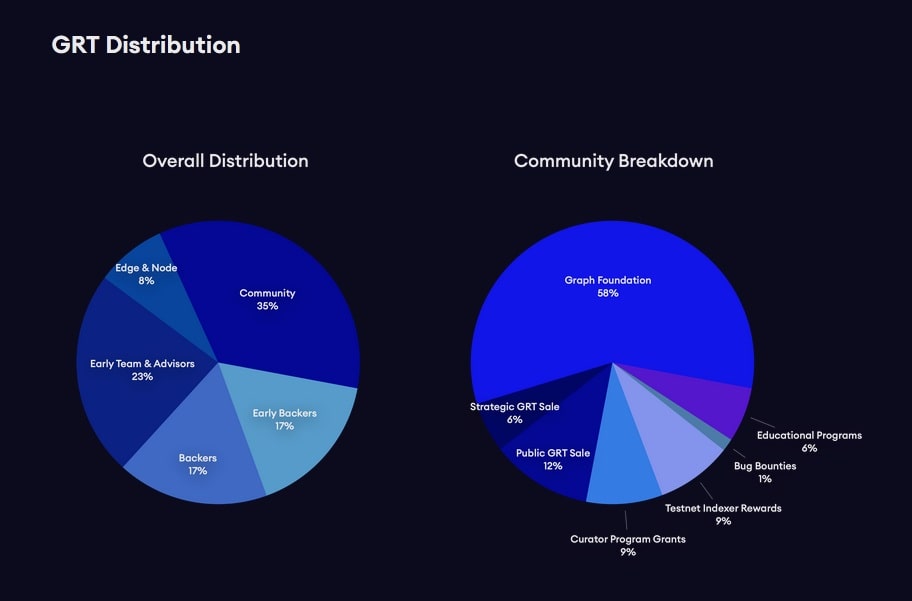

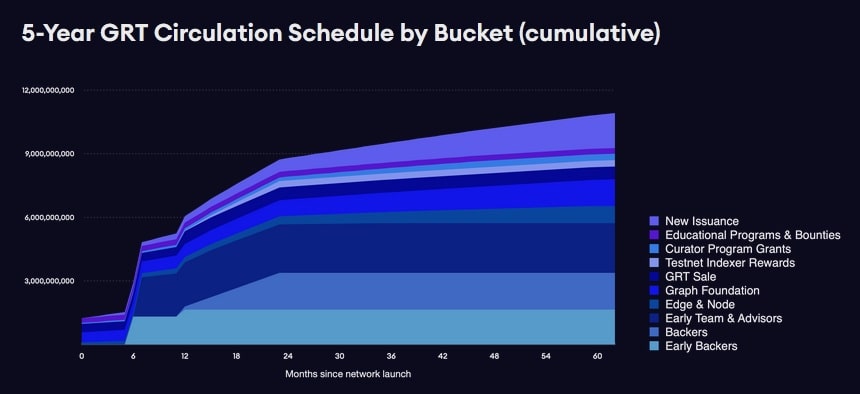

GRT is the utility token in The Graph ecosystem. The initial total token supply was 10,000,000,000 GRT, of which 400,000,000 GRT were put up for public sale. New token issuance is 3% annually, although this number may be changed in the future.

The Graph network is governed by The Graph Council. This council is a multi-signature 6 of 10 that balances the interests of five main stakeholder groups: indexers, active token holders, initial team, users and technical domain experts. Further decentralisation of network governance is planned for the future, but it's not yet clear exactly what scenario this will be run under.

The Graph (GRT) price analysis

As of 27 May 2022, the GRT token ranked 53rd among cryptocurrencies by market capitalisation at $987,985,236.

GRT price statistics (as of 27/05/22)

Current price | $0.1432 |

Market cap | $987,985,236 |

Circulating supply | 6,900,000,000 GRT |

Initial total supply | 10,000,000,000 GRT |

Daily trading volume | $96,165,441 |

All-time high | $2.88 (12/02/21) |

All-time low | $0.1237 (12/05/22) |

Website |

GRT's price history

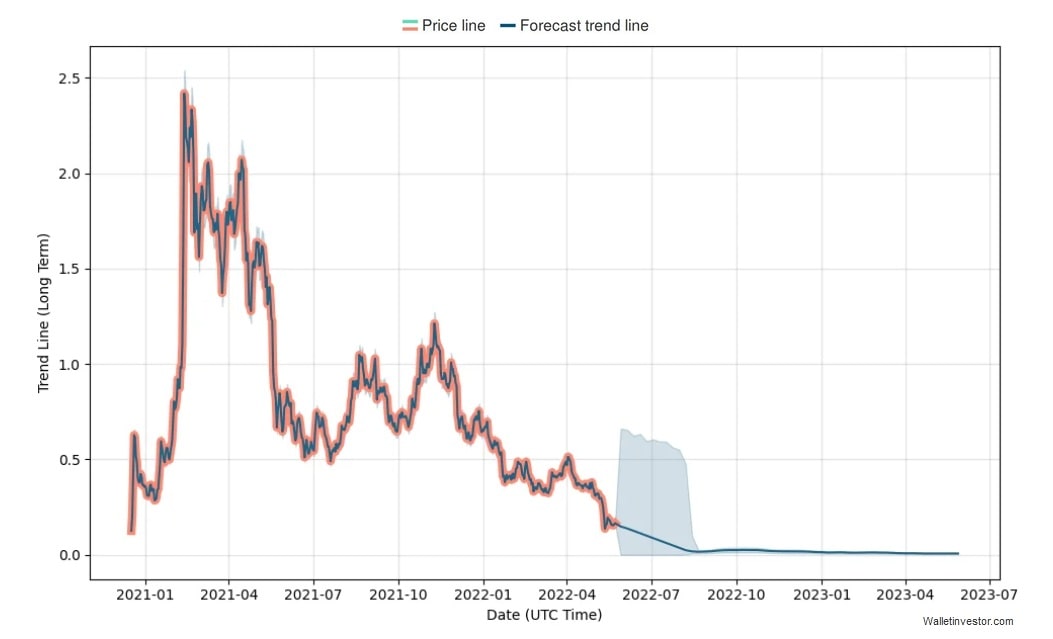

The GRT token entered the market at an opportune time in December 2020. After initial fluctuations, the token price began to rise sharply, and as soon as 12 February 2021, it reached its all-time high.

After that, the price started falling, moving in a fairly wide range. On 19 May 2021, the price broke the $1.20 support level and continued to fall.

At the end of July 2021, a local bullish trend started. However, after reaching a local high of $1.209, the price began to fall again, and the decline is still ongoing.

The Graph technical analysis

The GRT price has been moving in a descending channel since December 2021. On 15 March, the price broke through the upper boundary of this channel, and a bullish trend started to form. However, this did not last long. It soon changed back to a bearish trend, and on 11 May, the price returned to the descending channel.

The moving averages indicate strong bearish sentiment. The RSI is near the oversold line.

The nearest and only support level is the all-time low. The nearest resistance levels are at $0.24 and $0.28.

The Graph (GRT) price prediction 2022

The price behaviour of GRT, as with most other altcoins, is highly dependent on the overall state of the crypto market. However, in the case of GRT, an additional factor affecting price behaviour is the token unlocking schedule, which will cause the volume of GRT tokens in circulation to increase noticeably during the year. For this reason, it's highly probable that the GRT price will decline further, even in the case of moderate growth of the crypto market.

The Graph (GRT) coin price prediction for 2022, 2023, 2025 and 2030

Although the GRT token entered the crypto market relatively recently, it has a pretty high market capitalisation. This means that popular forecasting services don't overlook it.

Trading Beasts' GRT price prediction for 2022, 2023, 2025 and 2030

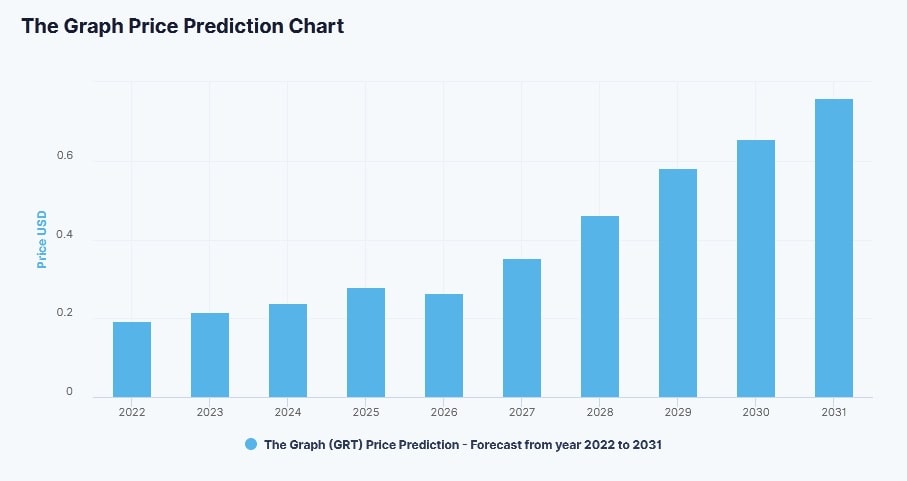

According to Trading Beasts' forecast, GRT's price will rise slowly in the coming years. They believe the token will be worth $0.225 at the end of 2022, $0.274 at the end of 2023 and $0.414 at the end of 2025.

Wallet Investor's GRT price prediction for 2022, 2023, 2025 and 2030

Wallet Investor doesn't agree with Trading Beasts and predicts the token's price will decline despite fluctuations. According to their forecasts, the price will be $0.0323 at the end of 2022, $0.0265 at the end of 2023 and $0.0277 at the end of 2025. After 5 years, in May 2027, the token price will reach $0.0199, according to Wallet Investor.

DigitalCoinPrice's GRT price prediction for 2022, 2023, 2025 and 2030

DigitalCoinPrice expects the price of GRT to rise. According to their models, the price will reach $0.18 at the end of 2022, $0.0.20 at the end of 2023, $0.29 at the end of 2025 and $0.66 at the end of 2030.

PickACrypto's GRT price prediction for 2022, 2023, 2025 and 2030

PickACrypto is very optimistic about the prospects for GRT. They believe the token's price can reach the $1-$2 range in 2022 and $4-$10 in 2023-2025.

Price Prediction's GRT price prediction for 2022, 2023, 2025 and 2030

Price Prediction also considers GRT as a good investment. They predict the average trading price of the token will be $0.17 in 2022, $0.24 in 2023, $0.56 in 2025 and $3.50 in 2030.

CryptoPredictions'GRT price prediction for 2022, 2023, 2025 and 2030

CryptoPredictions believe the token's price will rise slowly but steadily in the coming years. They predict the average price to reach $0.2132 by the end of 2022, $0.2601 by the end of 2023 and $0.3924 by the end of 2025.

The Graph (GRT) overall future value predictions

The Graph itself is a promising project that solves an important problem that has hampered the development of the blockchain industry. What's more, The Graph network is already up and running, with well-known projects such as CoinGecko, Uniswap, Decentraland and Synthetix using its functionality.

However, the project's token price has been in decline for most of its existence. The main reason for this is the unlocking schedule, which has caused the volume of tokens in circulation to increase faster than the demand for them. In addition, it's worth noting that GRT is an inflationary token, and its volume in circulation will increase over time even after all the locked tokens are unlocked.

Besides, it shouldn't be forgotten that the current network governance structure is rather centralised. Although the developers claim that the degree of governance decentralisation will increase in the future, it's currently unknown how and when it will happen.

Furthermore, The Graph is not the only project trying to fill such an important niche. It has competitors such as Bitquery. And while The Graph is now being referred to as the "Google of blockchains", things can still change.

How high can The Graph go?

If the project, in particular, and the blockchain industry, in general, continue to develop successfully, the token's price can potentially exceed $3 in the long term.

The Graph (GRT) price prediction today

In the near term, the GRT price is most likely to decline further, and a breakdown of the all-time low is a possible scenario.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.