Why Is Bitcoin Falling Today? When Will BTC Rise Again?

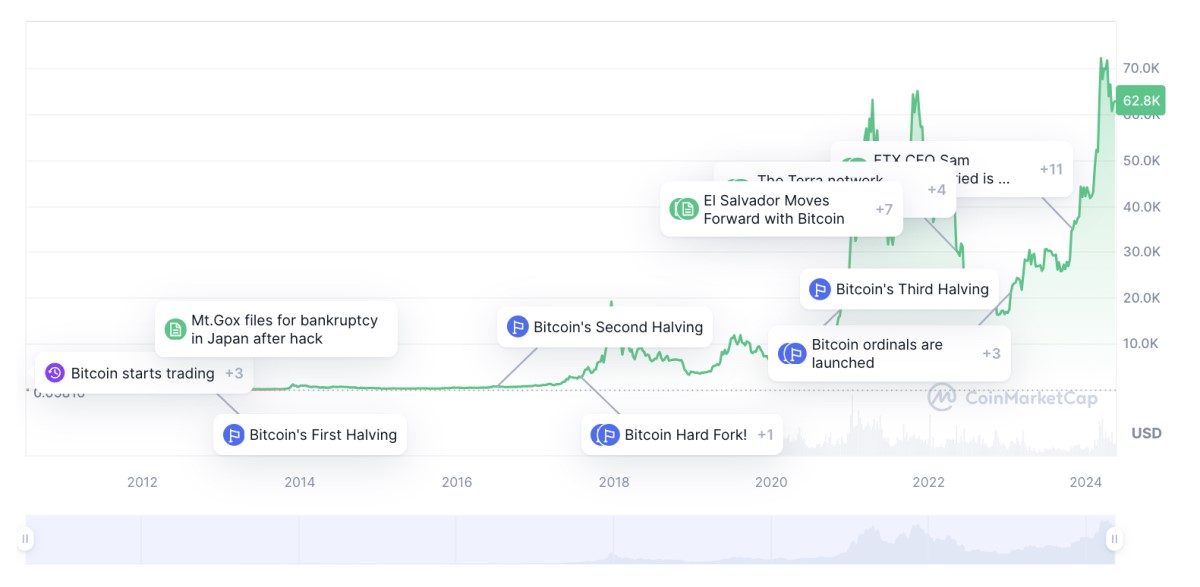

Why is Bitcoin falling? Is Bitcoin going to rise again? These are questions probably asked by every crypto trader or investor. The world of cryptocurrency is constantly fluctuating, with prices rising and falling in a matter of hours. Bitcoin, the first and most well-known cryptocurrency, is no exception. Following the much-anticipated Bitcoin halving in 2024, many crypto holders expected the asset's price to skyrocket the same week. However, in about 1 month following the fourth Bitcoin halving event, we still haven't seen the coin reach a new all-time high. What's more, we see BTC rapidly falling after slightly rising. What does this trend mean? In this article, we'll explore the factors that drive these fluctuations and look at what the future might hold for this asset.

Economists and journalists often get caught up in this question: Why does Bitcoin have value? And the answer is very easy. Because it is useful and scarce. — Eric Voorhees, Founder and CEO of Shapeshift

Will Bitcoin rise again?

The cryptocurrency market is highly unpredictable, and no one can say for certain what will happen to the price of Bitcoin in the future. Moreover, its past performance is not a guarantee of future results.

Having said that, there is a noticeable probability that the market situation has changed and the bearish trend is over. Of course, everyone is accustomed to the bearish trend by now. But a bear market cannot last forever. Sooner or later, there will come a point when the market phase changes. And there are a number of signs indicating that this may already be happening. Of course, this may only be a temporary correction, but that doesn't change the fact that the bearish trend will end sooner or later.

Considering Bitcoin's volatility and the rapid price change of other crypto assets, it's difficult to predict the future movements of crypto. Following the recent bullish trends, the market is mostly bearish again. As of May 2024, the asset's price fluctuates between $61,000 and $64,000. However, the market trends are changing rapidly, and we may see BTC hit the $100,000 mark by the end of the year.

Will the Bitcoin bubble burst?

The term "Bitcoin bubble" refers to the idea that Bitcoin's price is artificially inflated and will eventually collapse. While it's true that the price of Bitcoin has experienced significant fluctuations throughout its history, it's impossible to say with certainty whether the current state of Bitcoin is a bubble that will eventually burst or not. The price of Bitcoin is supported by demand for it and will collapse if people stop using it. And while we should not completely rule out that possibility, there is no indication at the moment that this will happen anytime soon.

Opinions about the future of Bitcoin's performance differ. By watching the crypto falling today, many assume the BTC bubble will burst once the price reaches its historical maximum value.

Following the discussion about Bitcoin's volatility and future performance, some experts believe the coin can surge to as high as $300,000. However, the bubble can burst soon after reaching the threshold, leading to a 'Bitcoin winter' that could last for years.

What causes Bitcoin to rise and fall?

As Bitcoin is an asset, its price is determined by the balance of supply and demand. This balance is influenced by many factors, which often makes it difficult to say which factor has played a decisive role in a particular change in price.

Why does Bitcoin fall?

There can be many reasons why the price of Bitcoin may fall. Some of the most common drivers of price decreases include:

- Negative news. Negative news, such as security breaches, the bankruptcy of major crypto exchanges, and negative publicity, can reduce demand for Bitcoin and cause the price to fall.

- Macroeconomic events. Macroeconomic events could reduce demand for high-risk assets, which include Bitcoin and for all assets in the market in general.

- Government crackdowns. If governments crack down on the use of Bitcoin, demand for it may decrease.

- Market manipulation. The sale of large volumes of Bitcoin by large holders could bring the price down.

- Social media. Surprisingly, you may watch the cryptocurrency price drop today because of things that don't touch conventional finances, such as international regulations and social media.

- Psychological factors. Psychological factors may also influence Bitcoin's downtrend. For example, if the asset fails to sustain a specific price mark, it can lead to a sell-off.

Why does the price of Bitcoin rise?

There are also numerous reasons why Bitcoin's price can rise. The most common ones are:

- Positive regulatory developments. Positive regulatory developments, such as recognising Bitcoin as a legitimate asset class, can increase demand.

- Macroeconomic events. Macroeconomic events, such as economic crises and inflation, could increase investors' demand for cryptocurrencies.

- Increase in acceptance and use. The more people use Bitcoin for financial transactions, the greater the demand for it.

- Political instability. Political instability and uncertainty, such as elections, wars, and political unrest, can increase demand for cryptocurrencies, leading to higher prices.

- Market manipulation. The purchase of large volumes of Bitcoin by the crypto market's big players can raise the price of Bitcoin.

- Utility. Cryptocurrency's ability to facilitate global transactions is one of the major reasons why so many people around the world love it.

- Institutional investment. The advent of Bitcoin ETFs led to a whopping 160% increase in Bitcoin's price in 2023 and about 50% in 2024 so far.

- Bitcoin halving is undoubtedly one of the major events driving BTC's price rise. Based on historical records, all halving events were followed by significant price boosts. Analysts expect the same to happen this time. Let's wait and watch.

Is it good to invest in crypto in 2024?

After the fourth Bitcoin halving event that happened in mid-April 2024, traders and investors alike are wondering: Will Bitcoin continue to rise in 2024?

While Bitcoin price movements cannot be predicted with certainty, the chances of 2024 seeing a rise in Bitcoin's price are good. However, it's worth remembering that Bitcoin is a high-risk asset. Therefore, always do your own research and don't invest more than you can afford to lose.

Can Bitcoin drop to $5,000 in 2024?

Given the high volatility and unpredictability of Bitcoin's price movements, such a scenario cannot be completely ruled out. However, the chance of Bitcoin falling to $5,000 in 2024 is quite low.

Where will cryptocurrencies be in 5 years?

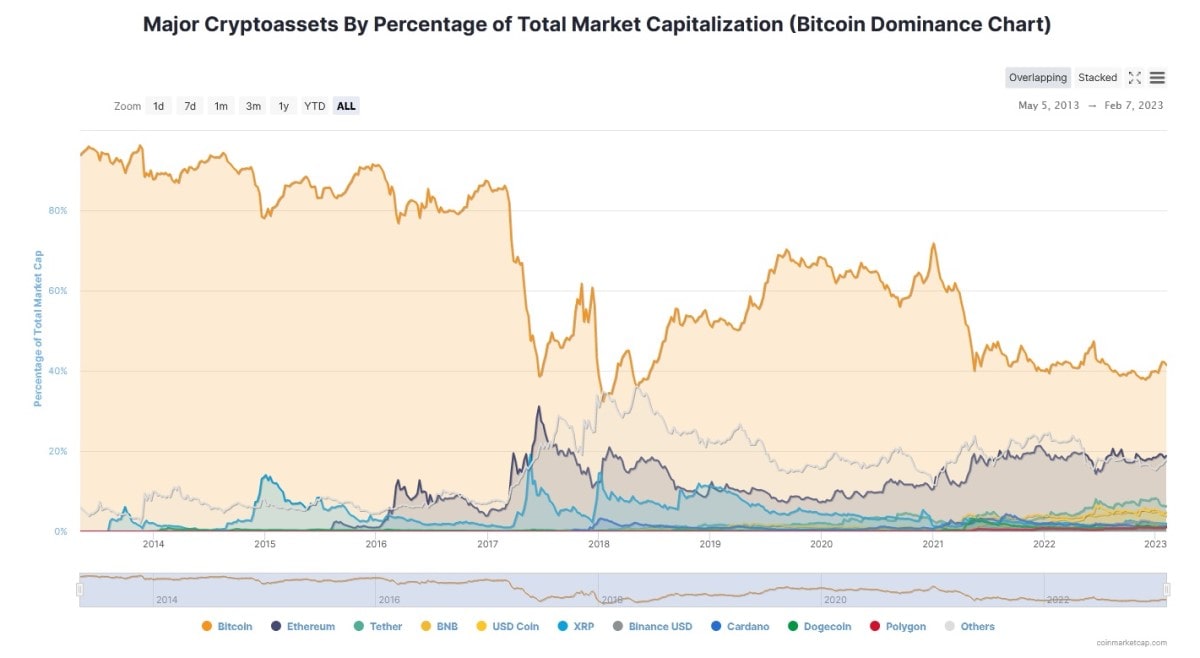

The prospects for cryptocurrencies over the next five years depend largely on how governments treat them. Blockchain technology and cryptocurrencies are here to stay, but regulators will strongly influence exactly what shape the crypto industry will take in the coming years. Being determined to keep control of the financial sector, many governments are now developing their own digital assets, so-called central bank digital currencies (CBDC).

Despite the similarities, CBDCs are essentially the opposite of decentralised cryptocurrencies, and their widespread adoption would concentrate unprecedented power in the hands of regulators. In that case, regulators may begin to treat decentralised cryptocurrencies with far less tolerance than they do now.

Having said that, it's worth noting that cryptocurrencies have been gaining increasing mainstream adoption in recent years, with more and more individuals, institutions, and corporations investing in and using cryptocurrencies. This trend will likely continue, leading to further growth and adoption of cryptocurrencies over the next five years. Thus, while we do not know how things will develop further, the potential of cryptocurrencies is evident.

How high will Bitcoin go?

The honest answer is nobody knows. However, it's reasonable to assume that Bitcoin has not yet reached its ceiling. Cryptocurrency adoption keeps growing, and Bitcoin remains the dominant cryptocurrency. There's also a chance that at the peak of the next bull run, Bitcoin's price could come close to $100,000 or even surpass that level.

When is the best time to buy BTC?

The best time to buy Bitcoin depends on your particular situation and the purpose of buying Bitcoin. The answer will vary greatly depending on whether you are buying Bitcoin for a long-term investment, intraday trading, or simply to transfer money across borders. If you need Bitcoin just to make a transfer and convert it back into fiat, it essentially makes little difference to you when you buy it.

However, if you buy Bitcoin for investing or even more so for trading, then the timing of buying Bitcoin is a complex and often subjective decision, and in that case, you cannot do without technical analysis. In general, the best time to buy Bitcoin is, of course, at the very beginning of a bullish trend. But such situations are quite rare. Much more often, you will have to look for good entry points using a trading strategy while considering the market situation.

BTC/USDT price chart

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

Why are crypto prices falling today?

You can notice the cryptocurrency price drop today. Speaking about the industry leaders, Bitcoin failed to sustain the $62,000 mark. Ethereum and several other altcoins also experienced a price drop. The reasons for crypto's price falling can be diverse. One possible cause of the current market condition could be the recent rally in GameStop stock. Such rallies in meme coins can significantly impact the price of digital assets.

Are crypto price predictions accurate?

Cryptocurrency price predictions can be helpful sources of information. However, you shouldn't fully rely on them when making investment decisions. The accuracy of crypto price predictions depends on multiple factors, including:

- Methodology (crypto price predictions that are based on thorough analysis and methodology are more accurate)

- Market volatility (due to Bitcoin's volatility and rapid price movements in the crypto market in general, sudden price movements can bring inaccurate predictions)

- Bias (predictions can be influenced by people making them like someone owning a crypto can overestimate its future performance).

What causes Bitcoin volatility?

Bitcoin's volatility is caused by many factors, which include but are not limited to the following:

- Supply and demand. The crypto's supply is limited to 21 million coins. The closer the circulating supply reaches this limit, the higher the coin's price climbs.

- Investor actions. If long-term Bitcoin investors (also known as Bitcoin whales) start selling their holdings, prices could plummet due to other investors' panic.

- Regulation changes can also cause Bitcoin's volatility.

- News and events. Investors and well-known crypto fans can create concerns, resulting in the crypto price falling.

- Speculation about price movements. This is one of the most common reasons for Bitcoin's volatility at any given moment.