AAVE Price Prediction2024-2030

The cash lending business has always been the domain of wealthy institutions such as banks. Due to this sector's high threshold of entry and strict regulation, this method of income generation wasn't available to ordinary people. However, with the advent of blockchain technology, this situation may change. In this article, we'll talk about Aave, a project that is designed to give ordinary people access to the lending market. We'll also consider the project's prospects and try to make a price prediction for its token.

What is Aave (AAVE)?

Aave is a decentralised finance (DeFi) lending protocol that allows its users to lend and borrow crypto assets using variable or fixed interest rates.

For the first time ever in history, we created finance as a human right after the barter economy, and that's very big.'' — Stani Kulechov, Founder and CEO of Aave

The history of Aave (AAVE)

The Aave project was founded by Finnish programmer and entrepreneur Stani Kulechov, who graduated from the University of Helsinki in 2018. While at university, he became interested in blockchain technology and Ethereum. On 1 May 2017, Kulechov founded the company ETHLend. In November of that year, ETHLend launched the ETHLend.io P2P lending platform and held an ICO for $16.2 million. The project sold 1 billion native LEND tokens. Of those, 300 million coins (23%) were kept by the founder and the team.

In September 2018, ETHLend.io was rebranded as Aave, which means "ghost" in Finnish. The project team explains this name by the fact that "the brand is aimed at creating a transparent and open infrastructure for decentralised finance". After the rebrand, ETHLend became a subsidiary of Aave.

On 8 January 2020, the mainnet of Aave's first version launched on the Ethereum blockchain. In October 2020, the native AAVE token was issued, and LEND tokens migrated to AAVE at a ratio of 100 to 1. In December 2020, the Aave V2 mainnet went live.

Aave's features

Aave allows users to lend and borrow cryptocurrency in a decentralised and trustless manner. There are no intermediaries, and you don't need to provide any documents or go through Know Your Customer (KYC) or Anti-Money Laundering (AML) procedures to use the platform.

Initially, the platform used a peer-to-peer (P2P) model where users interact through smart contracts. The disadvantage of the scheme is that counterparties and liquidity are not always available for efficient operations. Therefore, the developers decided to move to the peer-to-contract (P2C) model. On a P2C platform, funds are deposited through a special contract that allows you to instantly borrow crypto assets for interest payments to use credit.

In general terms, lenders put their funds into a pool, and users can take loans from it. Moreover, the platform allows lenders to withdraw their funds safely at any time. Borrowers deposit assets into the platform as collateral. In exchange, they can borrow a smaller amount of the asset determined by the Loan-to-Value (LTV) ratio, which is the maximum amount that can be borrowed for a particular collateral.

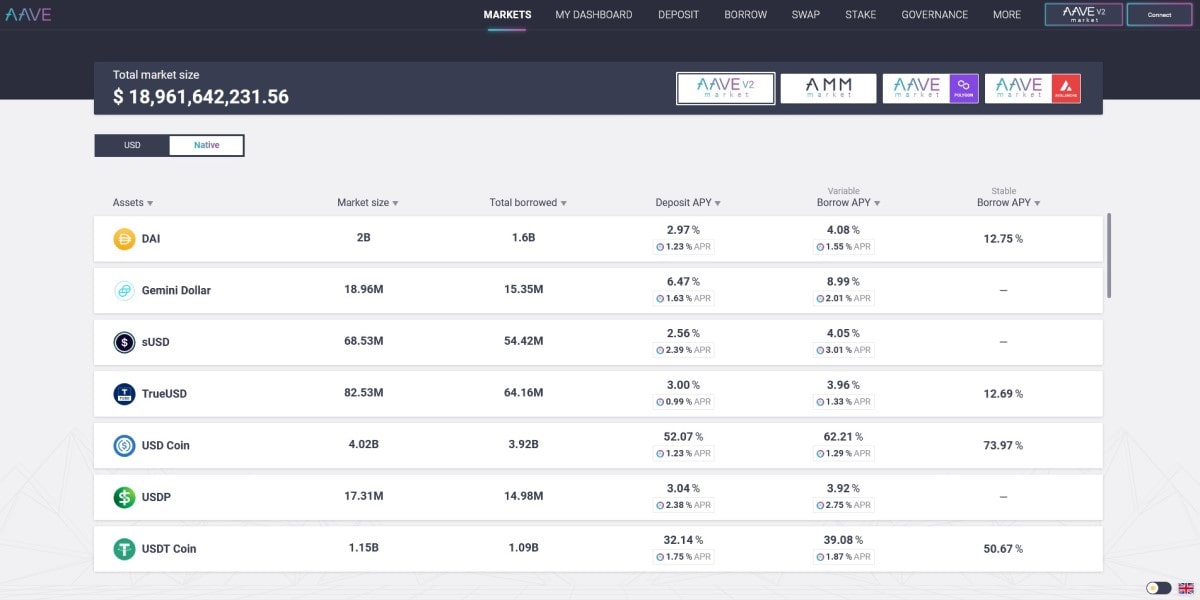

Borrowing funds involves 'overcollateralisation', which provides protection against the high volatility of cryptocurrency markets. The value of the collateral must exceed the value of the borrowed asset based on the LTV. The LTV, in turn, depends on volatility and other risk parameters of the collateralised asset. Users can lend or borrow any of the 31 tokens available on the platform, as well as use them as collateral.

In addition, the Aave platform offers so-called flash loans. These are undercollateralised loans in which obtaining a loan and paying off debt are carried out within the same block of the blockchain.

Flash loans can be used for:

- Rebalancing your portfolio through multiple operations within one transaction, which optimises commission

- Arbitration

- Self-liquidation

- Collateral swapping

The AAVE token is the native cryptocurrency of the project's ecosystem. It complies with the ERC-20 standard and is used as a governance token. Holders of this token can vote on proposals or collectively act as governing bodies of the protocol.

Aave (AAVE) price analysis

At the time of writing, the AAVE token ranked 62nd among cryptocurrencies by market capitalisation at $1,893,036,214.

AAVE price statistics (as of 26/03/24)

AAVE current price | $128.20 |

Market cap | $1,893,036,214 |

Circulating supply | 14,766,563 AAVE |

Max supply | 16,000,000 AAVE |

Daily trading volume | $125,419,656 |

All-time high | $666.86 (18/05/21) |

All-time low | $25.97 (05/11/20) |

Website |

AAVE's price history

The token was listed on cryptocurrency exchanges shortly after LEND migrated to AAVE. After AAVE entered the crypto market, the token's price declined until 5 November 2020, when it reached its all-time low. Then, it began to rise until almost mid-February 2021, and after a slight correction, it gave way to sideways movement. In May 2020, the price rallied to its all-time high but immediately fell sharply thereafter. The correction brought the price to the local low of $170.10 on 22 June, after which the price began to recover. Despite the September correction, this recovery continues to this day.

AAVE/USDT Price Chart

In 2022, despite its technological advancements, Aave experienced a significant downturn. A notable characteristic of Aave is its unpredictable and volatile nature, often displaying bullish and bearish trends.

Since June 2023, the price of the Aave token has fluctuated between $49 and $110. While there have been gradual corrections in recent months, the price has consistently remained above $55. Based on current price movements, there is potential for an increase in the value of the AAVE cryptocurrency soon.

Aave technical analysis

As of 26 March 2024, the sentiment surrounding Aave's price prediction leans towards bullish, supported by technical indicators. The 200-day Simple Moving Average (SMA) is anticipated to ascend in the coming month, projected to reach $120.45 by 24 April 2024. Additionally, the short-term 50-day SMA is expected to climb to $204.42 by the same date.

The Relative Strength Index (RSI) currently stands at 54.16, suggesting a neutral stance in the Aave market. This implies a balanced equilibrium between buying and selling pressure. Examining the classical pivot point (P1), which is presently valued at $123.55, Aave exhibits support levels at $121.53 and $118.28, with the strongest support at $116.26. Conversely, resistance levels are identified at $126.79, $128.81, and $132.05.

Despite the neutral RSI, the overall outlook remains bullish, with moving averages indicating potential upward momentum. Traders should closely monitor Aave's price action, particularly its ability to sustain above the support levels outlined. If Aave maintains its bullish momentum, it could surpass resistance levels and continue its upward trajectory. However, a failure to hold support levels may lead to a retest of lower support zones, with $116.26 being the critical level to watch.

Aave price prediction 2022

Given the current general state of the cryptocurrency market, AAVE, like many other altcoins, is likely to keep falling until there's a major shift in crypto market sentiment.

Aave price prediction 2024

According to various sources, AAVE's price in 2024 may fluctuate significantly:

- Changelly suggests a range from $105.39 in March to $317.68 in December.

- CoinCodex projects a substantial increase, estimating a rise of 228.85% to $406.57 by 22 April 2024.

- Bitscreener anticipates a potential upward trend leading to $153.49 but warns of a possible decline to $81.51 if momentum falters, with an estimated closing price of $111.03 for the year.

- CryptoPredictions offers an average price expectation of $105.905, peaking at $142.810 in December.

- Coin Price Forecast predicts a year-end price of $128, with a mid-year peak of $148.

Aave (AAVE) price prediction for 2024, 2025 and 2030

As a fairly popular altcoin, AAVE hasn't been able to escape the scrutiny of crypto experts. Let's see what they think about the outlook for the token's price.

TradingBeasts' AAVE price prediction for 2024, 2025 and 2030

According to TradingBeasts' projections, Aave (AAVE) is anticipated to achieve a price of $624.891 in 2024. Looking ahead to the end of 2025, Aave's price may ascend to $1,953.921. Further into the future, by 2030, Aave could potentially soar to a new all-time high of $1,194.042.

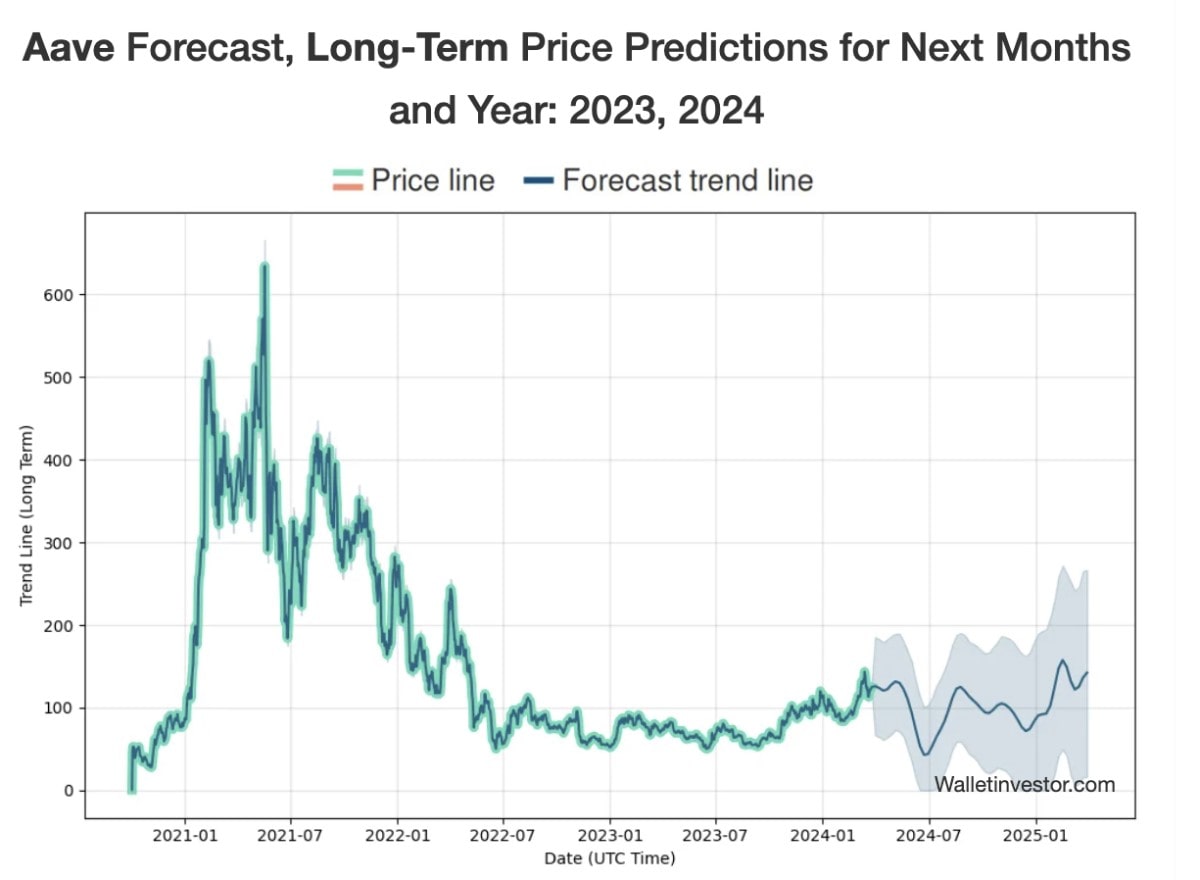

WalletInvestor's AAVE price prediction for 2024, 2025 and 2030

According to WalletInvestor's forecasts, Aave (AAVE) is projected to attain a price of $153.6051 in 2024. Looking forward to the conclusion of 2025, Aave's price could escalate to $253.9701. By 2030, there is a possibility that Aave could achieve a new all-time high of $253.9701.

Long Forecast's AAVE price prediction for 2024, 2025 and 2030

According to Long Forecast's projections, Aave (AAVE) is anticipated to demonstrate varied price movements throughout 2024, with estimates reaching $119 in March, $115 in April, $133 in May, $112 in June, $126 in July, $146 in August, $169 in September, $203 in November, and $207 in December. Looking ahead to 2025, Aave's price could climb to $292 in July, $222 in August, $258 in September, $217 in October, $210 in November, and $244 in December. In the more distant future, by 2030, Aave may achieve a new all-time high of $383 in April.

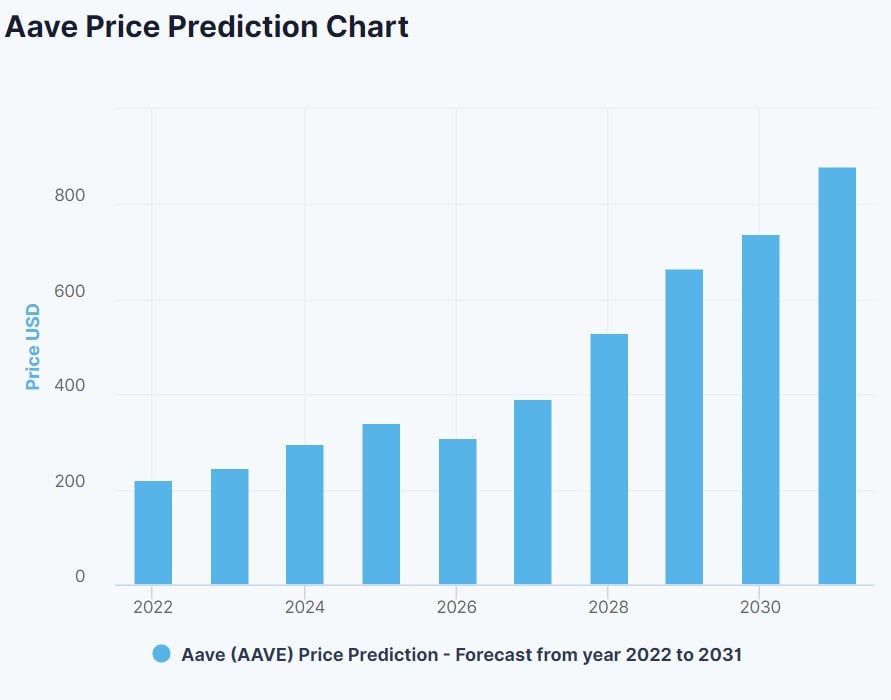

DigitalCoinPrice's AAVE price prediction for 2024, 2025 and 2030

According to DigitalCoinPrice calculations, the average price is anticipated to hover around $249.01, with a maximum reaching $266.69. Moving to 2025, the average cost is predicted to rise to approximately $304.56, with a maximum potential of $313.98. Looking further ahead to 2030, projections suggest an average price of about $874.57, with a maximum expected price of $911.53.

Aave (AAVE) overall future value predictions

The decentralised lending market has huge potential, and, at the moment, AAVE is the leading project in this market. The developers are actively working on the project, and its adoption is growing.

However, Aave suffers from the problem almost any other DeFi lending protocol has: the need for overcollateralisation. The attractiveness of loans is that they allow you to get more liquid funds than you currently have. Borrowing less money than what you have to deposit as collateral is pointless in most cases unless you know exactly what you're doing.

How high can Aave go?

Given the current general state of the crypto market, there's a real chance that the price will exceed its all-time high.

AAVE price prediction today

Despite the bearish sentiment, there are signs of a possible trend reversal. We recommend that you exercise caution when opening positions.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.