Arbitrum (ARB) Price Prediction 2023-2030

Ethereum is the most popular platform for creating smart contracts and decentralised applications (DApps). Due to the limited bandwidth of the Ethereum network, transactions become slower and more expensive. Not only Ethereum developers but third-party projects are trying to solve this scalability problem. In this article, we'll look at Arbitrum, its token ARB, and its price predictions.

What is Arbitrum (ARB)?

Arbitrum is a Layer-2 solution for scaling Ethereum, significantly reducing fees and increasing blockchain throughput without compromising security.

Although I couldn't foresee what the Ethereum ecosystem would look like in the future, I had an idea that combining the idea of general computation with blockchain would bring explosive innovation. However, as a computer system researcher, it was obvious to me that scalability would be a problem. – Ed Felten, Co-Founder and Chief Scientist of Arbitrum.

The history of Arbitrum

Arbitrum was created by Offchain Labs, an American company founded in 2018 in New York City by Ed Felten, Steven Goldfeder and Harry Kalodner. All three are specialists in cryptography and blockchain technologies.

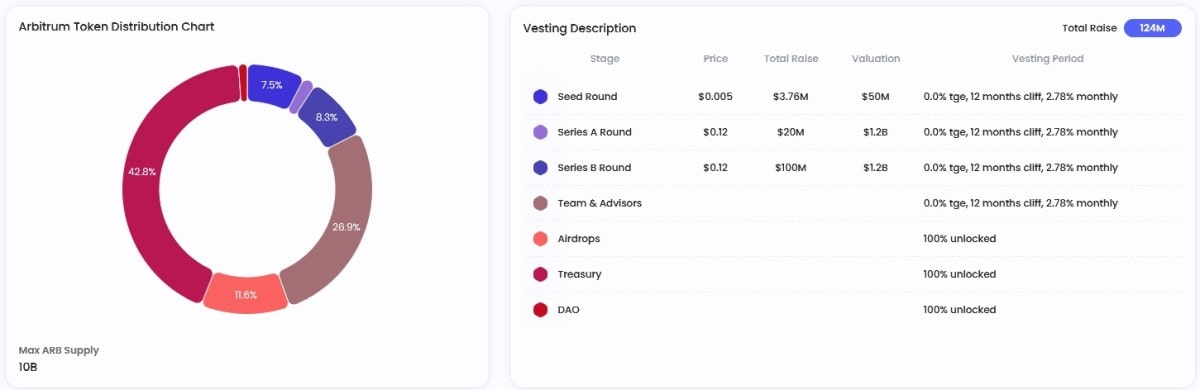

In 2019, Offchain Labs raised $3.7 million in a seed investment round. In the spring of 2021, before launching the alpha version of the Arbitrum network, the company held a Series A investment round, which raised $20 million. In August 2021, a Series B round was held, which raised another $100 million. Major investors included Lightspeed Venture Partners, Polychain Capital, Ribbit Capital, Redpoint Ventures, Pantera Capital, Alameda Research and Mark Cuban.

On 31 August 2021, the main Arbitrum One network was officially launched. At that time, the network lacked a native token.

In August 2022, the Arbitrum Nitro update was released, further reducing transaction fees and increasing network throughput.

In March 2023, the project conducted an airdrop of the ARB governance token. On 22 March 2023, in anticipation of the ARB airdrop, the daily number of transactions on the network exceeded that of Ethereum.

In June 2023, Offchain Labs released a tool for launching Layer-3 blockchains based on Arbitrum.

Arbitrum's features

Being a Layer-2 solution, Arbitrum processes transactions separately from the main Ethereum network and sends the processed data to the main network as a packet. This solution increases the scalability of Ethereum and reduces transaction costs.

Arbitrum is based on the concept of optimistic rollups. It's that transactions on Layer-2 are rolled up into a single transaction recorded on the ETH main network. This saves gas costs and avoids congestion on the main network. Optimistic rollups rely on "fraud-proof". They "optimistically" assume that an added block is valid unless proven otherwise.

New blocks are approved by validators who receive transaction fees. Arbitrum's architecture is designed so that only one honest validator is required to approve a block, regardless of how many malicious validators exist.

To become a validator with the ability to propose blocks, one needs to place ETH in a deposit smart contract. Anyone in the Arbitrum network within 7 days can claim that the block is fraudulent. If the block is fraudulent, it's removed, and the validator who proposed it loses the deposit. If the block has not been challenged within 7 days, it's transferred to the Ethereum blockchain.

Transactions are processed, and fees are collected using the ArbOS operating system. But the security of transactions is ensured by the Ethereum network.

Arbitrum uses its own Arbitrum Virtual Machine (AVM) to efficiently execute smart contracts. The AVM is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to seamlessly port existing smart contracts from the Ethereum network to Arbitrum. This compatibility ensures a smooth transition of DApps preserving their functionality while providing enhanced performance.

As of July 2023, Arbitrum's ecosystem is a home for over 500 blockchain projects, including well-known ones such as 0x, 1inch, Aave, Uniswap, USDC, DAI and many others.

ARB is a governance token that provides decentralised governance in the Arbitrum ecosystem. Ownership of ARB makes it possible to participate in decisions affecting the future of Arbitrum.

Arbitrum (ARB) price analysis

As of 25 July 2023, the ARB token ranked 36th among cryptocurrencies by market capitalisation at $1,489,725,668.

ARB price statistics (as of 25/07/23)

Current price | $1.17 |

Market cap | $1,489,725,668 |

Circulating supply | 1,275,000,000 ARB |

Total supply | 10,000,000,000 ARB |

Daily trading volume | $116,698,885 |

All-time high | $11.80 (23/03/23) |

All-time low | $0.9142 (15/06/23) |

Website |

ARB's price history

The price history of the ARB token is still quite short. The token was listed on cryptocurrency exchanges after airdrop on 23 March 2023. After the initial volatility faded, the price rose sharply on 13 April 2023 and reached a local high of $1.78 on 18 April.

Then the price started declining until 15 June, when the price reached its all-time low. After that, the trend changed, which made the price grow.

ARB/USDT price chart

Arbitrum (ARB) technical analysis:

On 24 July, the price broke down the diagonal support line and continued to decline after retesting. The moving averages are still bullish, but it's worth considering the lag of this indicator. Meanwhile, the MACD indicates a bearish sentiment.

The nearest support levels are $1.06 and $0.91. The nearest resistance levels are $1.35 and $1.82. However, it's worth noting that in the case of coins with such a short price history as ARB, technical analysis is more unreliable than usual.

Arbitrum (ARB) price prediction 2023

Given that the ARB token is relatively young, it's difficult to conclude its prospects. However, we can assume that two factors will dominate the token's price behaviour in 2023. Firstly, the general state of the crypto market. Secondly, the token's utility needs to increase. It's obvious both for the project community and investors that if ARB remains merely a governance token, there's a risk of decreasing interest in it.

Arbitrum (ARB) crypto price prediction for 2023, 2025, 2030 and 2040

ARB is one of the Top 50 cryptocurrencies by market cap, so it's no surprise that forecasting services haven't overlooked it. Let's see what they think of ARB's future.

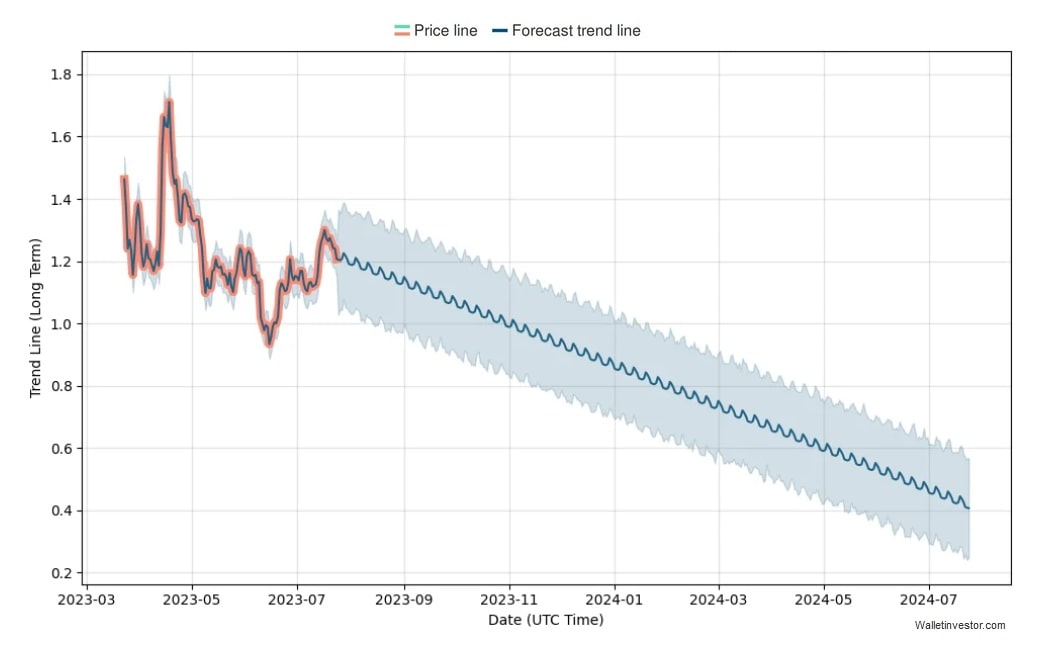

Wallet Investor's ARB price prediction for 2023, 2025, 2030 and 2040

Wallet Investor predicts that ARB's price will fall in the coming years, reaching $0.871 at the end of 2023 and $0.118 at the end of 2024. It'll recover in 2025 and reach $0.177 at the end of the year. However, the decline will continue, and the price will reach $0.138 at the end of 2027.

CoinCodex's ARB price prediction for 2023, 2025, 2030 and 2040

According to CoinCodex's analysis, ARB's price will rise. It'll be in the range of $1.024 - $2.71 in 2024, in the range of $2.29 - $9.24 in 2025 and in the range of $6.64 - $8.40 in 2030.

Cryptopolitan's ARB price prediction for 2023, 2025, 2030 and 2040

Cryptopolitan expects the average price to reach $1.51 in 2023, $2.17 in 2024, $3.10 in 2025, and $20.46 in 2030.

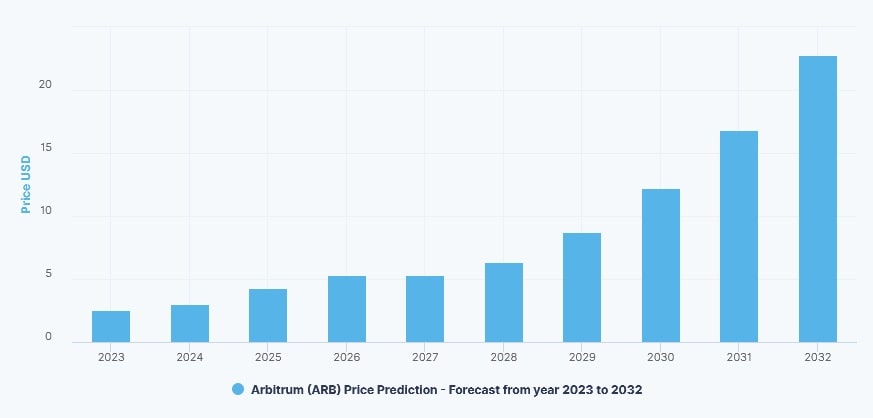

DigitalCoinPrice's ARB price prediction for 2023, 2025, 2030 and 2040

DigitalCoinPrice also predicts the token's price to rise. According to them, ARB's price will reach $2.53 at the end of 2023, $2.68 at the end of 2024, $3.82 at the end of 2025 and $11.55 at the end of 2030.

Gov Capital's ARB price prediction for 2023, 2025, 2030 and 2040

Gov Capital, whose predictions are usually very optimistic, unexpectedly provided a pretty bearish forecast in the case of ARB. They believe the price will fall to $0.163 in a year.

Price Prediction's ARB price prediction for 2023, 2025, 2030 and 2040

Price Prediction expects a significant increase in the token's price. They believe the average price will be $1.50 in 2023, $2.14 in 2024, $3.24 in 2025, and $21.99 in 2030.

CryptoPredictions'ARB price prediction for 2023, 2025, 2030 and 2040

CryptoPredictions also thinks that the price will rise, but slowly and smoothly. According to them, the average price will reach $1.361 by the end of 2023, $1.841 by the end of 2024 and $2.343 by the end of 2025.

Arbitrum (ARB) overall future value predictions

Is the Arbitrum coin a good investment?

The Arbitrum project is one of the most popular Layer-2 scalability solutions for Ethereum. Thanks to its technological innovations, it has real value. Moreover, Ethereum really needs a good Layer-2 solution. The project has some notable advantages:

- Scalability. One of the primary advantages of Arbitrum is its ability to significantly improve scalability for the Ethereum network. This scalability enhancement allows for a more seamless user experience and facilitates the mass adoption of DApps.

- Reduced gas fees. Arbitrum considerably reduces gas fees compared to directly interacting with the Ethereum mainnet.

- Compatibility with Ethereum. Arbitrum is fully compatible with Ethereum Virtual Machine. Due to this compatibility, developers can seamlessly migrate their existing Ethereum smart contracts and DApps to the Arbitrum ecosystem.

- Trust and security. Arbitrum employs a fraud-proof mechanism that enhances the security and trust of its transactions. This mechanism enables users to challenge and correct any invalid transactions or malicious activities, ensuring the system's integrity.

- Decentralised governance. The issuance of the ARB governance token transferred control of Arbitrum from Offchain Labs to a decentralised autonomous organisation (DAO).

However, like any other technology or solution, in addition to its advantages, Arbitrum has its limitations and disadvantages:

- Competition. As the blockchain industry continues to evolve, Arbitrum faces competition from other Layer-2 scaling solutions and blockchain platforms offering similar scalability features.

- Dependency on Ethereum. As a Layer-2 scaling solution, Arbitrum's success is closely tied to the health and stability of the Ethereum network. Any problems and challenges faced by Ethereum are very likely to affect Arbitrum.

- Rollup challenge time. Due to the rollup challenge time, transactions reach the Ethereum mainnet with a 7-day delay.

- Token distribution. Early investors and the team own too significant a portion of the token supply.

- The limited utility of the token. ARB is a governance token with few uses beyond the ability to influence decisions about the Arbitrum ecosystem. This makes it less attractive to users and investors. However, for additional incentives, the Arbitrum community has proposed distributing a portion of the accumulated revenue of the Arbitrum DAO to ARB token holders.

How high can the ARB coin go?

It's challenging to make such predictions at the moment due to the lack of historical data, but if the project continues to develop well, reaching the $2.80 mark during the nearest bull run looks quite realistic.

Arbitrum (ARB) price prediction today

In the near term, the most likely scenario is a further decline in ARB's price.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.