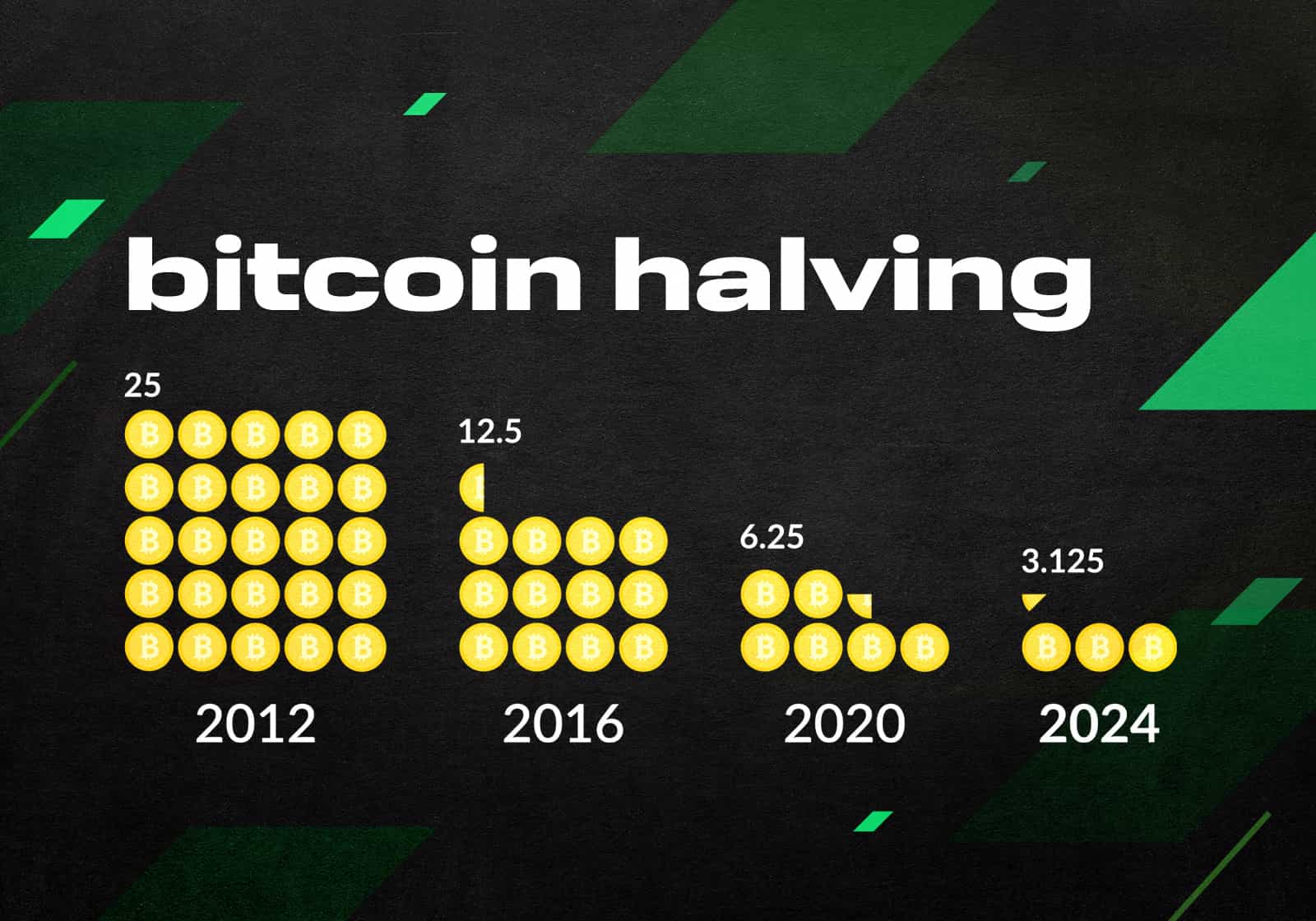

Bitcoin halving dates history

Bitcoin, the world's first cryptocurrency, has one important pre-programmed feature: The reward miners receive for including transactions into a block is not permanent. Halving crypto occurs after every 210,000 blocks mined. This event occurs about once every 4 years and is called "halving". If you want to know what halving means, the halving formula and its purpose, you can learn more about it in our other article on Bitcoin halving. In this article, we'll explore previous Bitcoin halving dates and their correlation with price history while also taking a quick look into the future halving countdown and everything that may happen around this phenomenon.

When was the last Bitcoin halving?

The most recent Bitcoin halving occurred on 19 April 2024, when block 840,000 was mined. As a result of that halving, now 3.125 new bitcoins (down from 6.25) are created roughly every 10 minutes.

Bitcoin halving dates

According to the Bitcoin algorithm, there will be 33 halvings in total, after which the fixed part of the block reward will become less than 1 satoshi (the smallest unit of Bitcoin). Essentially, it will be equal to zero. Four halvings have already taken place. Let's take a closer look at the Bitcoin halving countdown list and discover "How long does halving last?"

Pre-halving period

The halving countdown for Bitcoin, a key event in the world of halving crypto, is a pivotal moment that occurs approximately every four years. The halving formula, designed to reduce block rewards by 50%, marks the Genesis Block's historical mining on 3 January 2009 by Satoshi Nakamoto, the coin's enigmatic creator.

The creator of Bitcoin set the initial block reward at 50 BTC. Since Bitcoin had no monetary value in those days, there was no real incentive to participate in mining, and Satoshi was almost the only miner. However, as early as 17 March 2010, BitcoinMarket.com became the first-ever Bitcoin exchange. That caused a surge of interest in the new currency, and in the spring of 2011, the price of Bitcoin surpassed $1.

Although 50% of available Bitcoins were mined within that rather short period before the first halving and the supply of Bitcoin grew at a fairly rapid pace, Bitcoin's price at that stage increased from $0 to $12.

Pre-halving period

Date | 3 January 2009 |

Block number | 0 |

Block reward, BTC | 50 |

BTC created per day | 7200 |

BTC price at the start | N/A |

BTC price 100 days later | N/A |

BTC price 1 year later | N/A |

Bitcoin halving 2012

The first crypto halving event occurred on 28 November 2012, signifying a pivotal moment in the crypto world and offering insights into the questions of what halving means, how long does halving last, and why does halving increase price.

At first, the halving had no noticeable effect on Bitcoin's price. However, at the beginning of 2013, the coin's value began to grow steadily, and in April, it gave way to a correction and continued again in the autumn of 2013, ending above $1,100. This was followed by a prolonged fall in prices, which went down to $152 on 14 January 2015. Finally, in October 2015, nine months before the next halving, steady growth began again.

First halving

Date | 28 November 2012 |

Block number | 210,000 |

Block reward, BTC | 25 |

BTC created per day | 3600 |

BTC price at the start | $12 |

BTC price 100 days later | $42 |

BTC price 1 year later | $964 |

Bitcoin halving 2016

The occurrence of the second crypto halving on 9 July 2016 marks a significant event in the crypto community, shedding light on the questions of what halving means, how long does halving last, and why does halving increase price.

These expectations, coupled with a sharp rise in Bitcoin's renown and acceptance, led to a noticeable price increase that began at the end of May, a month and a half before the halving. However, a correction took place in mid-June, and soon after the crypto halving itself, the price fell again, with its local minimum reaching May levels.

As it later turned out, that was only a short-term correction. The bullish trend soon continued and developed into exponential growth. This growth peaked on 17 December 2017, when the price reached its all-time high of $19,700. After that, a long bearish trend set in.

There were several reasons for this spike in price; it's impossible to say what part halving played. In 2017, the popularity and acceptance of Bitcoin and other cryptocurrencies grew rapidly, attracting a large number of new participants to the crypto market. That, in turn, led to the emergence of an 'ICO bubble', which further increased demand for Bitcoin since many ICOs accepted it.

Second halving

Date | 9 July 2016 |

Block number | 420,000 |

Block reward, BTC | 12.50 |

BTC created per day | 1,800 |

BTC price at the start | $663 |

BTC price 100 days later | $609 |

BTC price 1 year later | $2550 |

Bitcoin halving 2017-2019

There were no halvings during these dates.

Bitcoin halving 2020

What halving means is a question that many in the crypto community ponder, especially in regard to questions about how long does halving last and why does halving increase price. The third halving, which took place on 11 May 2020, as well as the previous Bitcoin halving, did not cause an immediate price increase. It's true that growth began on earlier halving dates at the beginning of the year, but the coronavirus crisis that started in March caused Bitcoin's price to collapse. This makes it even more difficult to assess how much halving is already factored into the price. At the same time, it should be taken into account that the current amount of Bitcoin being mined is quite small compared to the total amount of Bitcoin traded, and it is unlikely that a relatively small drop in supply can cause a significant price increase. Thus, a possible further increase in the price of Bitcoin will be much more influenced by a growth in demand than a reduction in supply.

Third halving

Date | 11 May 2020 |

Block number | 630,000 |

Block reward, BTC | 6.25 |

BTC created per day | 900 |

BTC price at the start | $8740 |

BTC price 100 days later | $11,950 |

BTC price 1 year later | $58,250 |

Bitcoin halving 2024

Following the fourth Bitcoin halving on 19 April 2024, the reward for validating each new block on the Bitcoin network was halved. This reward, called the block subsidy, now stands at 3.125 bitcoins for successful miners. Miners also earn transaction fees from each block.

ViaBTC mined the 840,000th block, which marked the halving. Interestingly, the successful miner earned over 40 bitcoins worth over $2.6 million, including both subsidies and fees.

This amount is significantly higher than the total fees earned from the blocks immediately preceding the halving, totalling a little over 7 bitcoins worth over $450,000. This fee spike is unclear, but it may be due to users willing to pay higher fees to ensure their transactions were included in the halving block's 3,050 transactions.

Date | 19 April 2024 |

Block number | 840,000 |

Block reward, BTC | 3.125 |

BTC created per day | 450 |

BTC price at the start | $62,013 |

BTC price 100 days later | N/A |

BTC price 1 year later | N/A |

The next Bitcoin halving countdown

The next halving is expected around 2028. It will drop the block reward to 1.5625 BTC.

Fifth halving

Date | Around 2028 |

Block number | 105,000 |

Block reward, BTC | 1.5625 |

BTC created per day | 225 |

Future Bitcoin halvings

Bitcoin halvings will repeat approximately every four years until the block reward becomes equal to zero. After that, the only reward for miners will be the commissions for transactions included in the block. Although this can have severe negative consequences for the Bitcoin network, its participants have every chance of finding a solution to this problem.

Bitcoin Halving Price Predictions for 2028

With the approaching Bitcoin halving dates, there is a clear surge in diverse price forecasts on various online platforms and social circles that deal with cryptocurrency. However, it is important to note that the crypto market is highly volatile and unpredictable, making it possible to justify any price range for BTC. Consequently, all price predictions should be taken with a significant degree of scepticism and only regarded as a source of amusement.

Previously, Bitcoin halvings typically preceded new all-time high prices. However, the Bitcoin halving in 2024 is different from previous halvings. The price surged to new highs before the halving event. This recent increase was fuelled by spot bitcoin exchange-traded funds (ETFs), indicating that market demand may now have a greater influence on bitcoin prices than halving events.

Kraken's Head of Strategy, Thomas Perfumo, highlights the symbolic significance of this halving, showcasing Bitcoin's apolitical and steadfast monetary policy, especially amid global economic uncertainties.

Analysts at JPMorgan and Deutsche Bank suggest that the impact of this halving was already factored into current bitcoin prices, anticipating no significant upward movement post-halving. They predict that any immediate effects will be felt mainly in the Bitcoin mining sector, potentially leading to consolidation as profitability decreases due to reduced block rewards.

Nevertheless, there are signs that miners could still see increased revenue, even without a price surge, through avenues such as higher aggregate transaction fees facilitated by developments like Ordinals and layer-two networks.

If the historical chart patterns repeat, Bitcoin's $66,000 price could reach $434,280 per coin by the fifth Bitcoin halving event, which is scheduled for 2028.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What halving means

Bitcoin halving refers to the event where the reward for mining Bitcoin is reduced by half. Crypto halving occurs every four years. The halving formula is incorporated into Bitcoin's mining algorithm to ensure scarcity and combat inflation.

What happens when Bitcoin is halved?

Bitcoin undergoes a halving event every four years as part of its mining algorithm to prevent inflation and maintain scarcity. Reducing the rate of new Bitcoin issuance during halving is expected to increase the price if demand remains constant. This rewards system will continue until 2140 when the proposed maximum limit of 21 million bitcoins is reached.

What is halving in Bitcoin?

Bitcoin halving refers to the event where the reward for mining Bitcoin is reduced by half. This reduction occurs every four years and is a deliberate feature of Bitcoin's mining algorithm and halving formula to regulate inflation and maintain a sense of scarcity.

How long does crypto halving last?

Crypto halving lasts for approximately four years. This event, known as Bitcoin halving, takes place every 210,000 blocks. The process will continue until the total supply of 21 million BTC is reached. Experts predict that the final Bitcoin will be mined by the year 2140.

Why does crypto halving increase the price?

The price of the cryptocurrency increases due to the halving formula written in Bitcoin's mining algorithm. This policy helps maintain scarcity and counteract inflation. The reduction in the pace of Bitcoin's issuance leads to an increase in price, assuming that demand remains unchanged.

Why is Bitcoin halving important?

Bitcoin halving plays a significant role in making it a valuable and resilient digital currency. Incorporating the crypto halving formula, this mechanism ensures that Bitcoin remains scarce and resistant to inflation by preventing endless creation.