Compound (COMP) Price Prediction 2023-2030

Although blockchain technology is actively invading the finance industry, the decentralised lending market is still in its infancy. Compound is a project that is trying to advance the decentralised lending sphere. In this article, we'll explore the Compound project and its native token COMP and examine its price predictions.

What is Compound (COMP)?

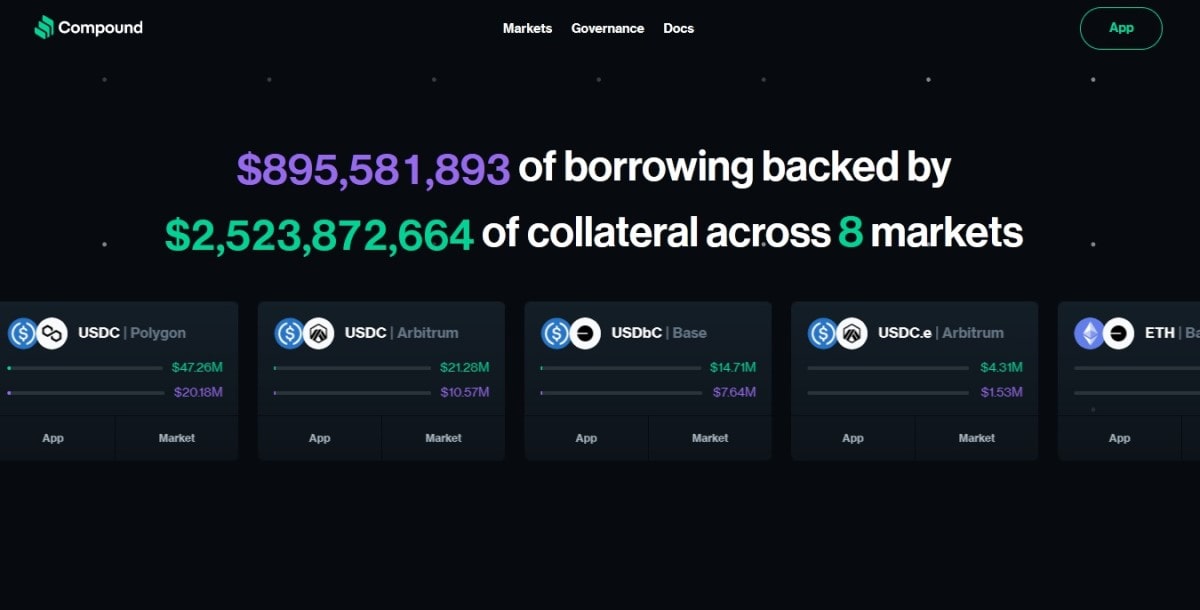

Compound is a decentralised lending protocol where interest rates are determined using an algorithm based on supply and demand.

What makes Compound really unique is that people can lend to or borrow from Compound for as long as they want (such as one hour, or one year), instead of a pre-defined duration, which is generally the case in peer-to-peer lending markets. — Robert Leshner, Co-Founder and CEO of Compound Labs.

The history of Compound

Compound Labs, Inc. was founded in August 2017 by Robert Leshner and Geoffrey Hayes. The company is headquartered in San Francisco, California, in the United States.

In January 2018, the development of the Compound protocol was announced. In May 2018, the company raised an $8.2 million seed investment. The list of investors included Andreessen Horowitz, Transmedia Capital, Compound Ventures and Coinbase Ventures, among others.

In September 2018, the first version of the protocol was launched. In February 2019, the project's whitepaper was published. In May 2019, the second version of the protocol was launched.

In November 2019, Compound Labs raised $25 million in a Series A funding round. In February 2020, COMP, the governance tokens, were issued.

In August 2022, Compound III, the third version of the protocol, was launched. In this version, the protocol has been streamlined, and more emphasis has been placed on security.

Compound's features

The way Compound works is reminiscent of a bank. Participants deposit their cryptocurrency and receive interest income on a regular basis. However, the difference is that the company doesn't keep anyone's assets. Everything is managed by a smart contract. No person or organisation can control the funds. It's an open-source platform, and anyone can connect to the protocol with a cryptocurrency wallet and immediately start earning interest on their crypto assets or borrowing cryptocurrency. Lenders and borrowers don't need to negotiate terms. The parties interact directly through a protocol that controls the interest rate and collateral.

Users who want to borrow cryptocurrency can do so by providing collateral. They can lock up their assets, such as Ethereum (ETH) or other supported tokens, and borrow a different cryptocurrency. The value of the collateral must exceed the borrowed amount by a specified ratio to ensure the loan's security.

To maintain the system's safety, borrowers must ensure their collateral maintains a minimum value relative to the borrowed amount. If the collateral's value falls below this threshold, it can be liquidated.

The interest rates for supplying and borrowing assets on Compound are determined by supply and demand. If more users want to borrow a specific asset, the interest rate for that asset will go up. Conversely, if there's an excess supply of a particular asset, the interest rate will decrease.

In the second version of Compound, liquid tokenised collateral in the form of cTokens was introduced into the protocol. However, in the third version, cTokens aren't used any more, and the collateral remains the property of the supplier except in the event of liquidation. In addition, the number of supported tokens has been reduced in the third version. This version of Compound allows users to borrow USDC using ETH, WBTC, LINK, UNI and COMP as collateral.

What does COMP crypto do?

COMP is the native governance token of the Compound ecosystem. It's an ERC-20 token. COMP token holders have the right to participate in the governance of the protocol. They can propose changes, vote on proposals, and influence the development and parameters of the protocol.

Users who supply assets or borrow on the Compound platform can earn COMP tokens as rewards. This incentivises participation and helps distribute ownership and decision-making influence across the user base.

How to buy and sell Compound crypto

The COMP token is traded on many crypto exchanges, both centralised and decentralised (DEX).

Compound (COMP) price analysis

As of 29 October 2023, the COMP token ranked 94th among cryptocurrencies by market capitalisation at $374,568,352.

COMP price statistics (as of 29/10/23)

Current price | $47.34 |

Market cap | $374,568,352 |

Circulating supply | 7,911,540 COMP (79.12%) |

Max supply | 10,000,000 COMP |

Daily trading volume | $29,105,895 |

All-time high | $911.20 (12/05/21) |

All-time low | $25.55 (10/06/23) |

Website |

COMP's price history

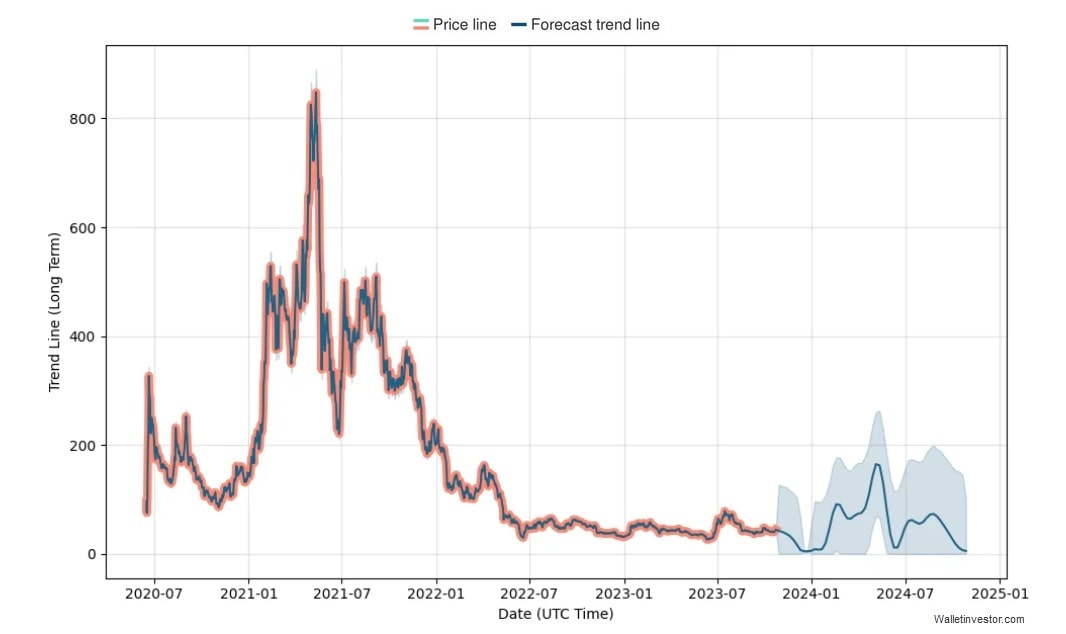

COMP was listed on crypto exchanges in June 2020. Shortly thereafter, a price decline began, which lasted until November 2020.

After that, the token's price started to rise significantly and reached its all-time high on 12 May 2021. This was followed by a long period of decline. On 10 June 2023, the price reached its all-time low and began to rise sharply. In mid-July 2023, the growth was replaced by a correction, but in mid-September, the price started to rise again.

COMP/USDT price chart

COMP technical analysis

On 29 October 2023, COMP price broke the local diagonal resistance line. Low trading volumes suggest a high probability of a false breakdown. However, Moving Averages, MACD, Parabolic SAR and RSI MA all indicate bullish sentiment.

The nearest support levels are $37.50, $35.00 and $31.50. The nearest resistance levels are $53.00, $71.00 and $80.00.

Compound (COMP) price prediction 2023

COMP is looking bullish. If the crypto market continues to grow, it's likely that the price will exceed $71 by the end of the year.

Compound (COMP) coin price prediction for 2023, 2025, 2030 and 2040

Many of the popular forecasting services try to answer the question, "What is the compound price prediction for 2023, 2025 and 2030?". Let's see what they think about it.

Wallet Investor's COMP price prediction for 2023, 2025, 2030 and 2040

Wallet Investor predicts a sharp drop in the COMP's price in the near future. According to them, the token's price will be $7.739 at the end of 2023. Despite significant fluctuations, the price will continue to decline and will be $4.463 at the end of 2024, $2.657 at the end of 2025 and $1.560 at the end of 2027.

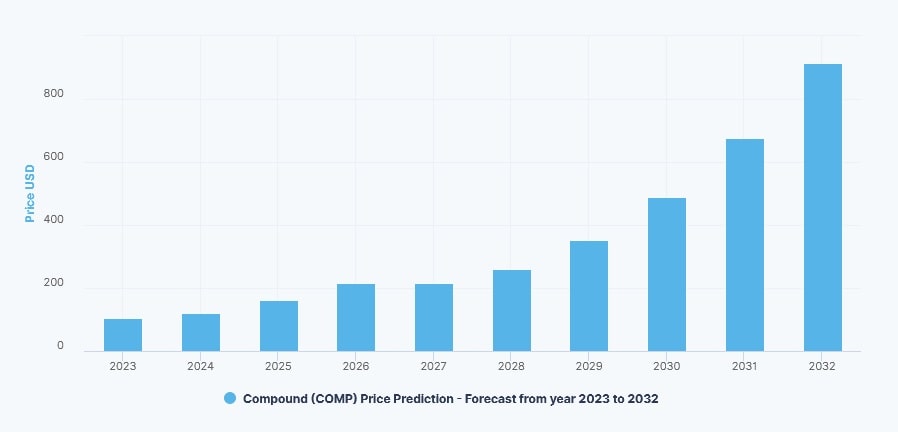

CryptoNewsZ's COMP price prediction for 2023, 2025, 2030 and 2040

CryptoNewsZ, on the other hand, expects the COMP's price to rise. They believe the price will be in the range of $32.43 - $78.78 in 2023, in the range of $66.64 - $95.93 in 2024, in the range of $81.88 - $117.87 in 2025 and in the range of $246.52 - $354.88 in 2030.

DigitalCoinPrice's COMP price prediction for 2023, 2025, 2030 and 2040

DigitalCoinPrice also anticipates the token's price to rise. According to their calculations, the token will be worth $101.57 at the end of 2023, $111.45 at the end of 2024, $160.13 at the end of 2025 and $477.26 at the end of 2030.

Price Prediction's COMP price prediction for 2023, 2025, 2030 and 2040

Price Prediction's forecast is very optimistic. They believe the average price will reach $65.35 in 2023, $96.81 in 2024, $143.42 in 2025, and $910.82 in 2030.

CryptoPredictions'COMP price prediction for 2023, 2025, 2030 and 2040

CryptoPredictions expects more moderate growth. According to their predictions, the average price will be $38.80 in December 2023, $55.81 in December 2024, $76.40 in December 2025 and $105.48 in December 2027.

Compound (COMP) overall future value predictions

Is COMP crypto a good investment?

The Compound protocol is a tool for generating passive income on crypto assets and is quite in demand. The project continues to evolve due in no small part to community governance. Interest rates based on supply and demand attract both lenders and borrowers. However, both the project itself and the COMP token have some disadvantages that need to be considered when making investment decisions:

- Smart contract risk. Compound operates using smart contracts, which can have vulnerabilities that can be exploited by thieves. While the Compound team conducts security audits, there's still a risk of bugs or vulnerabilities.

- Technical problems. In the project's history, technical problems have been repeatedly recorded despite numerous audits.

- Liquidation risk. Borrowers must maintain a minimum collateralisation ratio to secure their loans. If the value of their collateral falls below this threshold, it can be liquidated.

- Lack of insurance. Unlike traditional financial institutions, Compound doesn't offer insurance on deposits.

- Over-collateralisation. Borrowers on Compound are required to over-collateralise their loans, which means they must lock up more assets than they are borrowing.

- Limited options. Compound only supports a very limited number of cryptocurrencies.

- Regulatory uncertainty. The regulatory environment for DeFi is still evolving. Changes in regulations can affect the use and value of COMP tokens.

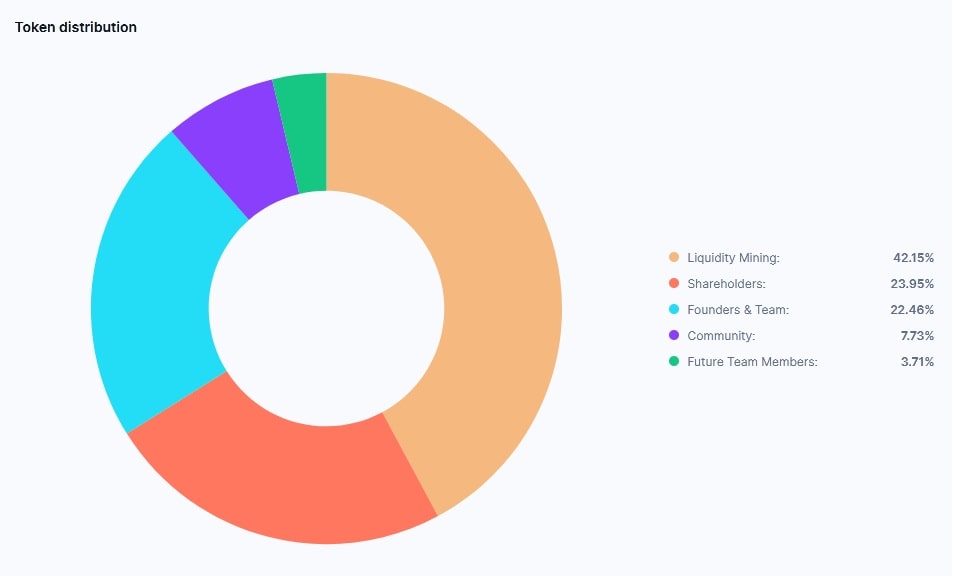

- Token distribution. A rather significant part of the token supply is controlled by the project team and large investors.

- Limited utility. The token has limited utility, which decreases interest in it.

Will COMP reach $100?

Considering that the token's price has already reached much higher values, this is quite possible.

How high can the COMP coin go?

If the project continues to develop successfully and the token's utility is expanded, COMP's price has a chance of exceeding $500.

Compound (COMP) crypto price prediction today

In case the breakout of the diagonal resistance line turns out to be false, it's most likely that the breakout attempt will be repeated after some time. If the breakout is confirmed, the price will probably reach the next diagonal resistance line.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.