The Top Challenges Facing the Crypto Industry

Since the inception of Bitcoin in 2009, the crypto industry has grown exponentially, attracting millions of users and investors worldwide. However, along with its potential for innovation and transformation, blockchain technology faces many challenges that hinder its widespread adoption. This article discusses the major challenges of blockchain technology that the cryptocurrency industry must overcome in order to achieve broader acceptance and integration.

Market volatility

Cryptocurrencies are known for their extreme price volatility. Unlike traditional assets, the value of cryptocurrencies can experience dramatic swings within short periods, sometimes in a matter of hours. The high volatility in the cryptocurrency market can be both an opportunity and a risk for investors. On one hand, the potential for significant gains attracts speculative investors looking to capitalise on price movements. On the other hand, the same volatility can lead to substantial losses, particularly for those who are not well-versed in the market dynamics.

For long-term investors, the unpredictable nature of crypto prices can be unsettling. Traditional investment strategies often rely on stable growth and predictable returns, which are challenging to achieve in the volatile crypto market. This uncertainty can deter institutional investors and large-scale adoption, as the risk associated with such investments may not align with their financial goals and risk tolerance.

One of the tools to help manage and mitigate volatility is stablecoins. These are cryptocurrencies designed to minimise price volatility by pegging their value to a stable asset, such as a fiat currency or a commodity. Stablecoins offer a potential solution for those looking to avoid the extreme fluctuations associated with traditional cryptocurrencies.

Security concerns

Another notable problem with cryptocurrency is security. With billions of dollars' worth of crypto assets at stake, hackers are constantly looking for vulnerabilities to exploit. The cryptocurrency industry has faced numerous security threats since its inception. These threats range from hacking and theft to phishing scams and fraudulent activities.

By adopting advanced encryption techniques, multi-factor authentication, regular security audits, and other solutions, the industry can enhance its security posture and build greater trust among cryptocurrency users. Addressing these security challenges is essential for the long-term growth and mainstream adoption of cryptocurrencies.

Scalability issues

Scalability has emerged as a critical challenge for the cryptocurrency industry. As the number of users and transactions grows, blockchain networks face limitations in processing capacity and transaction throughput, leading to slower and more expensive transactions. Scalability issues directly impact user experience. Slow transaction times and high fees can deter users and businesses from adopting cryptocurrencies for everyday transactions, hindering widespread adoption.

Blockchain developers are currently actively working on finding solutions to the scalability problem. Many approaches to solving this problem have already been developed, including Layer-2 protocols, sharding, improved consensus mechanisms, scalable blockchain architectures, etc. As these efforts continue to evolve and improve, they will be able to overcome scalability challenges, paving the way for wider adoption.

Interoperability challenges

Interoperability is an important yet challenging aspect of the blockchain and cryptocurrency industry. As the ecosystem grows and diversifies, the need for interoperability becomes increasingly important to enable users to access a wider range of services and assets across different networks.

One of the primary challenges in achieving interoperability is the fragmentation within the crypto ecosystem. There are numerous blockchain networks, each with its own architecture, standards, security protocols, and token economies. Bridging these fundamentally different systems requires sophisticated solutions that can translate and reconcile various data structures and protocols.

While some platforms, such as Polkadot and Cosmos, specifically designed to address this problem have made some progress, it's still far from being solved.

Regulatory uncertainty

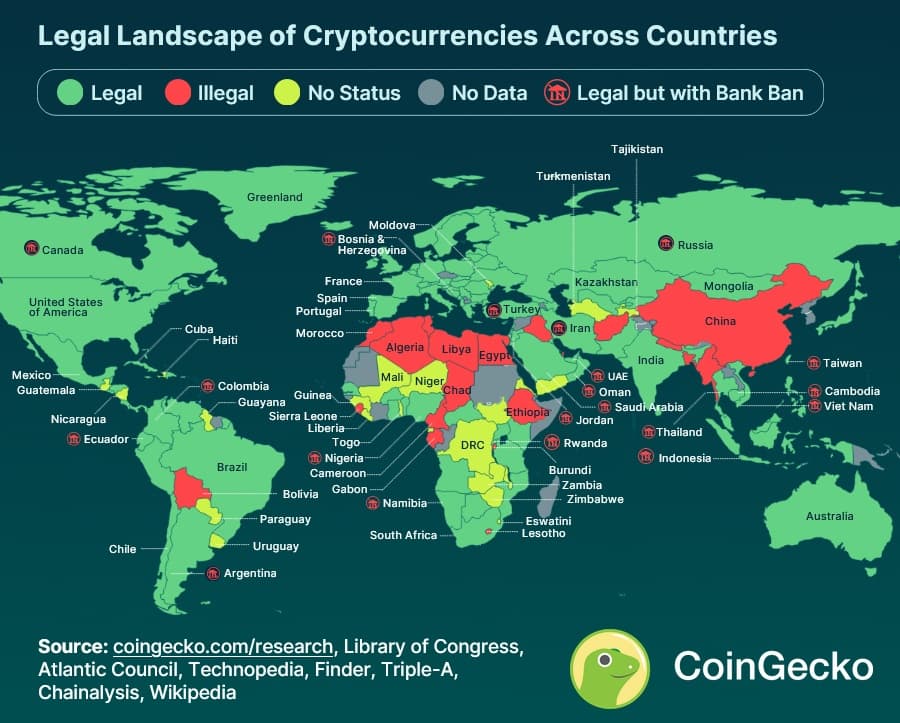

One of the major challenges the crypto industry faces is regulatory uncertainty. Governments around the world are still grappling with how the crypto industry should be regulated, leading to a patchwork of conflicting laws and regulations. Some countries have adopted a proactive approach, implementing clear and comprehensive regulations to govern the crypto space. Others have taken a more hostile stance, imposing restrictions or outright bans on certain crypto-related activities.

Regulatory uncertainty can have a significant impact on investor confidence and business operations in the crypto space. Investors may be hesitant to invest in a market where the rules are constantly changing or unclear, leading to reduced liquidity and slower growth. Businesses, on the other hand, may struggle to navigate the complex regulatory landscape, facing potential legal challenges. This uncertainty stifles innovation and limits the crypto industry's ability to reach its full potential.

Lack of consumer understanding and trust

One of the significant challenges in the cryptocurrency industry is the widespread lack of understanding and trust among consumers. This issue stems from several factors:

- Technical complexity. The underlying technology of cryptocurrencies, including concepts like blockchain, cryptographic keys, and consensus mechanisms, can be highly technical and difficult for the average consumer to grasp.

- Rapid innovation. The fast-paced nature of the crypto industry means that new technologies, platforms, and use cases are constantly emerging. Keeping up with these developments requires continuous learning, which can be overwhelming for consumers.

- Misleading information. The cryptocurrency space is rife with misinformation and hype, often propagated through both social and mainstream media. This can lead to misconceptions about how cryptocurrencies work, their potential benefits, and associated risks.

- Security concerns. Several high-profile incidents, such as exchange hacks and scams, have eroded public trust in the cryptocurrency industry.

- Association with illegal activities. Many people still associate cryptocurrencies with illegal activities. This negative perception, fuelled by media reports and officials, can deter legitimate users and investors from entering the market.

- Volatility. The extreme price volatility of cryptocurrencies adds to consumer mistrust. The potential for significant financial loss due to sudden market fluctuations makes cryptocurrencies seem like a risky and unreliable investment.

By addressing these issues, the crypto industry can build a more informed and confident user base, paving the way for broader acceptance and integration of crypto assets into everyday life.

Energy consumption

Cryptocurrencies like Bitcoin rely on Proof of Work (PoW) consensus mechanisms for transaction validation and network security. This process requires miners to solve complex mathematical problems, consuming vast amounts of electricity. The Bitcoin network alone is estimated to consume as much energy as some small countries.

To address this issue, crypto developers are exploring more energy-efficient consensus mechanisms. For example, Proof of Stake (PoS) requires much less energy than PoW because it relies on validators having a stake in the network rather than solving complex mathematical problems.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What happens if a cryptocurrency fails?

The most immediate consequence is a significant drop in the value of the cryptocurrency. As confidence wanes and selling pressure increases, the price can plummet, leading to substantial losses for investors.

Furthermore, crypto exchanges may delist the failing cryptocurrency due to low trading volumes or security concerns. This makes it harder for users to buy or sell the cryptocurrency.

What is the difference between cryptocurrency and digital currency?

The terms "cryptocurrency" and "digital currency" are often used interchangeably, but they have distinct meanings and characteristics.

Cryptocurrencies are a subset of digital currencies that use cryptographic techniques for security and operate on decentralised networks based on blockchain technology.

Digital currency is a broad term encompassing all forms of money that exist only in digital form. This includes cryptocurrencies but also covers other forms of electronic money that may or may not use blockchain technology.

What technological challenges does the crypto industry face?

Technological challenges include improving the scalability and speed of blockchain networks, enhancing security measures, developing interoperability between different blockchains, and ensuring user-friendly interfaces and experiences.