What is the Best Crypto to Buy in 2024?

The cryptocurrency market is constantly changing and evolving. The popularity and market cap of different crypto assets rise and fall. New assets are constantly appearing, some of which bring their investors good returns. As we look ahead to 2024, investors are starting to ask the question, "What is the best cryptocurrency to buy in 2024?". In this article, we'll try to answer this question.

Outlook for the cryptocurrency market in 2024

After a bearish 2022, the crypto market started to recover in 2023. Although it's impossible to predict the market's behaviour with certainty, many signs indicate that 2024 will be a favourable year for cryptocurrencies. More and more institutional investors are starting to show serious interest in cryptocurrencies. Blockchain technology continues to evolve, with various projects aimed at solving scalability, security and efficiency issues. The use cases and global adoption of cryptocurrencies by regular users are also growing. In addition, more and more people are beginning to view cryptocurrencies, especially Bitcoin, as a hedge against inflation and economic instability.

The combination of these factors is positive for the outlook for cryptocurrencies next year and could well lead to a new bull run in the crypto market. However, there are also factors that could negatively impact the crypto market, especially the increasing regulatory pressure on cryptocurrencies.

Key considerations before investing in cryptocurrencies

Investing in cryptocurrencies offers unique opportunities for financial growth, but it also comes with significant challenges and risks. When investing in cryptocurrencies, bear in mind the following:

- Risk management. Investing in cryptocurrencies is a high-yield, high-risk type of investment. Never invest more than you can afford to lose.

- Assess your risk tolerance. Cryptocurrencies are known for their price volatility. Determine how much risk you're willing to take and allocate your investments accordingly.

- Do your own research. Take the time to thoroughly research the specific cryptocurrencies you're interested in. Understand their technology, use cases, and the teams behind them.

- Emotional discipline. Don't give in to emotions. Be prepared to stay disciplined and avoid making impulsive decisions based on FUD (fear, uncertainty and doubt) or FOMO (fear of missing out). Set clear investment goals and stick to your strategy.

- Exit strategy. Determine your exit strategy in advance. Decide when you'll take profits or cut losses. Setting clear exit points can help you avoid making emotional decisions during market fluctuations.

- Diversification. Diversify your cryptocurrency investments to spread risk. Consider a mix of well-established coins and potentially higher-risk, high-reward options. Also, consider diversifying your portfolio with traditional financial instruments.

- Security. Use reputable wallets and exchanges to store and trade your assets. Consider hardware wallets for added security. Beware of phishing scams and keep your private keys safe.

- Regulatory environment. The regulatory landscape for cryptocurrencies varies by country and is subject to change. Stay informed about the legal status of cryptocurrencies in your jurisdiction.

- Determine your investment horizon. Are you in it for the long term, or are you looking for short-term gains? Your strategy will influence the cryptocurrencies you choose and how you manage your portfolio.

- Stay informed. The cryptocurrency market is highly dynamic. Keep up with news, updates, and market sentiment.

- Beware of scams. Be cautious of investments that promise guaranteed returns or seem too good to be true. If something looks suspicious, it probably is.

Best cryptocurrency to invest in 2024. Our top 10 list.

It's impossible to predict with certainty which cryptocurrencies will show good growth in the future. Nevertheless, we have compiled our own list of cryptocurrencies that we believe will be a promising addition to an investment portfolio.

Bitcoin

Bitcoin, the pioneer of cryptocurrencies, has a proven track record and is the most popular and adopted cryptocurrency. It may no longer be able to compete with younger cryptocurrencies when it comes to profitability, but its status as a store of value and 'digital gold' makes it an attractive option for more conservative investors.

BTC statistics (as of 10/11/23)

Current price | $36,535.77 |

Market rank | #1 |

Market cap | $713,878,914,682 |

Circulating supply | 19,537,787 BTC (93.04%) |

Max supply | 21,000,000 BTC |

Daily trading volume | $38,061,162,174 |

All-time high | $68,789.63 (10/11/21) |

All-time low | $65.53 (05/07/13) |

Ethereum

Ethereum, the second-largest cryptocurrency, is a blockchain platform that enables smart contracts and decentralised applications (dApps). Its long-standing presence and ongoing developments make it a reliable choice for investors.

ETH statistics (as of 10/11/23)

Current price | $2,114.83 |

Market rank | #2 |

Market cap | $254,304,644,708 |

Circulating supply | 120,266,597 ETH |

Max supply | - |

Daily trading volume | $24,127,563,079 |

All-time high | $4,362.35 (12/05/21) |

All-time low | $0.4209 (21/10/15) |

Solana

Solana is a newer entrant known for its high throughput and low transaction costs. Its focus on scalability, performance and decentralisation has made it one of the most popular blockchain platforms.

SOL statistics (as of 10/11/23)

Current price | $45.17 |

Market rank | #7 |

Market cap | $19,015,670,964 |

Circulating supply | 421,017,635 SOL |

Max supply | - |

Daily trading volume | $2,820,906,034 |

All-time high | $260.06 (06/11/21) |

All-time low | $0.5052 (11/05/20) |

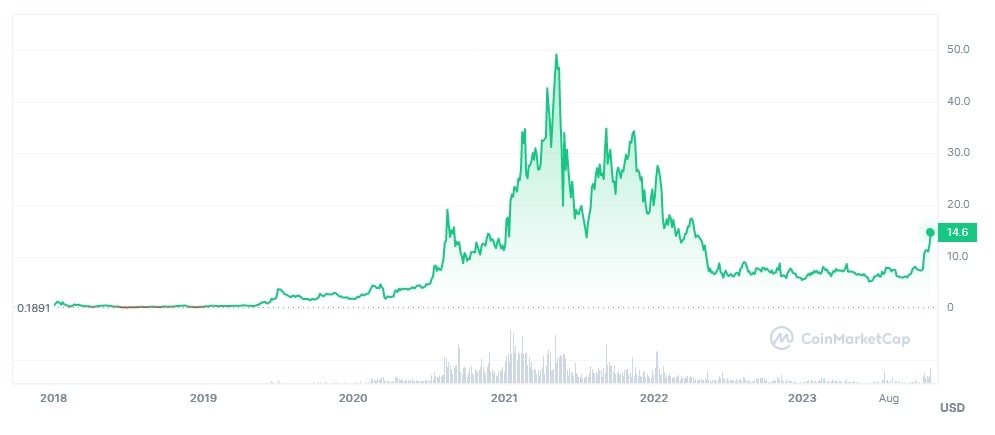

Chainlink

Chainlink is a decentralised oracle network that facilitates smart contracts to securely interact with external data sources. This function is crucial for the crypto industry, which makes this project very promising.

LINK statistics (as of 10/11/23)

Current price | $14.58 |

Market rank | #12 |

Market cap | $8,125,139,314 |

Circulating supply | 556,849,970 LINK (55.68%) |

Max supply | 1,000,000,000 LINK |

Daily trading volume | $1,598,656,473 |

All-time high | $52.88 (10/05/21) |

All-time low | $0.1263 (23/09/17) |

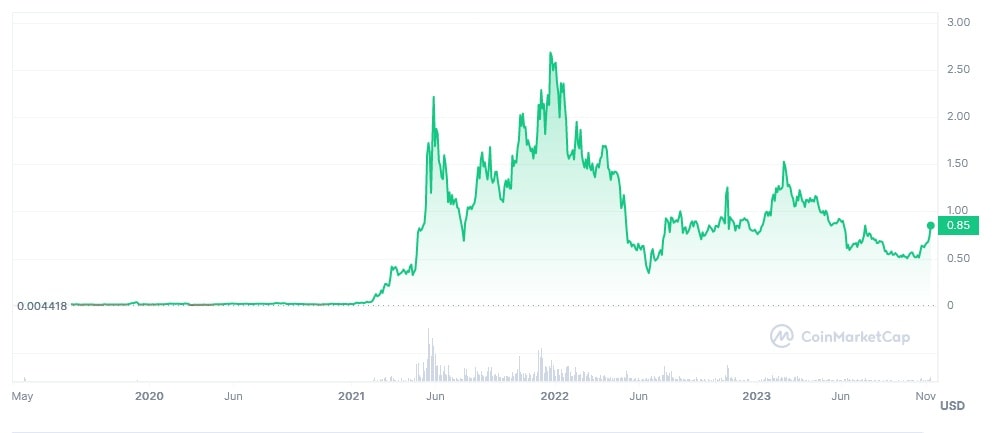

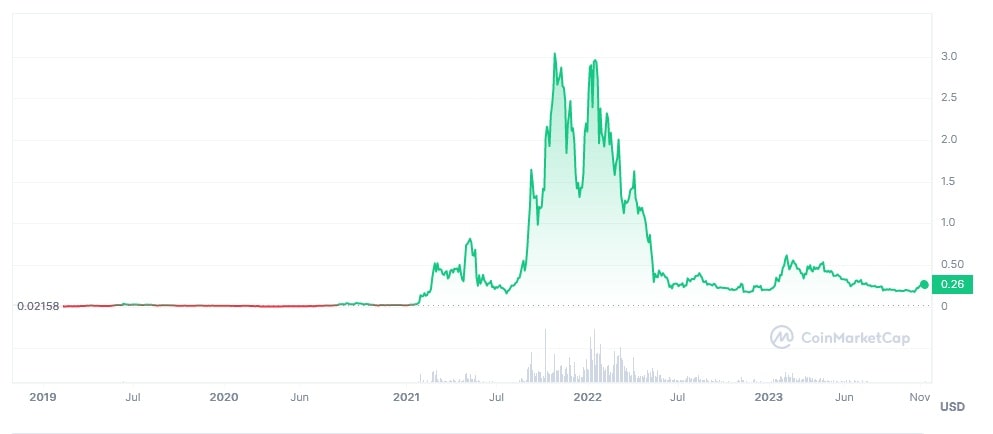

Polygon

Polygon is a popular Layer-2 scaling solution for Ethereum. It aims to enhance scalability and usability for dApps, contributing to the broader Ethereum ecosystem.

MATIC statistics (as of 10/11/23)

Current price | $0.8486 |

Market rank | #13 |

Market cap | $7,833,243,033 |

Circulating supply | 9,248,978,968 MATIC (92.49%) |

Max supply | 10,000,000,000 MATIC |

Daily trading volume | $795,080,899 |

All-time high | $2.92 (27/12/21) |

All-time low | $0.003012 (09/05/19) |

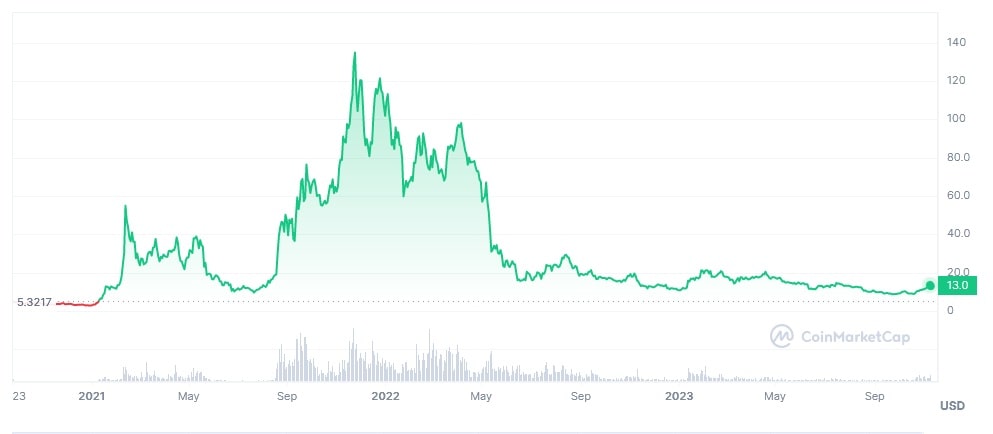

Avalanche

Avalanche is a platform designed for custom blockchain networks and decentralised applications. Its unique approach to blockchain architecture and focus on interoperability make this project a noteworthy competitor to Ethereum.

AVAX statistics (as of 10/11/23)

Current price | $12.97 |

Market rank | #20 |

Market cap | $4,610,614,042 |

Circulating supply | 355,365,855 AVAX (49.36%) |

Max supply | 720,000,000 AVAX |

Daily trading volume | $465,121,366 |

All-time high | $146.22 (21/11/21) |

All-time low | $2.79 (31/12/20) |

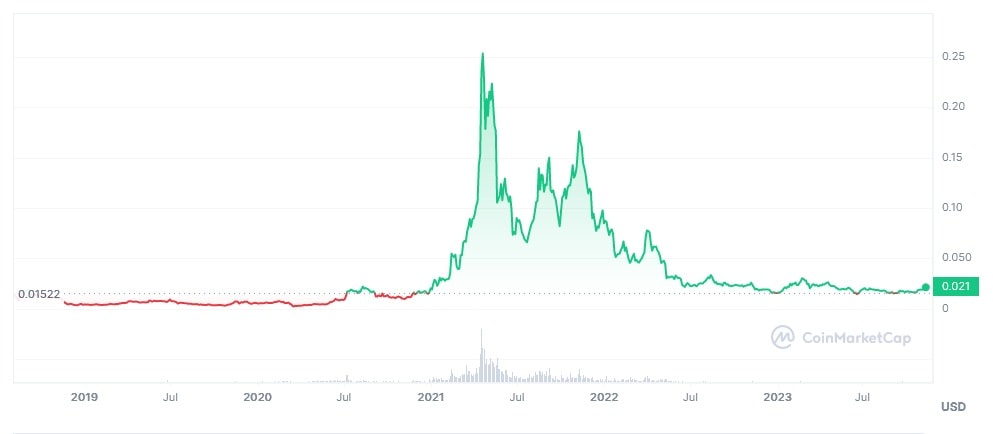

VeChain

VeChain specialises in supply chain management and business processes. Its real-world use cases and partnerships with major companies contribute to its reputation as a reliable and purpose-driven cryptocurrency.

VET statistics (as of 10/11/23)

Current price | $0.02194 |

Market rank | #37 |

Market cap | $1,595,440,432 |

Circulating supply | 72,714,516,834 VET (83.86%) |

Max supply | 86,712,634,466 VET |

Daily trading volume | $74,123,325 |

All-time high | $0.2782 (17/04/21) |

All-time low | $0.001678 (13/03/20) |

Arbitrum

Arbitrum is one of the leading Layer-2 scaling solutions for Ethereum, focusing on improving transaction efficiency and reducing costs.

ARB statistics (as of 10/11/23)

Current price | $1.21 |

Market rank | #40 |

Market cap | $1,536,504,858 |

Circulating supply | 1,275,000,000 ARB |

Max supply | N/A |

Daily trading volume | $789,029,710 |

All-time high | $11.80 (23/03/23) |

All-time low | $0.7453 (11/09/23) |

Fantom

Fantom is a high-performance DAG (directed acyclic graph) platform that aims to overcome the limitations of previous-generation blockchain platforms. It's known for its high transaction speeds and low fees but is still relatively unknown among similar projects.

FTM statistics (as of 10/11/23)

Current price | $0.002614 |

Market rank | #63 |

Market cap | $727,871,700 |

Circulating supply | 2,803,634,836 FTM (88.30%) |

Max supply | 3,175,000,000 FTM |

Daily trading volume | $138,414,836 |

All-time high | $3.48 (28/10/21) |

All-time low | $0.001953 (13/03/20) |

Telcoin

Telcoin is an ambitious project designed to facilitate fast and affordable remittances using blockchain technology. Its focus on financial inclusion and cross-border payments, as well as its reliance on mobile device users, positions it as a potential disruptor in the traditional remittance industry.

TEL statistics (as of 10/11/23)

Current price | $0.002614 |

Market rank | #240 |

Market cap | $183,079,402 |

Circulating supply | 70,253,762,192 TEL (70.25%) |

Max supply | 100,000,000,000 TEL |

Daily trading volume | $1,995,691 |

All-time high | $0.0649 (11/05/21) |

All-time low | $0.00006516 (13/03/20) |

Other cryptocurrencies worth paying attention to

While Bitcoin, Ethereum, and other well-known cryptocurrencies dominate the crypto market, the crypto space is vast and continually evolving. Exploring new projects and innovative tokens can uncover very lucrative opportunities for investors willing to venture beyond the mainstream.

However, it's worth remembering that investing in newer cryptocurrencies involves increased risk, even by crypto market standards, so thorough research is paramount. Consider factors such as the team behind the project, technology, partnerships and overall market demand.

Conclusion

In the dynamic world of cryptocurrencies, 2024 holds promise. Established giants like Bitcoin and Ethereum offer reliability, while emerging projects present opportunities. Invest wisely, considering regulatory shifts, technological advancements, and global economic trends. In this ever-changing landscape, success lies in adaptability, self-discipline, diligence, and a solid understanding of both traditional and emerging assets.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.