Cryptocurrency trading strategies

Every day, someone gets tired of sitting at a desk and decides to become a trader. Many people think that the cryptocurrency market is a very easy niche to begin with. This is the first and main reason for their failure.

However, many people learn how to trade. After acquiring basic knowledge, they understand the necessity of a reliable trading strategy. Traders can't win with technical analysis or fundamental analysis alone. Learning different strategies for trading and how to implement them is a must.

A cryptocurrency trading strategy is a set of actions aimed at creating profit in the cryptocurrency market. No one can give you a 100% guarantee that you will always have income. However, a trading strategy will guarantee that you won't fail.

Crypto trading strategy

Why is trading so popular, yet the world is only aware of a few really successful and rich stockbrokers or cryptocurrency traders? That's because of the mass of information that you have to absorb. Moreover, you have to use all of this material when choosing a reliable trading strategy.

Don't follow someone else's ideas. Follow the market situation and try to understand its cues.

First of all, when creating or using a crypto trading strategy, you must understand that it's a very unstable market. You may see price fluctuations of between 20-30% in just a few days. When trading on stock indices, it's almost impossible to see that kind of shift in a day. However, the cryptocurrency index might change by 100% or even more. Secondly, Bitcoin is “the father” of cryptocurrencies. Hence, prices very often follow its trend. If you're going to trade altcoins, the most important part of your strategy should be to see what's going on with Bitcoin.

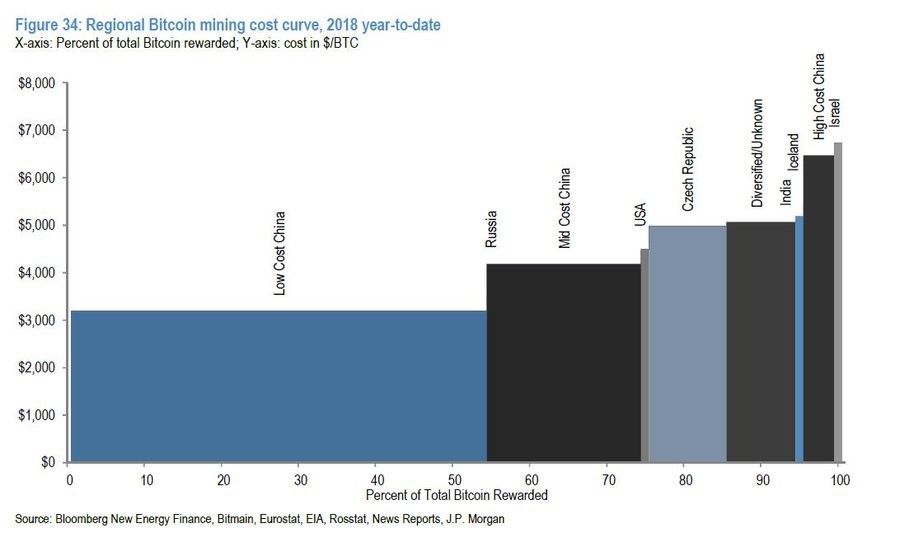

Usually, cryptocurrency traders don't mine coins. Nevertheless, they are always aware of the cost of mining. For example, Bitcoin Cash has become very valuable since its hard fork on 1 August 2017 because miners need many resources to find new blocks. If mining costs increase, the price of the coin also rises.

Lastly, you have to follow all political and economic news. They have a great influence on this market. For example, when Iran attacked US military bases in Iraq, Bitcoin's price rose from $8,000 to $8,300. This situation created an uptrend for the whole market. You can't be a successful trader if you don't follow the news.

These are the three main principles of cryptocurrency trading. From these points, traders have created several trading theories and strategies.

- Buy & Hold. This strategy is more about investing than trading. People buy an asset and hold it for a long time. They try to predict prices for months and check charts for long periods of time. This strategy is mostly based on fundamental analysis.

- Swing trading. This cryptocurrency trading strategy is about using the correction during the formation of a trend. Traders have to enter the trend at the time of correction. Swing trading means to wriggle after the trend.

- Day trading. This strategy means trading on the exchange within one trading session during the day. Positions opened on this day are not transferred overnight to the next session.

- Scalping. This is a high-speed, high-frequency form of trading theories and strategies. A trader opens and closes positions within a period of 1 to 15 minutes. Each deal ideally brings a small profit. Altogether, the series of small profits from each transaction yields high income.

Day trading strategy

Most day traders spend their lives making profit from cryptocurrency trades. They make dozens of exchanges and transactions every day. You can earn enormous rewards, but you need a lot of time (months, even years) to become a successful day trader.

An exchange with lots of distinctive cryptocurrency pairs is the first thing you should find.

A pair means two coins or tokens that are being traded. For example, if you think that Monero's price might rise against Litecoin's, you have to find an XMR/LTC pairing.

The next requirement is a high-liquidity platform. It is your guarantee for a permanent buyer/seller connection. Otherwise, you won't be able to make a deal when the price is falling.

Very often, people try to associate day trading with an easy path to wealth. In fact, this rarely happens. It's a very long, hard path to having a billion dollars in your bank account. The SEC warns: “Day traders tend to face serious financial losses in the first month of trading”.

You have to analyse a lot of information and be ready to connect each trap with bearish or bullish trends. As a trader, you must have a deep understanding of price fluctuations and use them for your personal gain. Yet, day trading is one of the most effective trading strategies.

Day cryptocurrency trading tips

Day trading may provide both large incomes and losses. If you're interested in making lots of money, you should remember that it isn't ‘free money'. You have to resist stress and stay cool-headed in addition to following all of your tactics.

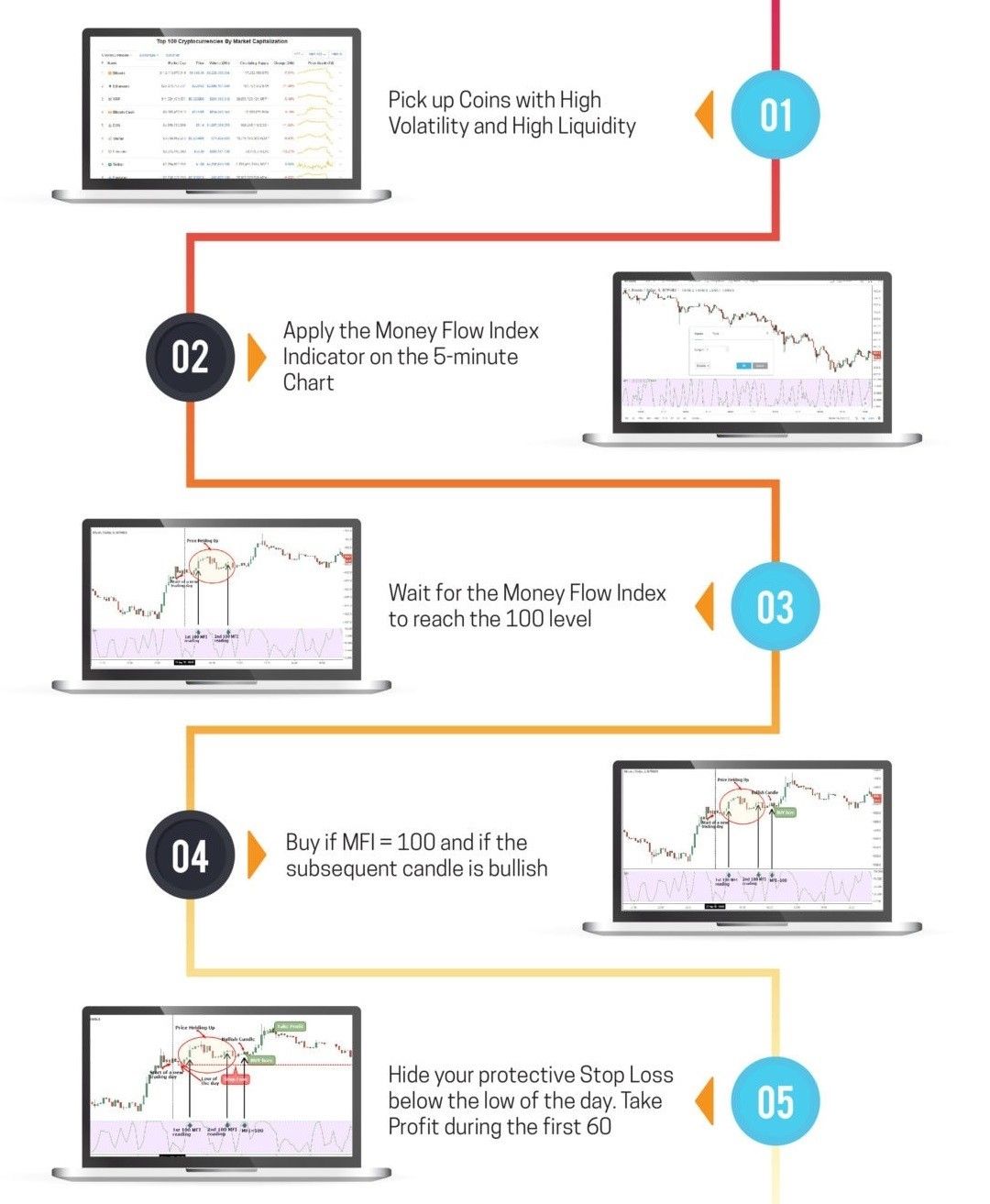

Before day trading, you should check for high volatility of cryptocurrency being traded. This provides more opportunities to make deals, allowing you to gain more profit.

The traded cryptocurrency should be liquid. Check the exchange platform and the coin (token) to see how liquid it is. How do you do this? You can go to Coinmarketcap and look at the cryptocurrency's 24-hour trading volume.

Trading strategy for beginners

The beginning is the most difficult stage in every niche. On the other hand, it's also the simplest stage because you have to do very little to reach your first achievements. Traders say that HODL is the easiest scheme for beginners. ‘HODL' means holding assets for the long term in the belief that the price will rise in the future.

It's very easy because a trader only needs a little knowledge for it to be rewarding. Why? Almost all cryptocurrencies experience enormous growth over the long term. Moreover, you can also invest in popular coins or tokens to minimise your risks.

So, what should you do? Buy promising cryptocurrencies and hold onto them for months. For instance, you could buy 100 Ethereum and just check the index in 3 years. The probability that it'll be higher is almost 100%.

You're not obligated to check the prices very often. You should actually avoid checking it regularly because you may sell your assets too early.

This strategy is one of the less effective ones. There is no guarantee that every cryptocurrency will rise over the years. Nevertheless, trading is about statistics. Charts show that all the people who bought cryptocurrency during the bearish trend at the beginning of 2018 have a 100-200% increase in income today.

Best cryptocurrency trading strategies for 2023

One of the most successful trading strategies is statistical arbitrage. It seems very complex, but after several deals, you'll see that it's simple enough. The way this strategy works is you buy coins on an exchange, then sell them on another platform and, finally, sell them for fiat currency. The logic of this reliable trading strategy is to take advantage of the lag in price corrections across these exchanges.

The only difficulty is the fee. You have to use platforms with a low commission to earn a profit. Be vigilant when using statistical arbitrage because a fee can be even higher than the potential income.

Following the bears on the market for the last two years, many investors quit cryptocurrencies. As a result, the market's volatility fell. That's good for banks but not for traders, most of whom say that HODL will be more popular in 2020 than in previous years.

Bitcoin trading strategy

Most people begin their trading path with BTC because it's the most traded and valuable cryptocurrency. That's why you have to be fluent in crypto trading methodology. While choosing different strategies for trading Bitcoin, you should rely on your own experience and style.

If you're very emotional and tend to make mistakes, you have to use an algorithmic strategy. That means using formulas to identify points at which you need to place different orders. Today, these strategies are associated with using trading robots, but you have to configure them the right way to be successful.

If you're disciplined and can easily manage risks, you could try margin trading. This allows you to deposit less but gain the same profit. However, you have to place every order very carefully, or you might end up in debt.

Trading strategy for Bitcoin 2023

Your trading strategy for Bitcoin will be the same as those used for alternative cryptocurrencies, like swing, day trading, scalping and others. Most of your tactics will be similar, but you'll have more opportunities because Bitcoin is the most popular digital currency.

However, if you've already invested in BTC, you may want to diversify risks with a hedging strategy. This is the practice of making tactical orders to decrease the risks of existing positions.

In this case, you'll open a short position on BTC, which involves selling the asset for the actual market value while under the pretence that it might decline. If it really falls, you would buy it back for a lower cost and margin the difference. This means that any loss to your first BTC position would be countered by the income from the short position.

Bitcoin day trading strategy

Day trading has the same principles for each cryptocurrency. Nevertheless, there are some benefits to day trading Bitcoin:

- High supply and demand

- Many exchanges allow leverage trading with BTC

- Universal access – all exchanges have added BTC to their lists

- BTC-oriented exchanges provide lower fees and minimum deposits for BTC.

There are two highly popular day-trading tactics for BTC:

- Breakout. This opportunity comes up when the coin passes a certain level of support or resistance. Once the level is broken, the cryptocurrency is traded in the same trend. When you see the potential breakout, you have to open the position. The ‘stop-loss' should be placed below the first resistance zone.

- Breakout retest. There might be an uptrend after the first breakout, but then, bulls will go back to this level to check the resistance. If the volume is higher at this stage, it means that prices will achieve a new maximum.

How to become a successful cryptocurrency trader

There is one simple answer: be fully prepared. We already mentioned some points:

- Understand the market.

- Manage your risks.

- Follow the news.

- Check BTC charts.

- Be aware of the cost of mining.

One more important step is to build a trading plan. This should include your goals for each period of trading, style (how often you plan to trade) and attitude toward risk. Check out other cryptocurrency traders' Twitter accounts. Very often, they give some useful information. But only use them for your analytics, not for making trades.

Avoid all pump and dump groups. Many newbies in this market think that they can profit by connecting with such groups. In fact, they are strategies based on inaccurate statements and analytics. That means you'll have a bigger chance of losing all of your money.

Lastly, learn as much as possible. This market is very new, so there are many unknown hacks and pitfalls. You should stay up-to-date on all market news to be successful.

Choose a trusted crypto exchange

One of the most important rules every trader has is to use only trusted exchanges. This will provide fast deals, high security and easy withdrawals. Moreover, your personal data will not be used for someone else's purposes. How do you choose an exchange?

- Check for daily volume.

- Read its documentation.

- Find out about its headquarters and exchange team.

- Check for safe HTTP connections (the web address should begin with "HTTPS").

Furthermore, try to use an exchange from your country. This may simplify compliance with regulatory changes. Please note that some platforms only support a limited number of countries.

Use a reliable platform for cryptocurrency trading

Nowadays, you can find many exchanges with different conditions. However, as previously mentioned, you should choose a trusted crypto exchange. Here is a list of some popular platforms that provide good client service:

- Binance

- Kraken

- Poloniex

- StormGain

Remember this: if you choose a deceitful platform, you may lose your trading budget and your personal data to boot, including billing information.

Best cryptocurrency trading strategies for 2024

There are numerous types of strategies in trading. Here are the 5 most effective trading strategies for 2024:

- Hodling (Long-Term Investing). Traders buy cryptocurrencies to hold them for an extended period, anticipating long-term price appreciation.

- Day Trading. Traders buy and sell cryptocurrencies within the same day, aiming to profit from short-term price movements.

- Swing Trading. Traders aim to profit from short- to medium-term price swings by holding positions for several days or weeks.

- Scalping. Traders make numerous small daily trades to profit from minor price fluctuations, focusing on short-term movements.

- Trend Following. Traders use technical analysis to capitalise on the momentum to identify and trade in the direction of market trends.

It's important to note that the effectiveness of the top strategies for trading can vary depending on market conditions and individual skills. Traders often use different strategies for trading over time, combining different approaches to suit their goals. Successful trading also requires continuous learning, discipline, and risk management. Before using any of these strategies in trading cryptocurrency, thorough research and practice in a simulated or low-risk trading environment are crucial to gain experience.

Trading strategy for Bitcoin in 2024

Bitcoin's most successful trading strategies align with your goals, risk tolerance, and trading style. Some popular strategies include HODLing, swing trading, and day trading.

HODLing is one of the basic trading strategies where you buy and hold Bitcoin for a long time, regardless of market fluctuations. The term originated from a misspelling of "hold" in a Bitcoin forum post.

For successful Bitcoin trading, it is vital to do thorough research and stay updated on market news. Setting realistic goals, managing risk through stop-loss orders, and avoiding emotional decision-making is also crucial.

Common mistakes to avoid when deciding where to start trading crypto include making decisions based on emotions, neglecting thorough research, lacking a solid trading plan, and failing to manage risk effectively.

To start Bitcoin trading, open an account with a reputable cryptocurrency exchange, conduct research, and start with small investments. Remember that trading cryptocurrency carries risks, so only invest what you can afford to lose.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What are the types of trading strategies?

There are four main types of trading strategies: scalping, day trading, swing trading, and position trading.

- Scalping involves short-term trades lasting seconds or minutes, targeting small intraday price movements for quick profits.

- Day trading, suitable for those averse to overnight risks, involves entering and exiting positions within the same day, relying on frequent small gains.

- Swing trading, with a timeframe spanning several days to weeks, allows traders to capture short-term market moves without constant monitoring.

- Position trading focuses on long-term price movements, spanning weeks to years, and utilises weekly and monthly charts to identify entry and exit points, disregarding minor fluctuations.

Can I use AI to create a trading strategy?

AI can be used to develop trading strategies. By employing AI algorithms to examine data and produce trading signals, traders can enhance their trading performance by executing more profitable trades with improved entry and exit points. Research has demonstrated that strategies for trading crypto powered by AI consistently deliver higher returns on investment than different trading strategies relying solely on human decision-making.

Is cryptocurrency trading legal?

The legality of cryptocurrency trading is determined by the country in question. Numerous jurisdictions permit cryptocurrency trading, provided individuals adhere to regulatory frameworks and comply with existing financial laws. Certain countries have embraced cryptocurrencies and implemented well-defined regulations, while others may have more unclear or stringent policies. To ensure compliance with local regulations, individuals must conduct research and comprehend the legal status of cryptocurrency trading in their respective countries. Moreover, those involved in cryptocurrency trading must stay informed about any regulatory changes, as regulations can evolve.

Where to start trading crypto?

Start trading crypto on StormGain by following these steps:

- Sign up with just your e-mail address and a secure password.

- Test and trade in a demo account to learn how to trade cryptocurrency.

- Deposit funds using your bank account. In as little as 5 minutes, you can deposit crypto using your bank card.

- Exchange your cryptocurrencies at the lowest rates. Deposit your crypto asset or buy it using a bank card and exchange it with the most popular currencies.

- Start cryptocurrency trading with leverage of up to 500x.

- Utilise free trading signals to trade confidently.