How to Make Money with Crypto in 2024

It's been over a decade since the first crypto coin was officially released. Since Bitcoin's price started to rise drastically, many people shifted their focus from traditional investing methods to a more innovative approach - cryptocurrency. The number of people eager to learn how to invest in crypto increases manifolds as the moment of Bitcoin halving approaches. Many users who have never ever thought about investing in crypto, have now started wondering, "How to start investing in crypto for beginners?" "How much money do you need to start trading crypto?" and "In what crypto should I invest to make a profit in 2024?" This beginners' guide to crypto investing reveals answers to these and many other questions. Let's dive in and explore how to make money with crypto.

Ways to Earn with Crypto

You've probably heard stories of crypto investors who earn $1,000 or more overnight. However, how do they know which crypto is good to buy at a particular moment? Besides investing in Bitcoin, Ethereum, and other popular digital assets, how can you predict which coin has the biggest potential for growth? Understanding cryptocurrency for beginners is vital for a good start.

Can I make money with crypto, as others do? You definitely can, provided you learn how to invest in crypto and which coins have a good future. Let's discover the most effective ways to make money with crypto and discuss all you need to know about crypto trading.

Mining

Traditional mining is one of the most popular ways of making money with crypto. To start earning passive income from mining, you must understand how it works.

To start mining, select a blockchain running on the Proof-of-Work consensus mechanism. Bitcoin is one of the most vivid examples without any slight exaggeration. However, it's also the most expensive example. If you are taking your first steps with mining, opting for cheaper alternatives like Dogecoin or Litecoin is better.

By mining, you provide computational power and electricity to the algorithm of the selected project. The algorithm, in turn, uses these resources to verify transactions and add new data blocks to the chain. As a result, miners earn rewards for their efforts.

Mining can be done through hardware or cloud mining services. However, it's important to note that mining is not the easiest way to start making money with cryptocurrency, especially if you are a beginner. Besides, it requires a lot of electricity, so you'd better weigh all the pros and cons before you decide to start mining passive income.

Cloud Mining

If you cannot afford Bitcoin mining at the start of your journey of learning cryptocurrency and ways of earning passive income, you may try cloud mining. This is a service provided by cloud mining companies, letting you borrow their computational power for a specific fee.

To start cloud mining, you must buy a mining plan to rent computational power. In exchange, you can use the computational power to earn rewards. Cloud mining is a great alternative to traditional mining. If you cannot afford to buy mining gear, you can rent it for a fee with cloud mining.

When comparing which of these two options—traditional mining or cloud mining—is better for beginners, cloud mining wins.

Trading

Trading is another popular way of making money with cryptocurrency. How to make money through trading cryptocurrency? This method suggests that you buy and sell cryptocurrency on exchanges and profit from price fluctuations. This method is risky, especially if you are a beginner. Ensure you learn the basics before you start.

To begin with, it's worth differentiating between long-term and short-term trading.

- As the name suggests, long-term trading indicates holding crypto assets for a long time. This method requires your patience and belief in the steady growth of the chosen crypto assets. Rather than just trusting the chosen coin's price will rise, you should base your choice on facts and research.

- Short-term trading involves quick buy and sell decisions, ranging from a few minutes to weeks.

Which method to choose? The answer depends on your trading goals, risk tolerance, and the time you can devote.

Long-Term Trading

Long-term trading involves buying and holding cryptocurrency for an extended period, often years. The choice of crypto assets for long-term trading should be grounded on thorough research.

If you opt for long-term trading, you must choose crypto assets with strong fundamentals, real use cases, and a promising future. It's better to rely on projects with solid teams behind them.

Once you choose the cryptocurrency to use for long-term trading, decide where you will store it. We recommend choosing StormGain as one of the most reliable and secure crypto exchanges with built-in crypto wallets.

Short-Term Trading

If you lack patience for long-term trading, you can try short-term trading. This is an exciting way of making money with crypto, where investors capitalise on rapid market shifts.

There are a few fundamentals to consider to succeed with short-term trading.

- First of all, cryptocurrencies are highly volatile. Traders should play safe in order not to become victims of price fluctuations. The goal of short-term trading is to learn how to make a profit daily and benefit from price rises and falls while still keeping risks in mind.

- The challenges of crypto trading should never be underestimated. The crypto market is well-known for its unpredictability, and losses happen frequently. To minimise the risks of being left without profits, short-term traders safeguard themselves by setting stop-loss orders. We've discussed them in detail in one of our previous guides. Feel free to check it out.

- Learning how to use technical analysis tools and how to read charts and indicators' signals plays a pivotal role in short-term traders' decision-making.

Whether you opt for the long-term or short-term trading method, staying well-informed about the latest news and trends in the cryptocurrency world is another key to correct decision-making. Timely information can help traders modify their decisions quickly. So, keep your hand on the pulse of the freshest news we publish on the StormGain blog.

Investing

Investing is another proven method of making money with crypto. There are plenty of investment opportunities you can choose from. For example, you can invest in individual coins like Bitcoin or ICOs, NFTs, etc. Investing is a great way to diversify your portfolio and spread your risk.

Let's learn how to invest in crypto by considering several popular investment channels.

Investing in DeFi Projects, NFT Tokens

First, consider investing in DeFi and NFT tokens. It can be a rewarding venue. However, like any other crypto investment, conduct thorough research to understand the dynamics.

Decentralised Finance (DeFi) is a blockchain-based financial service and product that operates independently from a centralised institution. To invest in DeFi, you commonly need to take the following steps:

- Set up a self-custody crypto wallet.

- Research and choose a DeFi project. You can choose from several DeFi projects with varying investment risks.

- Apply proper risk management strategies and diversify.

- Invest what you can afford to lose.

Also, consider investing in non-fungible tokens (NFTs). These are digital assets encrypted on blockchains with unique codes, differentiating them from each other. Here are the steps you need to take to invest in NFTs:

- Set up a crypto wallet funded with cryptocurrency compatible with the NFT platform.

- Choose an NFT marketplace like OpenSea, Binance, and Magic Eden.

- Buy an NFT at either a fixed-price or auction sale.

- If granted the right, you can mint a new one for sale or buy one from other creators and resell it.

Investing in ICOs and IEOs

When learning how to make money with crypto, the possibilities seem to be endless. They are!

ICOs and IEOs are two more opportunities for growing your investments. These are fundraising methods used by blockchain startups to secure their capital.

Initial Coin Offerings (ICOs) involve a company issuing new coins or tokens. Investors buy tokens during ICOs, believing the project will succeed and their investments will increase in value. If the project succeeds, early investors make big profits.

Initial Exchange Offers (IEOs) are similar to ICOs. The difference is that IEOs are conducted by exchange platforms. Investing in IEOs offers a certain degree of trust and safety since crypto exchanges commonly vet projects before letting them launch an IEO.

Whether you decide to invest in ICOs or IEOs, it's crucial to do your own research before making a decision. Ensure you look through the white paper of the chosen project. Also, consider learning more about the team behind it. Look for clear use cases.

Referral and Partnership Programmes

If you wonder how to make money from crypto without trading, consider joining a referral or partnership programme. It's common practice for companies in different industries to welcome more users to their community through affiliation, and crypto platforms aren't an exception.

Referral programmes are especially popular in the retail industry. However, crypto platforms use a similar approach. They let you sign up for a referral programme and earn your referral link. You earn a particular reward by sharing this link with others and making people click on it to sign up, purchase, or take a different action. It may be a commission or any other reward. This is a great way of making money with Crypti without trading or investing.

Holding or Hodling

Hodling is a strategy used explicitly in the cryptocurrency market. It involves buying crypto assets and holding them for a long time. The term was derived from a Bitcoin supporter's misspelling of the word "hold" in a 2013 Bitcointalk forum post. Since then, crypto fans have widely adopted it and turned it into an abbreviation, "Hold On for Dear Life."

The idea of hodling cryptocurrency is to benefit from long-term value appreciation. Hodlers believe in the future potential of a selected crypto asset.

However, hodling comes with its risks as well. There is no guarantee the price of the chosen crypto asset will increase over time. The value can be highly volatile, and you may lose more than you could gain.

Pros and Cons of Earning with Crypto

Is it worth investing in crypto? There are always two sides to a coin. When it comes to investing in crypto, there are both advantages and drawbacks for you to consider:

Pros | Cons |

Crypto transactions are anonymous. Your identity is kept private. | Cryptocurrency is highly volatile. Your investment can result in significant losses. |

Cryptos run on decentralised networks, which reduces the risk of technical crashes. | Although cryptos are safe, there are still risks of hacking and fraud. |

Proof of work and proof of stake consensus mechanisms secure crypto networks. | The evolving crypto regulatory environment can create uncertainty. |

You are given a wide selection of cryptos in which you can invest. | Crypto mining consumes a lot of energy. |

You can gain significant returns if the crypto's value increases. | Cryptos can be used for illegal purposes. |

Start Earning Today

This is how to make money with crypto in 2024. If you're considering earning money with cryptocurrency, the initial step is to conduct thorough research. It's crucial to comprehend the diverse forms of cryptocurrency, the different approaches to generating income with crypto, and their respective advantages and disadvantages. Once you have a solid grasp of these aspects, you can begin investing.

Equally important is finding a secure and dependable method for storing your cryptocurrency. Options include using a hardware wallet, software wallet, or an online exchange. Regardless of your choice, ensure that it offers high-security measures and instils trust in safeguarding your funds.

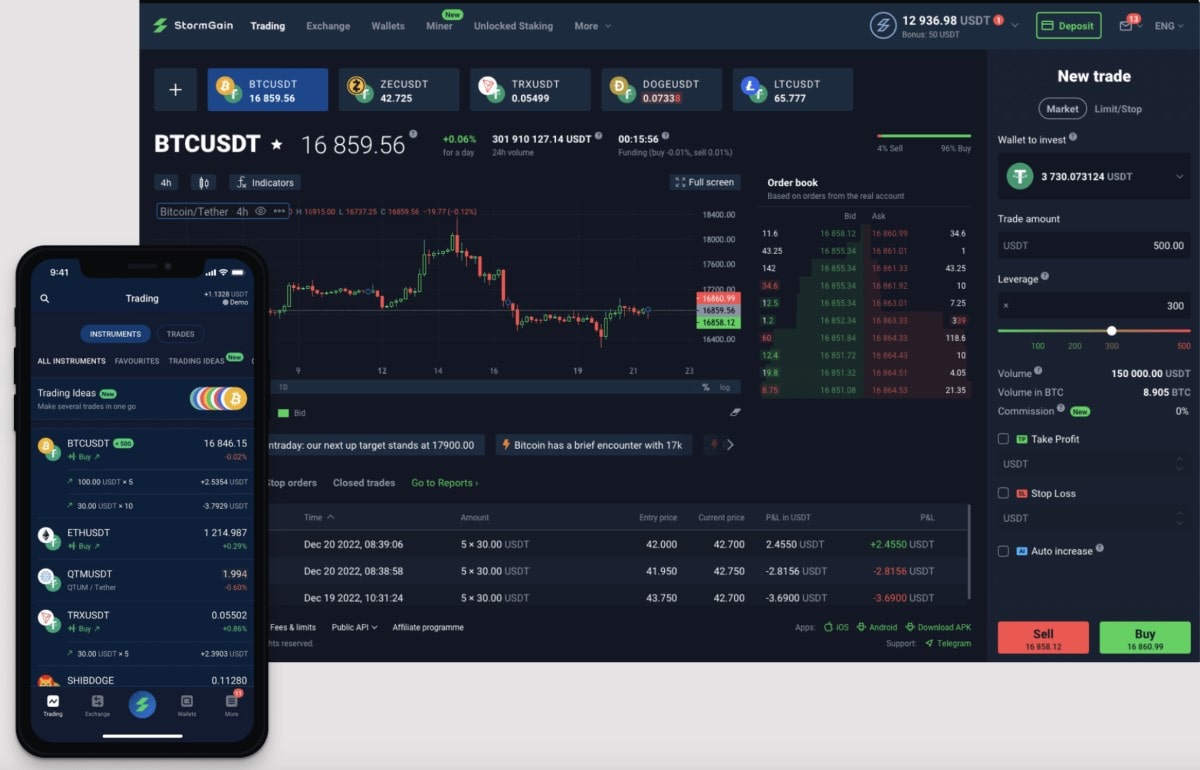

Why Users Choose StormGain

StormGain is a popular choice among crypto traders for several reasons:

- We offer up to 300x leverage for cryptocurrencies and even up to 500x leverage.

- We provide advanced trading tools and an impressive engine, making it a good choice for leverage traders.

- StormGain provides free trading signals to help traders make informed decisions.

- We also offer a free demo account with $50,000 worth of virtual funds for users to practice trading.

- StormGain has an efficient cloud-mining feature.

- We only charge trading fees on profitable trades.

- StormGain is designed to be user-friendly, making crypto trading more efficient.

While it's difficult to predict the crypto that will make you rich in 2024, the present-day market trends offer you a wide choice of investment opportunities. The price of the most popular crypto assets has increased recently, making them an appealing investment opportunity for short-term trading.

Whatever method to earn with crypto you select, always remember to do your own research before making an investment decision. Never invest more than you can afford to lose.

Learn and earn with crypto in 2024!

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.