UMA (UMA) coin price prediction for 2023, 2025 and 2030

Universal Market Access (UMA) has become one of the much-discussed crypto assets in 2023. With the growth of the cryptocurrency sector, various challenges have emerged, including scalability issues, network latency, and security risks. However, innovative solutions have been developed to address these issues on the blockchain. UMA coin is one such token that aims to tackle these challenges. This article discusses the UMA crypto price history, its potential in the crypto market, and UMA coin price predictions for 2023 and beyond.

What is UMA crypto?

UMA is a DeFi platform built on the Ethereum blockchain that enables users to create and customise synthetic assets to meet their specific financial needs. Synthetic assets are valuable financial contracts that mimic the performance of stocks, bonds, commodities, etc. UMA coin, an ERC-20 token, serves as the native and governance token of the UMA protocol, allowing holders to vote on proposals and price requests and stake their tokens.

The UMA protocol incorporates the Data Verification Mechanism (DVM) to ensure reliable verification of blockchain oracle data, preventing corruption and guaranteeing accuracy. The smart contract design of UMA relies on the participation of liquidators, token sponsors, disputers and UMA token holders. Liquidators and disputers are vital in monitoring synthetic asset price feeds and resolving disputes within the protocol. They help maintain sufficient collateral, margin balances and margin requirements. In case of liquidation, a token sponsor can dispute and challenge the liquidation within the initial two-hour window.

UMA Crypto History

The UMA project, founded in 2018 by Goldman Sachs traders Allison Lu and Hart Lumber, launched its token in 2020 and has since formed numerous partnerships. Risk Labs, the trademark owners of UMA, recently announced the launch of ETH tokens representing 500 major equity assets in the US. Collaborations with Blockchain Capital, Coinbase and Two Sigma have also contributed to UMA's growth.

UMA's protocol's strong and secure fundamentals have been key to its development. Notable news and developments include:

- In May 2021, UMA partnered with Yam Finance and crypto.com to release NFT products, expanding the user base and offering a wide range of product suites.

- UMA raised $2.6 million in July 2021 through the Range Token pilot, allowing market participants to use it as collateral and diversify their portfolio, reducing the risk of liquidation and increasing profit opportunities.

- In January 2022, UMA collaborated with Hats Finance, a decentralised cybersecurity protocol, to incentivise hackers who disclose vulnerabilities in the network by offering bounties for identifying possible attack areas.

- In February 2022, Polymarkets integrated UMA's optimistic oracle to provide immediate and decentralised solutions for information markets. This integration automatically enables the receipt and request of data types and the resolution of disputes among owed accounts. Polygon, an information prediction platform, supports polymarkets.

UMA (UMA) Overview

UMA offers a robust platform for DeFi developers to create synthetic assets whose value derives from the price fluctuations of the corresponding real-world assets. The creation of synthetic tokens entails using an ERC-20 collateral such as DAI, which must be at least 120% of the value of the newly generated tokens. For example, to create $200 worth of synthetic BTC coins, you must provide crypto collateral valued at $240. It's important to note that these tokens have an expiration date tied to the contract that created them. They can be bought or sold like any other ERC-20 token until expiration.

UMA Crypto White Paper

In December 2018, the original UMA white paper was published, outlining its platform as a service that provides financial contracts through synthetic assets. The project's initial goals included removing obstacles in financial markets, implementing restrictions on short selling and leverage, and tokenising financial risk using blockchain.

However, in April 2020, a second white paper was released. It focused on UMA's Data Verification Mechanism and Oracle service, which were based on economic incentives and security. This new documentation eliminated any mention of "synthetic assets". In the same month, UMA conducted its initial DEX offering (IDO), releasing 2 million UMA tokens into the market.

UMA Features

The UMA platform operates in three segments: Synthetic Token Builder, Data Verification Mechanism (DVM) and Governance Policy. The Synthetic Token Builder allows users to generate synthetic tokens by setting prices, expiry dates, and collateral requirements. The user initiating the smart contract is the facility owner, while another party, the sponsor, provides the necessary collateral.

The DVM is an oracle service that users can turn to when there's a dispute over the collateral value used in a contract. UMA incentivises token holders to verify the collateral value and call for liquidation if it falls below the desired level. The DVM also plays a role in conflict resolution, requiring the locking of UMA tokens to qualify as a valid disputer.

UMA token holders have governance control over the platform. When the Data Verification Mechanism is utilised, they vote to determine an asset's price. Additionally, token holders vote on system upgrades and can choose to discard or freeze smart contracts in exceptional circumstances. Token holders receive rewards for their active engagement during voting, with the sharing ratio determined by the amount of assets they hold on the UMA platform.

UMA Crypto Benefits

The UMA platform offers numerous benefits, including its unique ability to accept any asset as collateral for generating synthetic assets. For example, ETH can be used as collateral to process BTC synthetic tokens, which still accrue a 10% annual interest. The platform provides economic guarantees to secure smart contracts and enhance their immutability. Using the "priceless" model, UMA reduces reliance on oracles, resulting in fewer on-chain entries and increased security. The Priceless contract design is known for its fast generation of synthetic assets that replicate the value of any asset.

UMA Crypto Price Analysis

At the time of writing this UMA coin price prediction on 28 November 2023, the UMA crypto price was $1.79, with a daily trading volume of $6,634,516. The crypto UMA ranked #249 on CoinMarketCap, with the UMA coin market cap of $133,017,016, a circulating supply of 74,480,392 UMA, and a total supply of 116,018,606 UMA.

UMA crypto price statistics (as of 28/11/23)

Current price | $1.79 |

UMA coin market cap | $133,017,016 |

Circulating supply | 74,480,392 UMA |

Total supply | 116,018,606 UMA |

Daily trading volume | $6,634,516 |

All-time high | $43.37 (04/02/21) |

All-time low | $1.16 (25/05/20) |

Website |

UMA crypto price history

The UMA coin was introduced in April 2020 through an Initial Coin Offering (ICO) on Uniswap. During the ICO, UMA sold 2 million tokens at approximately $0.25 each. The total supply of coins was 100.13 million. The remaining coins were reserved for project pioneers, network programmers and future sales.

Currently, there are approximately 55 million circulating coins. Since its launch, the value of the UMA coin surged to around $1.5 in the following three months.

In late July 2020, UMA announced its yield dollar lending and borrowing service, causing the price to rise to $5.

The UMA crypto price rose throughout August 2020, reaching an impressive $28. However, it gradually declined throughout the rest of the year.

Early 2021 witnessed a crypto market boom, and UMA responded positively, reaching an all-time high of $43.37 on 4 February. However, it later decreased and closed 2021 at $8.93.

Unfortunately, 2022 was a tumultuous year for UMA and the cryptocurrency market. The collapse of the Terra (LUNA) blockchain in May and the bankruptcy of the FTX (FTT) exchange in November had a significant impact. UMA closed the year at $1.49, representing a substantial annual loss of nearly 85%.

So far, 2023 has been relatively uneventful for UMA despite recent improvements. The token exceeded $2 in February and spiked past $3 in May. However, the market hit when the United States Securities and Exchange Commission (SEC) sued the Binance and Coinbase exchanges in June. By 10 June, UMA dropped to $1.39 after Crypto.com (CRO) announced the suspension of its American institutional operations.

UMA experienced a rally in the following weeks and peaked at $1.81 on 28 July. However, news in August that Elon Musk's SpaceX sold a significant amount of Bitcoin (BTC) caused the market to decline. By 12 October, UMA was valued at just $1.24. Nevertheless, it increased to $1.76 later that day but dropped to about $1.45 on 17 October.

As of 28 November 2023, UMA is struggling to keep up with other cryptocurrencies. In the past seven days, it has decreased by almost -2.12%. Over the last month, the UMA crypto price has reduced by 16.513%, resulting in an average decrease of $0.3531. The price change over the past 90 days is approximately -13.06%, with a range between a minimum average price of $1.98 and a maximum average price of $2.21.

UMA/USDT price chart

UMA crypto technical analysis

Based on data from 28 November 2023, the general sentiment for UMA price prediction is bearish. The technical indicators suggest that UMA's 200-day SMA will decrease and reach $1.625931 by 27 December 2023. The short-term 50-day SMA is expected to reach $1.784366 by the same date. The Relative Strength Index (RSI) currently stands at 58.29, indicating a neutral position in the UMA market.

UMA Crypto Price in 2023

In 2023, the UMA token had a promising start, surpassing $2 in February and reaching over $3 in May. However, when the SEC sued Binance and Coinbase exchanges in June, the market took a hit. As a result, UMA dropped to $1.39 by 10 June following Crypto.com's announcement that it was suspending its American institutional operations.

Despite the setback, UMA gradually regained momentum and peaked at $1.81 on 28 July. Unfortunately, the market faced another blow in August when Elon Musk's SpaceX sold a significant amount of Bitcoin (BTC), causing UMA's value to decline to just $1.24 by 12 October. On 16 October, UMA started at $1.30 but experienced a 35% surge, reaching $1.76 later that day. However, by 17 October, the UMA crypto price had dropped to around $1.45.

Is UMA crypto a good investment?

It's difficult to determine if UMA is a worthwhile investment. The token has shown positive performance recently, but its long-term sustainability is still being defined. As with any cryptocurrency, thorough research is essential before considering an investment in UMA.

UMA (UMA) coin price prediction for 2023-2050

Now, let's consider the UMA coin price predictions for the short and long term, which should help us understand whether the UMA coin is a good investment or not.

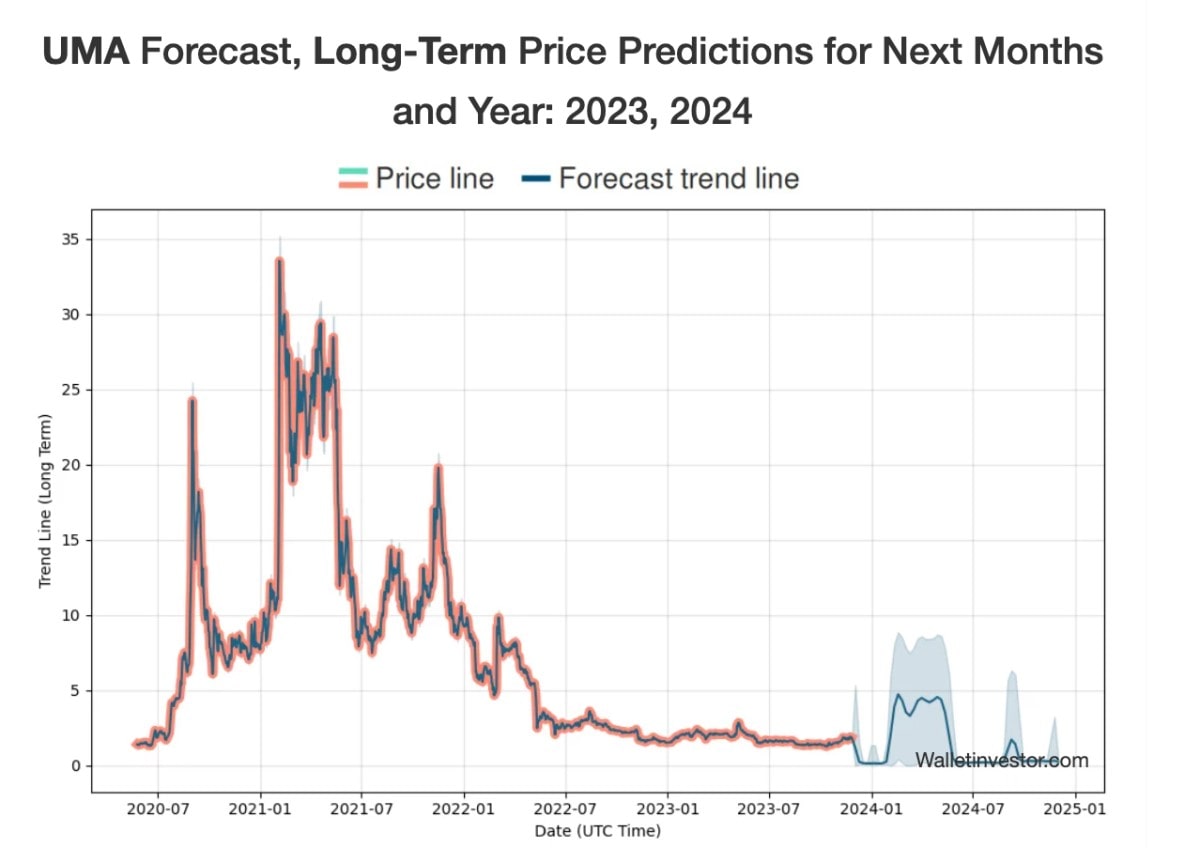

WalletInvestor UMA (UMA) coin prediction for 2023, 2025, 2030, 2040 and 2050

According to WalletInvestor's UMA (UMA) coin prediction, UMA's long-term investment outlook isn't favourable. WalletInvestor forecasts that the UMA crypto price will reach $0.186 by the end of 2023. Additionally, the UMA crypto price prediction for 2025 is expected to be $0.173; by 2028, the average crypto price is projected to be $0.0448.

Price Prediction UMA (UMA) crypto price prediction for 2023, 2025 and 2030

According to priceprediction.net, the UMA crypto price is expected to reach a minimum of $1.94 in 2023. The maximum price projection is $2.11, with an average price of $2.04 throughout the year. In 2025, the price of UMA is predicted to reach a minimum of $4.28. By 2030, the lowest possible price forecast for UMA is $29.28.

CoinCodex UMA (UMA) coin price prediction for 2023, 2025 and 2030

According to CoinCodex's UMA crypto price prediction, UMA is expected to decrease by 7.25% and reach $1.659449 by 2 December 2023. Based on UMA's historical price movements and BTC halving cycles, the estimated yearly low UMA price prediction for 2024 is $1.556835. For 2025, the projected UMA price ranges from $3.48 to $14.01. Looking ahead to 2030, the UMA price prediction falls between $10.04 and $12.71.

UMA (UMA) future forecast in general

Based on various predictions from reputable sources, the future forecast for UMA (UMA) appears to be mixed. According to WalletInvestor, the long-term outlook isn't favourable, with a projected UMA crypto price of $0.186 by the end of 2023. On the other hand, priceprediction.net suggests a more optimistic scenario, anticipating a UMA crypto price ranging from $1.94 to $2.11 in 2023 and reaching a minimum of $4.28 by 2025. CoinCodex provides a nuanced perspective, projecting a decrease to $1.659449 by December 2023, with a wide range of possibilities for 2025, varying from $3.48 to $14.01.

How high can UMA go?

Based on current trends and potential technological advancements, experts predict the UMA coin price could rise significantly in the coming years. By 2030, some experts estimate that the UMA coin could exceed a value of $29.28.

UMA crypto price prediction today

UMA's crypto price prediction today indicates that its price in 2024 is expected to reach $3.31. However, the price could vary between $3.97 and $2.65.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.