25.09.23 - 01.10.23

Last week results

Instruments:

Bitcoin witnessed price fluctuations over the past week, making two attempts to rise. Initially retracing, it eventually grew to the level of 27,000 and consolidated there.

▶️Bitcoin (BTC) marked a 3.54% gain, reaching $27,169 per coin on Friday, driven by increased demand. After months within the "accumulation zone" ($24,756 to $31,818 since March 2023), BTC has seen a change in holding patterns. According to data shared by Will Clemente of Reflexivity Research on X (formerly Twitter), hort-term traders liquidated holdings, while long-term holders increased stakes, leading to record Bitcoin holdings. Chart by Glassnode analytics confirm these changes. Long-term holders (defined as those holding Bitcoin Unspent Transaction Outputs (UTXOs) for over 155 days by Glassnode Academy) tend to be less engaged in swing or day trading, instead employing strategies like dollar-cost averaging or position trading. This shift towards long-term holding has culminated in record level holdings of Bitcoin. The increase in demand and reduced market volatility due to less frequent trading could be contributing factors to the recent rise in Bitcoin's price.

▶️Polkadot (DOT), a multi-chain platform, after a significant 92.91% decline from its peak, trades above the critical support level of $3.98, showing tightening price action. The current market setup, characterised by a descending triangle and bolstered by positive Relative Strength Index (RSI) and Awesome Oscillator (AO) indications, suggests a potential bullish breakout. The $4.31 level, which facilitated a 33% rally and an 11% bounce in mid-June, has emerged as a key hurdle for Polkadot. Overcoming this level could lead to a rally, targeting $4.80 and possibly even $5, should the market outlook turn bullish. However, Bitcoin's influence on altcoins is significant. A closure below the support level could invalidate the bullish trend, triggering a potential 7% crash to $3.70.

▶️Ethereum shows signs of life, experiencing a rebound with a 1.79% increase, reaching $1,619.4, which increases hopes and creates a bullish sentiment. Breaking through the 21-day Exponential Moving Average (EMA), whichis a crucial technical indicator, is a positive signal, hinting at a potential recovery. While the market remains unpredictable, this growth hints at the potential recovery of this widely used network and spurt stirs optimism among investors.

These week’s key events

Bitcoin witnessed price fluctuations over the past week, making two attempts to rise. Initially retracing, it eventually grew to the level of 27,000 and consolidated there.

▶️Bitcoin (BTC) marked a 3.54% gain, reaching $27,169 per coin on Friday, driven by increased demand. After months within the "accumulation zone" ($24,756 to $31,818 since March 2023), BTC has seen a change in holding patterns. According to data shared by Will Clemente of Reflexivity Research on X (formerly Twitter), hort-term traders liquidated holdings, while long-term holders increased stakes, leading to record Bitcoin holdings. Chart by Glassnode analytics confirm these changes. Long-term holders (defined as those holding Bitcoin Unspent Transaction Outputs (UTXOs) for over 155 days by Glassnode Academy) tend to be less engaged in swing or day trading, instead employing strategies like dollar-cost averaging or position trading. This shift towards long-term holding has culminated in record level holdings of Bitcoin. The increase in demand and reduced market volatility due to less frequent trading could be contributing factors to the recent rise in Bitcoin's price.

▶️Polkadot (DOT), a multi-chain platform, after a significant 92.91% decline from its peak, trades above the critical support level of $3.98, showing tightening price action. The current market setup, characterised by a descending triangle and bolstered by positive Relative Strength Index (RSI) and Awesome Oscillator (AO) indications, suggests a potential bullish breakout. The $4.31 level, which facilitated a 33% rally and an 11% bounce in mid-June, has emerged as a key hurdle for Polkadot. Overcoming this level could lead to a rally, targeting $4.80 and possibly even $5, should the market outlook turn bullish. However, Bitcoin's influence on altcoins is significant. A closure below the support level could invalidate the bullish trend, triggering a potential 7% crash to $3.70.

▶️Ethereum shows signs of life, experiencing a rebound with a 1.79% increase, reaching $1,619.4, which increases hopes and creates a bullish sentiment. Breaking through the 21-day Exponential Moving Average (EMA), whichis a crucial technical indicator, is a positive signal, hinting at a potential recovery. While the market remains unpredictable, this growth hints at the potential recovery of this widely used network and spurt stirs optimism among investors.

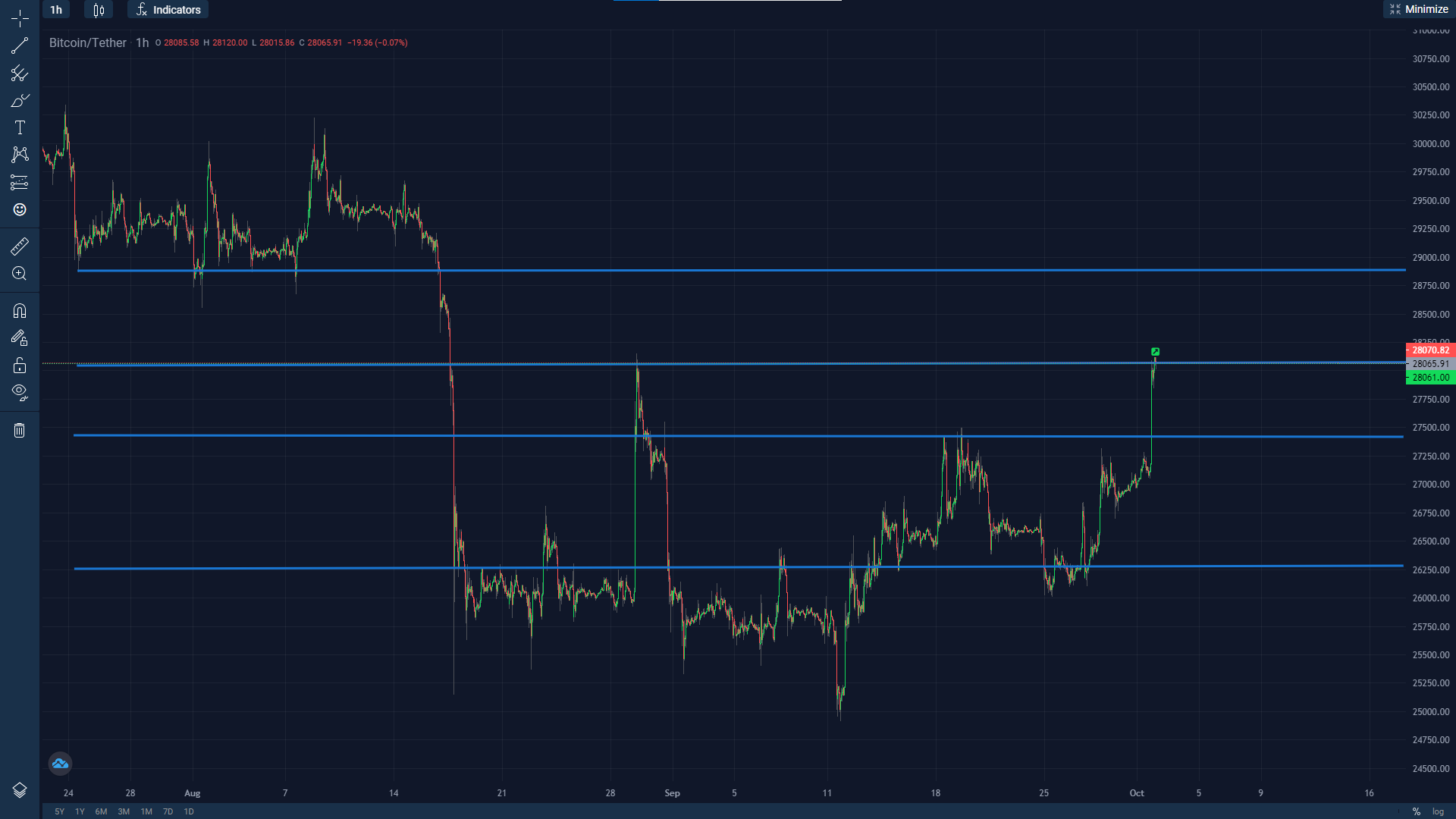

📈 BTC: Holds on to the Verge of Decline

💡 3 reasons to trade BTC now:

🔹Possibility to open a trade with a short stop loss while market is calm.

🔹Readable historical levels to set an objective goal.

🔹Formation of an upward trend for long-term transactions.

💡 Technical analysis: In increasing upward movement, the best strategy is to open trades during a price reversal or level breakout, placing the stop loss close to the level. However, the profit-risk ratio may not always be very lucrative.

Long Strategy: Open a buy trade if the price rises to $28,220. Set a Stop Loss at $27,820 and a Take Profit at $28,790.

Short Strategy: Open a trade if the price falls to $28,070 and forms a reversal pattern. Place a Stop Loss at $28,260 and a Take Profit at $27,470.

❗️ Seize this opportunity to make informed decisions in the market.

Translated by an automatic translation system.

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.