06.02.23 - 12.02.23

Last week results

Instruments:

The week's top gainers: The past week was accompanied by a downtrend. Bitcoin has formed reversal candlestick configurations on large scale charts, confirming the downward movement. At the same time, the trend develops with sharp falling impulses and very short corrections. There aren’t indications for a price reversal upward by the end of the week.

What happened last week :

▶️ Tether Puts $700M of Net Profit in Q4/2022 to Reserves

▶️ Binance temporarily halted withdrawals of stablecoin USDC as investor concerns mount after FTX collapse

▶️ U.S. SEC targets crypto 'staking' with Kraken crackdown

These week’s key events

The week's top gainers: The past week was accompanied by a downtrend. Bitcoin has formed reversal candlestick configurations on large scale charts, confirming the downward movement. At the same time, the trend develops with sharp falling impulses and very short corrections. There aren’t indications for a price reversal upward by the end of the week.

What happened last week :

▶️ Tether Puts $700M of Net Profit in Q4/2022 to Reserves

▶️ Binance temporarily halted withdrawals of stablecoin USDC as investor concerns mount after FTX collapse

▶️ U.S. SEC targets crypto 'staking' with Kraken crackdown

📈 BTC consolidate

As expected last week, Bitcoin broke the support line of the uptrend and fell down the width of this trend. It is premature to say with confidence that the price will only go down now. Indeed you need to give priority to sell deals, but do it carefully.

💡 3 reasons to trade BTC now:

🔹Downtrend is the best opportunity to earn money as fast

🔹 A lot of levels are built by last extremums and it can be used correctly to place Stop Loss and Take Profit orders.

🔹 If your strategy involves buy and hold, then the price to buy looks attractive.

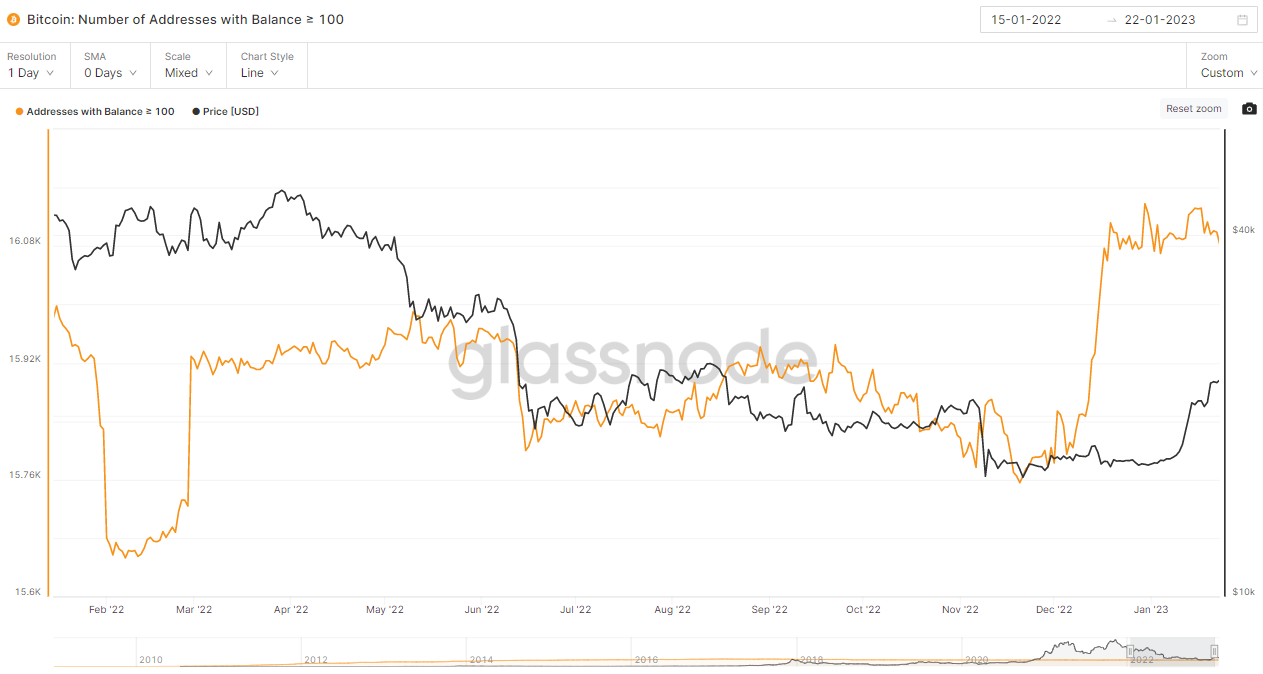

BTC:The number of unique addresses holding at least 100 coins.

🔹Technical analysis: The downtrend could be rejected if the price breaks 23000. When the price breaks through the support levels, you need to open sell deals. When the resistance levels are broken, you need to refrain from opening buy trades.

Long Strategy: We can open deal for current prices. About $22,110. We can apply a Take Profit at $22,330. The Stop Loss should be $21,710. But keep in mind that this deal will be counter trend so use less multiplier.

Short Strategy: We can open a short trade on price $21,700 or more safety on $21,400 when the resistance line will be broken. Place Take Profit at $20,700. A Stop Loss can be considered at $22,140.

❗️ Use this opportunity to make the right decision.

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.