18.07.22 - 24.07.22

Last week results

Instruments:

💡Bitcoin has dropped by 73% from its all-time highs and is now consolidating near $20,000. Right now, even the strongest and most resilient groups — both long-term holders and miners — are under huge pressure. The market is full of uncertainty, and the search for a bottom continues.

▶️ US inflation data turned out to be worse than expected and was another blow to Bitcoin. Inflation stands at 9.1%, and there's an increased chance of the US Federal Reserve performing a three- or even four-fold rate hike at its next meeting on 27 July. Right now, 71% of the market believes the interest rate hike will be 0.75% in one go, while 29% think it'll be a 1% increase.

▶️ Regulation of the crypto market is back on the agenda, putting additional pressure on BTC. The G20 supervisory body is expected to propose the first rules for global regulation of cryptocurrencies in October. The Bank of England believes cryptocurrencies should be regulated similarly to traditional finance. South Africa will also regulate crypto as traditional financial assets, and it won't be a means of payment.

▶️ The good news was that Grayscale plans to convert the GBTC BTC trust into a spot BTC ETF, which could take 2 years. Its launch in the US could be a big event for crypto markets. The conversion of the Grayscale Bitcoin Trust into a spot ETF traded on the NYSE will increase investor access to BTC. A previous Nasdaq survey showed that 72% of US financiers (who manage $26 trillion) would be willing to increase their Bitcoin investments if a spot BTC ETF were launched.

These week’s key events

💡Bitcoin has dropped by 73% from its all-time highs and is now consolidating near $20,000. Right now, even the strongest and most resilient groups — both long-term holders and miners — are under huge pressure. The market is full of uncertainty, and the search for a bottom continues.

▶️ US inflation data turned out to be worse than expected and was another blow to Bitcoin. Inflation stands at 9.1%, and there's an increased chance of the US Federal Reserve performing a three- or even four-fold rate hike at its next meeting on 27 July. Right now, 71% of the market believes the interest rate hike will be 0.75% in one go, while 29% think it'll be a 1% increase.

▶️ Regulation of the crypto market is back on the agenda, putting additional pressure on BTC. The G20 supervisory body is expected to propose the first rules for global regulation of cryptocurrencies in October. The Bank of England believes cryptocurrencies should be regulated similarly to traditional finance. South Africa will also regulate crypto as traditional financial assets, and it won't be a means of payment.

▶️ The good news was that Grayscale plans to convert the GBTC BTC trust into a spot BTC ETF, which could take 2 years. Its launch in the US could be a big event for crypto markets. The conversion of the Grayscale Bitcoin Trust into a spot ETF traded on the NYSE will increase investor access to BTC. A previous Nasdaq survey showed that 72% of US financiers (who manage $26 trillion) would be willing to increase their Bitcoin investments if a spot BTC ETF were launched.

📈 Bitcoin expecting an exit from consolidation

Bitcoin is trending upward, and BTC has consolidated above $21,000. It's quite a positive signal despite the pressure. Plus, it managed not to drop below $19,000.

Here are three reasons to buy Bitcoin right now:

🔹 Recently, there has been a lot of talk about forecasts of the future BTC price. There were heated discussions about how markets need to fall and hit bottom before they can rise again. Some say Bitcoin's price should be somewhere at $10,000-$14,000, a point at which most participants are ready to buy in and wait for an upward move. But the market usually moves against the crowd's expectations, and if that's the case now, we'll see some growth.

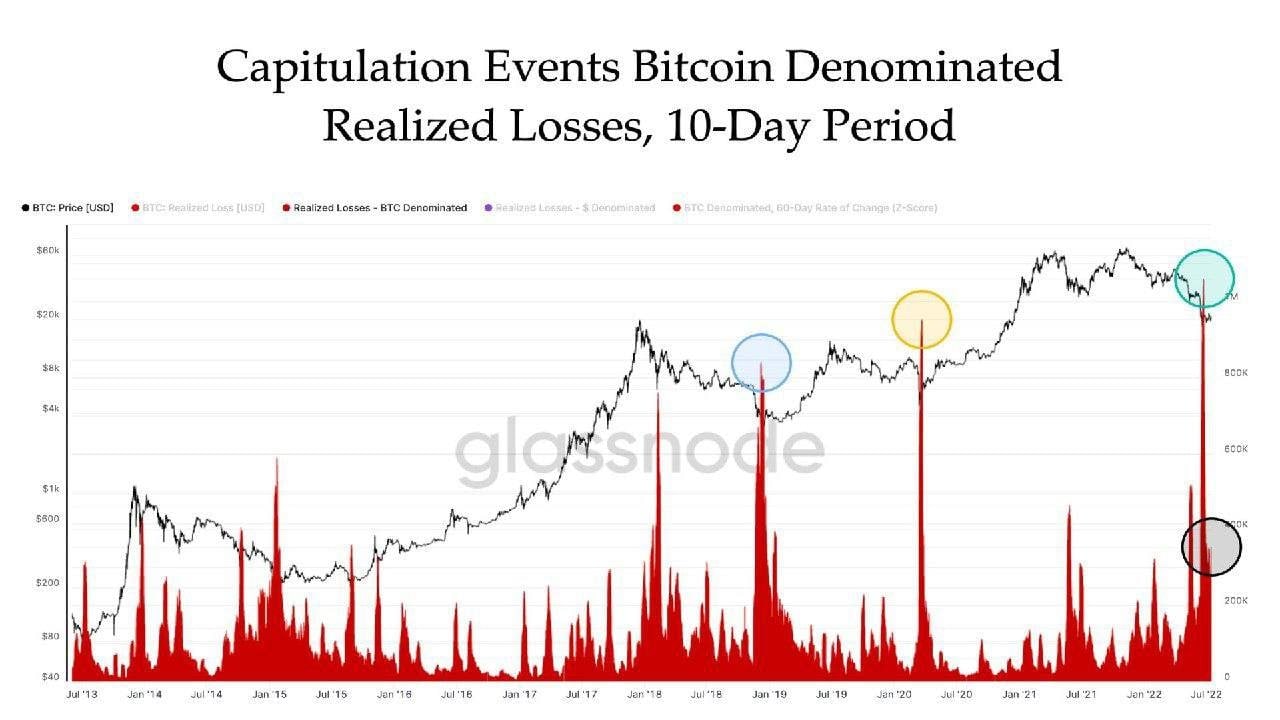

🔹 According to Glassnode, it's safe to say that the BTC market has gone through its most powerful capitulation in its history. Participants were actively using leverage and were selling their cryptocurrency at a loss at very low prices due to forced liquidations by exchanges. This event brought maximum pain to traders. Such events often signal a subsequent trend reversal because only buyers remain in the market when it runs out of sellers.

Fig. Realised Bitcoin losses on exchanges. Source: Glassnode

Fig. Realised Bitcoin losses on exchanges. Source: Glassnode

🔹 Technical analysis: Bitcoin has consolidated above the $21,000 level while forming an uptrend. This means we can expect further movement to the $22,000 mark (the local high as of 8 July 2022). If it crosses this point, it may be worth considering buying in with a target at $26,200.

❗️ Seize the opportunity and enter a position at the right time.

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.