19.09.22 - 26.09.22

Last week results

Instruments:

Another week came and went with mostly negative sentiment for cryptocurrency. Markets aren't very optimistic about the Ethereum Merge that took place on 15 September.

▶️ Investors are disappointed with ETH's switch to PoS. The cryptocurrency community is finding increasing evidence of a centralised system that threatens the stability of validators. Analysts note that four platforms control over 61% of staked Ethereum.

▶️ Additional pressure on cryptocurrencies came from US inflation data. Price pressure was higher than predicted, bringing back fears that the US Federal Reserve will raise rates fairly rapidly.

▶️ At the same time, cryptocurrency exchanges saw a significant increase in trading volume amid ETH's protocol switch, from $18.1 billion on 6 September to $28.6 billion. Almost half of that volume is from trades dealing with Ethereum.

These week’s key events

Another week came and went with mostly negative sentiment for cryptocurrency. Markets aren't very optimistic about the Ethereum Merge that took place on 15 September.

▶️ Investors are disappointed with ETH's switch to PoS. The cryptocurrency community is finding increasing evidence of a centralised system that threatens the stability of validators. Analysts note that four platforms control over 61% of staked Ethereum.

▶️ Additional pressure on cryptocurrencies came from US inflation data. Price pressure was higher than predicted, bringing back fears that the US Federal Reserve will raise rates fairly rapidly.

▶️ At the same time, cryptocurrency exchanges saw a significant increase in trading volume amid ETH's protocol switch, from $18.1 billion on 6 September to $28.6 billion. Almost half of that volume is from trades dealing with Ethereum.

📈 Bitcoin lingers at key support level

Bitcoin (BTCUSDT) failed to develop upward momentum. As a result, the cryptocurrency came under pressure and moved toward its June low to around $17,700. This level acts as key support that could contain the crypto coin's fall.

💡 3 reasons to buy Bitcoin now:

🔹 Major investment companies are showing an interest in cryptocurrencies. Charles Schwab, Citadel Securities and Fidelity Digital Assets, backed by venture capital firms Paradigm, Sequoia Capital and Virtu Financial, are preparing to launch the EDX Markets exchange, which will serve retail and institutional investors.

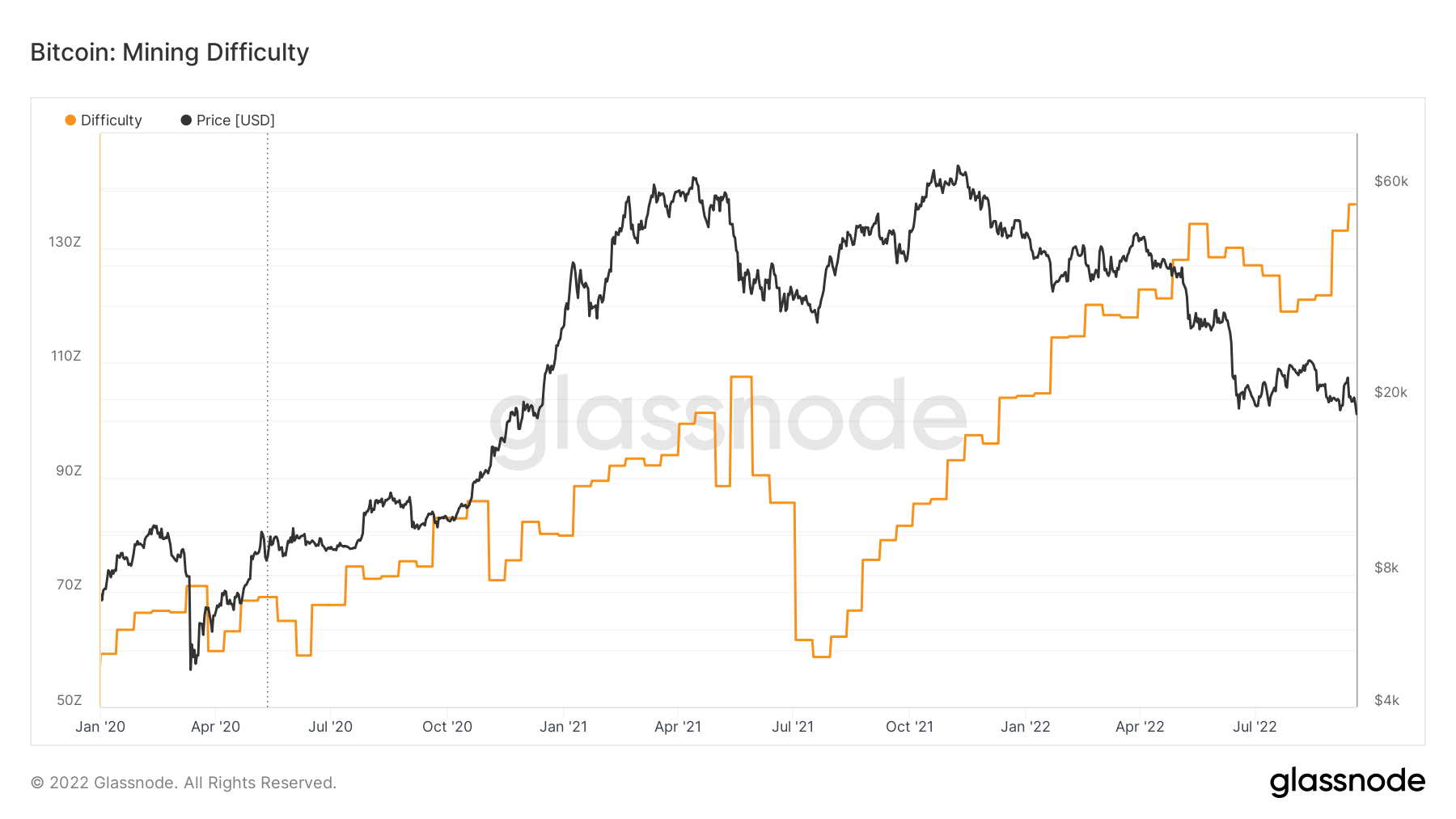

🔹 Bitcoin's mining difficulty has resumed its upward trend and reached a new high, just like the network's hash rate, which resulted in the next Bitcoin halving date being moved to an earlier date (from May 2024 to Q4 2023). Combined with increasing trading volume on exchanges, it could create a Bitcoin shortage and trigger an increase in prices.

Image Bitcoin mining difficulty. Source: Glassnode

Image Bitcoin mining difficulty. Source: Glassnode

🔹 Technical analysis: Focus on the $17,700 mark. If it holds, the price will be able to resume upward movement, with the nearest target at $20,600. As such, a rebound from this level should be seen as a buying opportunity.

❗️ Seize this moment to enter a favourable position.

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.