23.01.23 - 30.01.23

Last week results

Instruments:

The week's top gainers: After bitcoin surged to the 23,000 mark, it stopped and began to fluctuate in a range. One day the price rises, the next day the price falls. But at the same time, judging by the growing highs, maintaining a growing trend. And this means that intraday traders were able to trade up one day, down another day. And the bulls simply hold open trades in the hope of continuing the movement.

What happened last week :

▶️ The total value of the crypto market has exceeded $1 trillion for the first time since the FTX crash.

▶️ For BTC, which surged almost 40% in January, this was the best month since October 2021.

▶️ Amazon plans to launch its own NFT service.

These week’s key events

The week's top gainers: After bitcoin surged to the 23,000 mark, it stopped and began to fluctuate in a range. One day the price rises, the next day the price falls. But at the same time, judging by the growing highs, maintaining a growing trend. And this means that intraday traders were able to trade up one day, down another day. And the bulls simply hold open trades in the hope of continuing the movement.

What happened last week :

▶️ The total value of the crypto market has exceeded $1 trillion for the first time since the FTX crash.

▶️ For BTC, which surged almost 40% in January, this was the best month since October 2021.

▶️ Amazon plans to launch its own NFT service.

📈 BTC end of Bear Market or just a Bull Trap ?

The price constantly renews its highs confidently bouncing off the support levels. These are good opportunities to buy BTC at a better price.

💡 3 reasons to buy BTC now:

🔹The price is in the corridor, maintaining an upward trend. This means that in the long run you can open deals in growth or trade in any direction, but with intraday goals.

🔹 Shorting can be used, but doing so can be very dangerous since we might see another short squeeze.

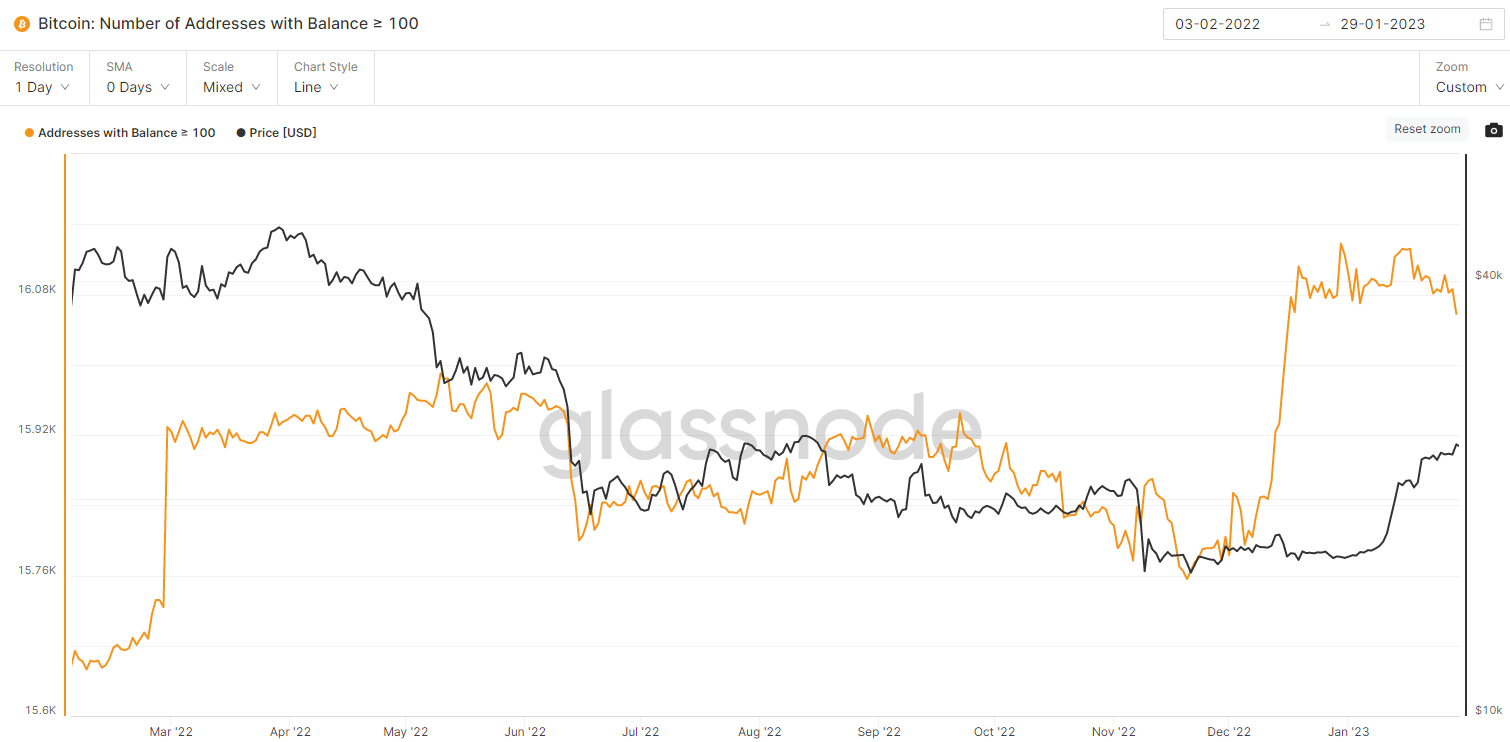

🔹 The number of unique addresses containing at least 100 coins has slightly decreased after a meteoric rise, but this is not significant.

BTC:The number of unique addresses holding at least 100 coins.

🔹Technical analysis: Updating resistance levels indicates the dominance of an uptrend. Buy from broken resistance levels and hold the trade according to your goals.

Long Strategy: We can open a long position if the price moves over $23,400, then we can apply a Take Profit at $24,600. The Stop Loss should be around $23,200.

Short Strategy: We can open a short trade at $23,800 and place our Take Profit at $23,200.. A Stop Loss can be considered at $24,050.

❗️ Use this opportunity to make the right decision.

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.