14.06.22 - 20.06.22

Last week results

Instruments:

Cryptocurrencies were under pressure from market-wide factors. The biggest drop happened at the weekend. Markets were assessing US inflation statistics, which continue to break records. In this context, US citizens have begun to withdraw more funds from the crypto market amid expectations of the Federal Reserve tightening its monetary policy.

A number of other central banks are also tightening their monetary policy. All of this hurts cryptocurrencies.

News emerged that the Celsius platform halted withdrawals. Its assets are included in the investment portfolio of the most capitalised stable coin, Tether (USDT). This event didn't add any optimism to the crypto market, either.

These week’s key events

Cryptocurrencies were under pressure from market-wide factors. The biggest drop happened at the weekend. Markets were assessing US inflation statistics, which continue to break records. In this context, US citizens have begun to withdraw more funds from the crypto market amid expectations of the Federal Reserve tightening its monetary policy.

A number of other central banks are also tightening their monetary policy. All of this hurts cryptocurrencies.

News emerged that the Celsius platform halted withdrawals. Its assets are included in the investment portfolio of the most capitalised stable coin, Tether (USDT). This event didn't add any optimism to the crypto market, either.

Bitcoin. Everything will be decided by the $20,000 mark

Bitcoin (BTCUSDT) moved out of the range, crossing its lower boundary. Technically, it means that the crypto may continue its downward movement. It has a significant support level of $20,000. Breaking below this level will open the path downward. However, there are several factors that suggest Bitcoin will bounce back from this level.

Here are four reasons to buy Bitcoin right now:

● Bitcoin prices are now below the cost of mining. It can't stay at these levels for long because otherwise, it wouldn't be economically viable to mine it, limiting supply.

● Against the backdrop of Bitcoin's fall, a large number of stable coin transfers to cryptocurrency exchanges was seen. Such transactions could indicate preparation by whales (i.e., large investors) to build up BTC positions.

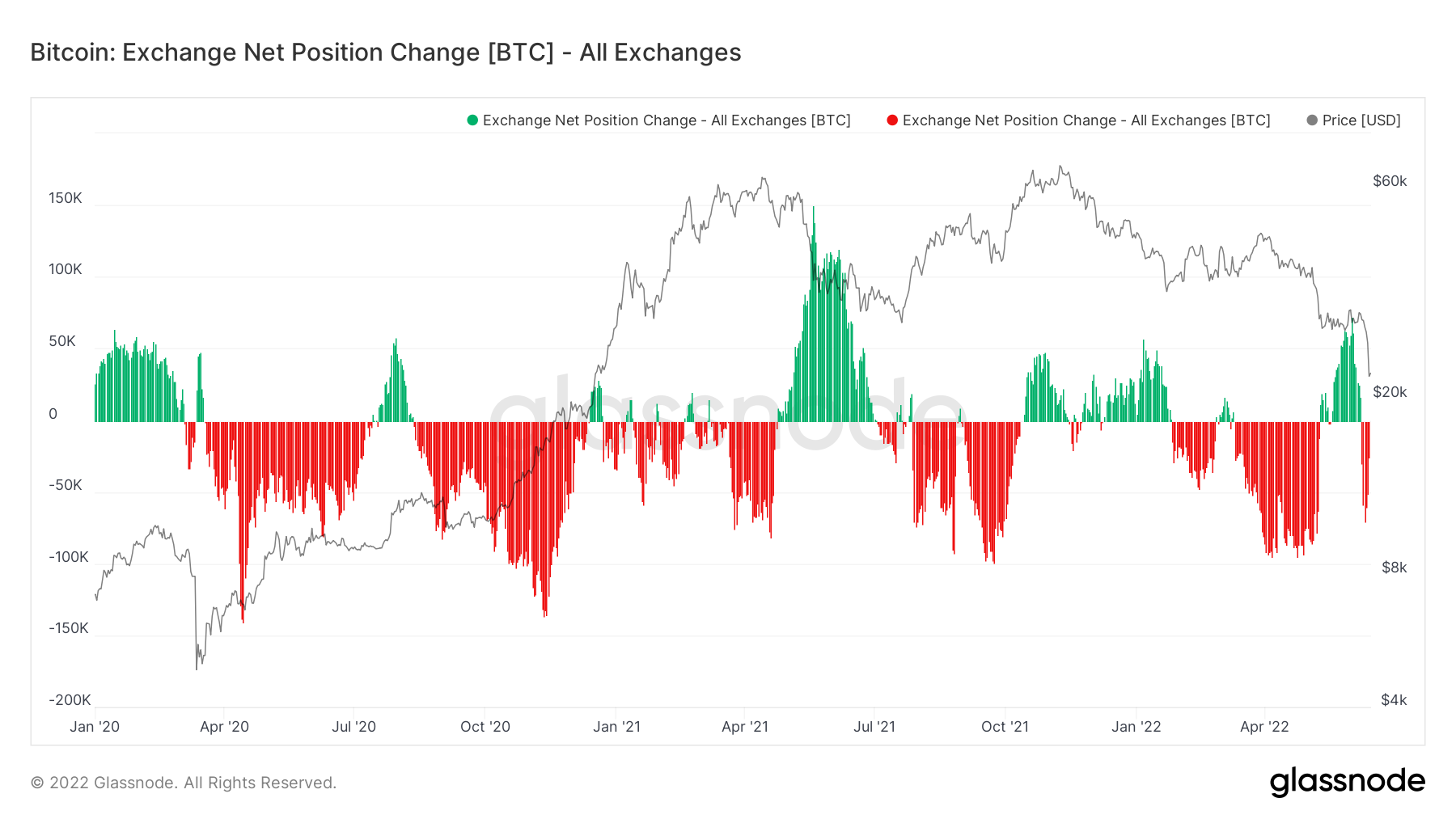

● Despite Bitcoin seeing its price drop, a net outflow of BTC continues to occur on the biggest exchanges. This movement confirms the potentially high demand for Bitcoin, which means that the overall balance of Bitcoin on exchanges is shrinking. That can cause a rise in prices.

Fig. Bitcoin exchange net position change. Source: Glassnode

Fig. Bitcoin exchange net position change. Source: Glassnode

● Technical analysis: Bitcoin is approaching the support level at $20,000. Consider positions only after the situation with the crucial support level has become clearer. A rebound from this level would allow the price to return to the $25,300 level. Otherwise, it may fall to $18,700.

Seize the opportunity and enter a position at the right time.

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.