20.06.22 - 27.06.22

Last week results

Instruments:

One factor weighing on cryptocurrencies was the US Federal Reserve's decision to declare a key interest rate hike of 75 basis points. Furthermore, the US regulator made it clear that it is preparing to tighten its monetary policy at every one of its remaining meetings in 2022.

Singapore-based hedge fund Three Arrows Capital, which has been a major investor in leading crypto projects, started to liquidate its assets in order to cover its liabilities.

Data from analytics company CoinMetrics indicates that cryptocurrency miners have started transferring their coins to crypto exchange wallets. This would suggest that they are converting cryptocurrency to fiat money in order to pay for their operational expenses.

These week’s key events

One factor weighing on cryptocurrencies was the US Federal Reserve's decision to declare a key interest rate hike of 75 basis points. Furthermore, the US regulator made it clear that it is preparing to tighten its monetary policy at every one of its remaining meetings in 2022.

Singapore-based hedge fund Three Arrows Capital, which has been a major investor in leading crypto projects, started to liquidate its assets in order to cover its liabilities.

Data from analytics company CoinMetrics indicates that cryptocurrency miners have started transferring their coins to crypto exchange wallets. This would suggest that they are converting cryptocurrency to fiat money in order to pay for their operational expenses.

Bitcoin displaying worrying signals

Bitcoin (BTCUSDT) probed the $20,000.00 level, but as of yet has not been able to gain a foothold below this key support. However, the original cryptocurrency has hit 17590.18. This is one of those worrying signals that would suggest that BTC is likely to continue its decline over the short term.

Here are 4 reasons to sell Bitcoin right now:

- A short-term dip below $20,000 would be an extremely worrying sign. Throughout its entire history, BTC has never fallen below the high of the previous bull cycle. This has now happened for the first time.

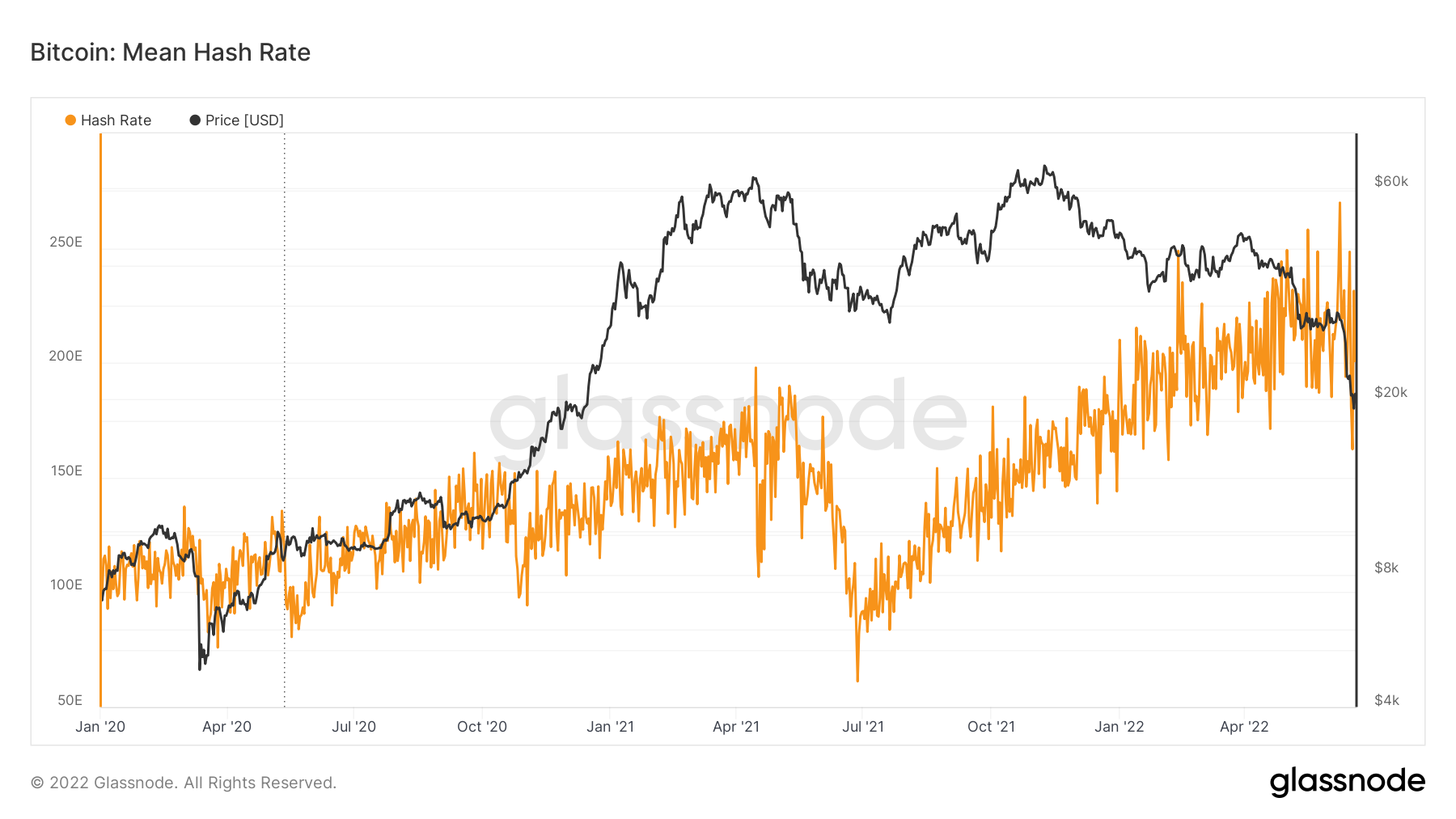

- Falling cryptocurrency prices led to a sharp decline in the network hash rate. This indicator has fallen 10.25% against the high reached on 14 June when the hash rate stood at 234 EH/s. That could negatively affect the network's reliability.

Fig. Bitcoin hash rate. Source: Glassnode

Fig. Bitcoin hash rate. Source: Glassnode

- Bitcoin is seeing net inflows to exchanges. This suggests that holders of the cryptocurrency are favouring a switch to fiat for various reasons. However, rising supply could have a further impact on crpyto prices.

Fig. Bitcoin transfers across all exchanges. Source: Glassnode

Fig. Bitcoin transfers across all exchanges. Source: Glassnode

- Technical analysis: should Bitcoin fall below 20,000, this would be interpreted as a short-term sell signal with a near-term target of 17,600.00. A decline below this local low would pave the way for a further drop to 13,000.00.

Seize this moment to buy in.

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.