16.05.22 - 23.05.22

Last week results

Instruments:

The critical event was the actual zeroing out of the Terra token's (LUNA) value, which lost 99.99% in just a few days. This event triggered the drop of all cryptocurrencies, given the loss of confidence in the entire crypto market. The reasons for the collapse are still unclear, and the community still stands to do an autopsy. Still, it's worth noting that Terra (LUNA) was one of the Top 10 cryptocurrencies by market capitalisation just 2 weeks ago.

The UST stablecoin was not backed by money or securities from the start. Its exchange rate was supposed to be supported by an algorithm, which issued coins of its sister cryptocurrency, LUNA, when the rate dropped. However, when UST prices began to decline, the algorithm didn't help. LUNA went into hyperinflation and saw its price drop from $85 to $0.005 in a matter of days. The project had a Plan B, a Bitcoin reserve fund, but its fate is now unknown. Major cryptocurrency exchanges have also delisted LUNA-linked derivatives.

These week’s key events

The critical event was the actual zeroing out of the Terra token's (LUNA) value, which lost 99.99% in just a few days. This event triggered the drop of all cryptocurrencies, given the loss of confidence in the entire crypto market. The reasons for the collapse are still unclear, and the community still stands to do an autopsy. Still, it's worth noting that Terra (LUNA) was one of the Top 10 cryptocurrencies by market capitalisation just 2 weeks ago.

The UST stablecoin was not backed by money or securities from the start. Its exchange rate was supposed to be supported by an algorithm, which issued coins of its sister cryptocurrency, LUNA, when the rate dropped. However, when UST prices began to decline, the algorithm didn't help. LUNA went into hyperinflation and saw its price drop from $85 to $0.005 in a matter of days. The project had a Plan B, a Bitcoin reserve fund, but its fate is now unknown. Major cryptocurrency exchanges have also delisted LUNA-linked derivatives.

Bitcoin remains under pressure

Bitcoin (BTCUSDT) remains under pressure and is testing last year's lows. After a dramatic collapse and a test of $25,400, its price rebounded and consolidated above $28,200. This indicates that large limit buyers have triggered, and an upward correction after the decline is likely to begin.

Here are three reasons to buy Bitcoin right now:

● Bitcoin has bounced back from its expected break-even zone. According to our analysis, the cost of mining it is currently $26,000. A prolonged presence of BTC below these levels would prevent most miners from making a profit, resulting in a capacity outage, a subsequent shortage and a rise in the asset's price.

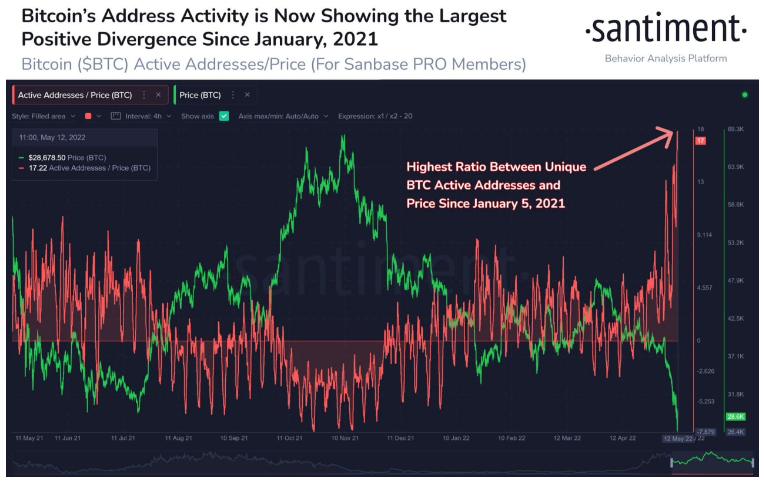

● Santiment notes a strong positive divergence between unique wallet activity and price. BTC network activity has surpassed the all-time highs of January 2021 while its price is still down. This factor has historically been a strong bullish signal.

Fig. Unique Bitcoin wallets activity. Source: Santiment

Fig. Unique Bitcoin wallets activity. Source: Santiment

● Technical analysis: After declining, Bitcoin rose sharply from $25,400 and consolidated above $28,200, forming a Doji reversal candlestick pattern on the daily chart. Its growth potential remains high, and this could be a good buying point, with the nearest target at $37,000.

Seize the opportunity and enter a position at the right time.

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.