16.05.22 - 23.05.22

Last week results

Instruments:

The head of the ECB, Christine Lagarde, noted that many people don't understand the risks of investing in cryptocurrencies. But she also expressed the need to regulate digital assets.

Swiss watchmaker Tag Heuer has started accepting payments in cryptocurrency in the US. It's the first brand from the LVMH group to authorise this new way of making payments. The list consists of 12 cryptocurrencies, including Bitcoin, Ethereum and Dogecoin.

Terra's fate will be decided on 25 May, when the vote regarding its fork will be finalised. It's currently supported by 85% of voters, but don't be excited just yet: many of the biggest validators still have to vote.

These week’s key events

The head of the ECB, Christine Lagarde, noted that many people don't understand the risks of investing in cryptocurrencies. But she also expressed the need to regulate digital assets.

Swiss watchmaker Tag Heuer has started accepting payments in cryptocurrency in the US. It's the first brand from the LVMH group to authorise this new way of making payments. The list consists of 12 cryptocurrencies, including Bitcoin, Ethereum and Dogecoin.

Terra's fate will be decided on 25 May, when the vote regarding its fork will be finalised. It's currently supported by 85% of voters, but don't be excited just yet: many of the biggest validators still have to vote.

Institutional investors show interest in Bitcoin again

Bitcoin (BTCUSDT) is approaching an important resistance level of 31,200. It's the first barrier that cryptocurrency needs to overcome to continue to rise. The cryptocurrency is currently around breakeven levels, so there's still a chance for growth.

Here are three reasons to buy Bitcoin right now:

● The cryptocurrency industry continues to attract institutional players, as evidenced by new investments in infrastructure. KuCoin has raised $150 million in a pre-Series B funding round. Citigroup and Wells Fargo have invested $105 million in the Talos crypto trading platform.

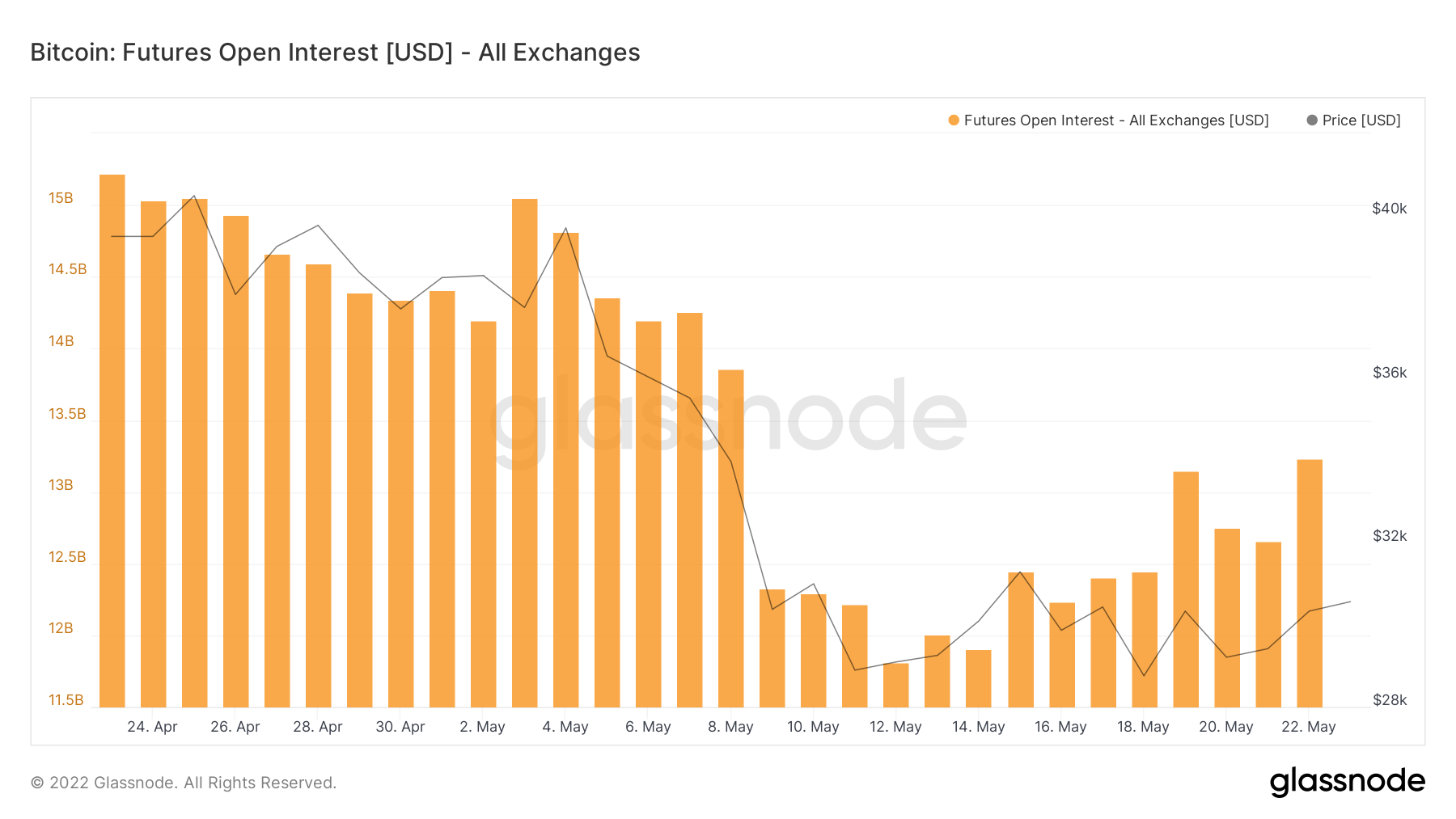

● The open interest indicator demonstrates an upward trend. This can be seen in investors' willingness to buy crypto dips in current conditions. Thus, it's worth expecting an increase in demand for Bitcoin from large buyers, which could support the price.

Fig. Open interest in Bitcoin futures. Source: Glassnode

Fig. Open interest in Bitcoin futures. Source: Glassnode

● Technical analysis: Bitcoin is moving towards the resistance level at 31,200. If we see a break above this level, it'll allow further growth to the next target price at 34,070.

Take advantage of this golden buying opportunity.

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.