27.06.22 - 04.07.22

Last week results

Instruments:

Crypto exchanges are making employees redundant, which is primarily bad news for the crypto market. Employee redundancies were seen at Bybit, Coinbase, Gemini and Bitpanda. At Vauld, a crypto exchange sponsored by Coinbase, 30% of employees were let go.

JPMorgan predicts that public mining companies and even private miners will continue to sell Bitcoin in the short term to cover their operational expenses.

One bit of positive news for the cryptocurrency market was a report that Binance is planning to launch Binance Institutional. The trading platform will focus on large investors: family offices, wealthy individuals, asset managers and hedge funds.

These week’s key events

Crypto exchanges are making employees redundant, which is primarily bad news for the crypto market. Employee redundancies were seen at Bybit, Coinbase, Gemini and Bitpanda. At Vauld, a crypto exchange sponsored by Coinbase, 30% of employees were let go.

JPMorgan predicts that public mining companies and even private miners will continue to sell Bitcoin in the short term to cover their operational expenses.

One bit of positive news for the cryptocurrency market was a report that Binance is planning to launch Binance Institutional. The trading platform will focus on large investors: family offices, wealthy individuals, asset managers and hedge funds.

Bitcoin sees no grounds for an upward push

Bitcoin (BTCUSDT) has so far been able to remain above $20,000. However, the cryptocurrency has no strong push towards growth. What's more, some on-network indicators show that this level will be tested again.

Here are 3 reasons to sell Bitcoin now:

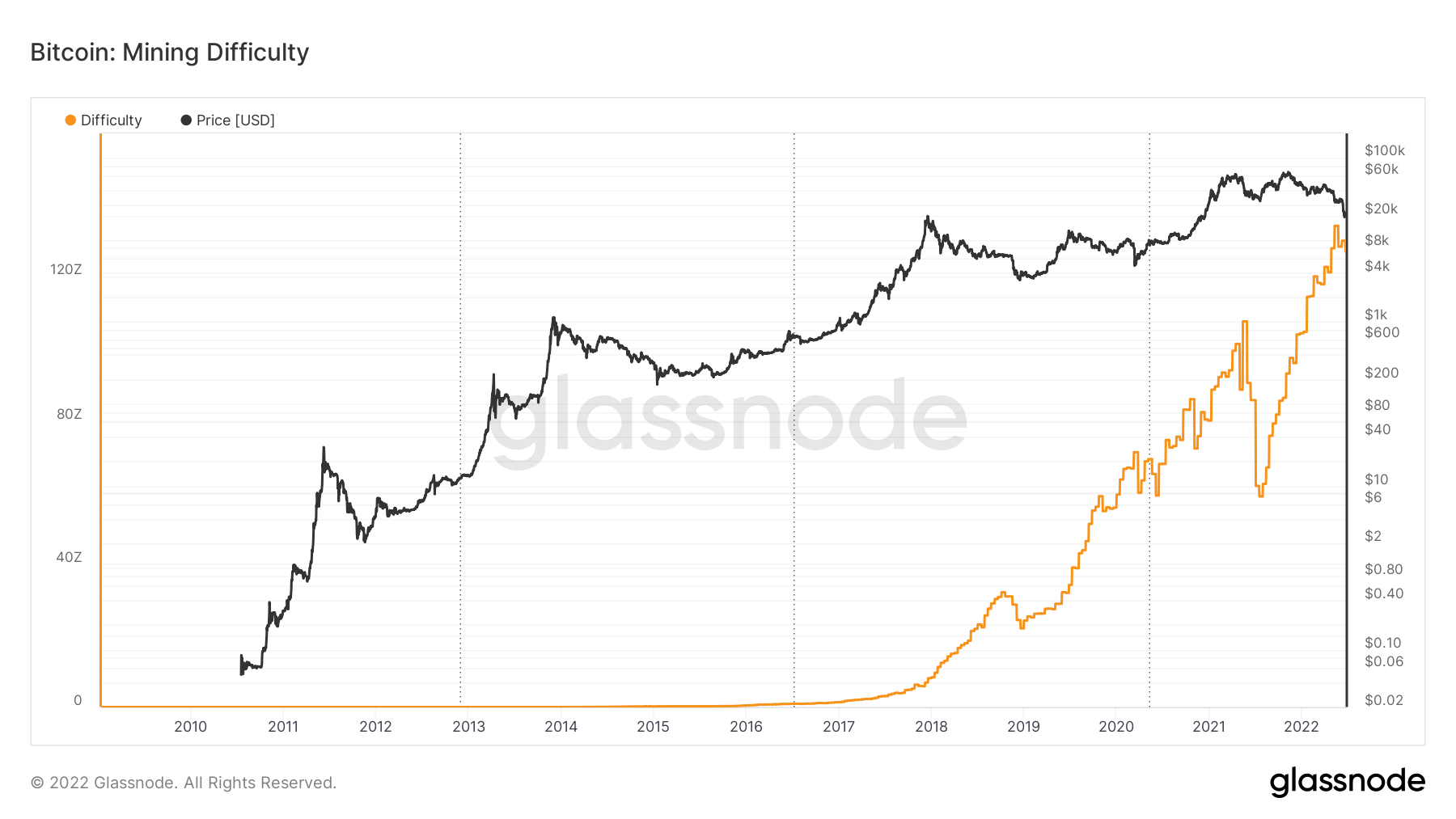

● Some mining companies have announced a move away from the strategy of accumulating mined BTC. They don't exclude the daily sell-off of mined BTC, which would increase the cryptocurrency's supply.

● The crypto's price drop led to a fall in BTC mining difficulty, which fell by 2.35%. This could also lead to an increased supply of the cryptocurrency, which would negatively affect its value.

Image Bitcoin mining difficulty. Source: Glassnode

Image Bitcoin mining difficulty. Source: Glassnode

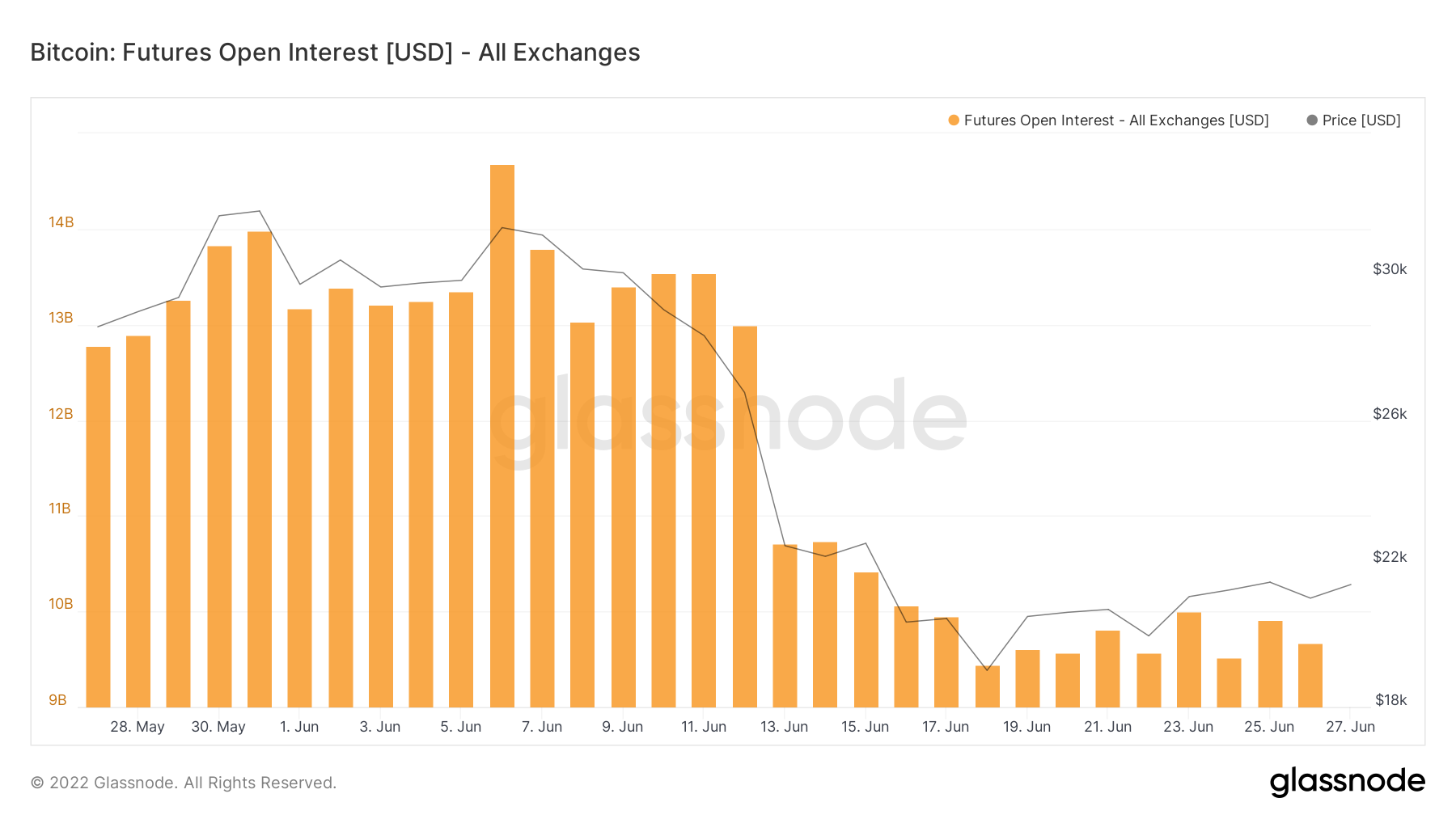

● Despite BTC's low price, institutional investors are rushing to buy it. We can see this in the indicator for open interest in Bitcoin futures. This phenomenon coincides with sentiments in traditional markets, which are seeing lower interest in risky assets.

Image Bitcoin futures open interest. Source: Glassnode

Image Bitcoin futures open interest. Source: Glassnode

● Technical analysis: Bitcoin is nearing the upper border of the range that it's primarily been in for the past 10 days. If the price doesn't manage to overcome this level, it could be advisable to open sell positions with a target at $20,000 and then $17,600.

Seize this moment to enter a favourable position.

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.