Feeling the pressure? How to stay calm when Bitcoin crashes

The holiday season was not kind to Bitcoin and other cryptocurrencies as the original coin dropped almost 20% over the last 30 days. BTC has been in steady decline since peaking in early November and is hovering around $43K at the time of writing. Where Bitcoin goes, the whole crypto market usually follows, and the price of everything from altcoins to NFTs all took a hit.

Longtime crypto hodlers may not be too fazed about this development, but if you're new to crypto, you might be concerned to see prices go down. If this is you, don't panic; there are many people in the same boat as you and plenty who have seen it all before, too. In 2020 and 2021, many individuals invested in crypto for the first time. StormGain reached over 1 million active users in 2021, part of a wider trend of new sign-ups to crypto platforms around the world.

For many new crypto holders, this could be their first experience of a temporary crash or even a bear market period. Crypto is not unique in this regard; it can happen with any investment. The most important thing is to manage the psychological pressure of playing the market so you can make rational, profitable decisions. Here are a few tips to help you weather the storm.

Look at the historical data

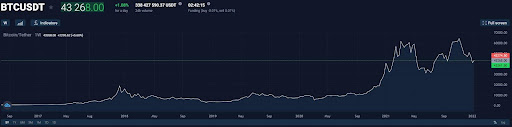

It's important in any investment to have a long-term perspective. Ask anyone who has been in the crypto space for years, and they'll tell you that Bitcoin's current price is far from a disaster. BTC only broke 40K for the first time back in January 2021. Bitcoin dipped even lower last summer to under $30K in July.

In 2020, BTC's price even dropped below $6K before going on to hit record highs later that year. BTC also faced a dramatic crash in 2018 that wiped out over 80% of its value. Nonetheless, when you look at the historical data, it confirms that it's still a great time for cryptocurrency, and veteran investors who held on or even bought through previous dips will be aware of this because of their long-term view.

BTC/USDT five-year chart: note the difference in 2021-22 to previous years

In fact, crypto's volatility is part of the appeal for many traders as it increases the profits that can be made by buying low and selling high. A crash can benefit traders, but they should be emotionally prepared to take advantage of them.

Mentally prepare for ups and downs

Cryptocurrencies are easy to invest in and a trendy topic in the news and among influencers who will draw attention to any market movement with all the drama and intensity that it takes to attract views in today's fast-paced news cycle. FOMO and greed, on one side, and fear on the other can lead to short-term investors rapidly buying in during moments of hype and selling off en-masse when frightened.

A multitude of things can affect this, from proposed government regulations to viral tweets from influencers, venture capital fads, etc. It's important to follow the market news, sure, but be aware that much of it is trying to play on your emotions.

New crypto traders need to accept that this isn't the first crash, and it won't be the last. If it's not currently the optimal time to sell BTC for profit, who says it needs to be done now? Look at everything that happens in the context of the long-term development of the currency and your personal needs. If you're not desperate to cash out, it might be better to simply wait for a better time or even accumulate. Make your decisions based on what the numbers mean to your own situation. Asset prices and media hype both go in cycles: you want to use them, not be used by them.

Make a plan

One of the best ways to save your mental health during market movements is to make a plan. Set aside the assets you want for long-term investing and which ones you can use to play around and take risks with. StormGain's crypto indices, for example, are good to leave untouched for a longer period as a hedge against volatility. Options, on the other hand, are good for speculation. For all your assets, decide for yourself in advance what prices you're comfortable buying/selling at. That way, when the ups and downs come, they're part of the plan rather than a shock.

Always be learning

Cryptocurrency is an emerging technology that is not always fully understood by new investors who entered to chase a trend. We can expect more developments that affect the price of BTC before it settles, but crypto adoption by individuals and institutions is steadily increasing, and it's not going away anytime soon.

The best way to position oneself in this adoption period is to learn as much as possible about crypto and its market context. It's not even necessary to risk your assets to turn a crash into a learning experience. StormGain's demo account, for example, lets you trade virtual crypto under real market conditions, allowing you to test ideas that can be put into play over the next market cycle. On top of that, StormGain also features a built-in education programme, with resources and webinars available to gain crypto knowledge that helps you make calm, rational decisions during any market situation.

Not a StormGain customer yet? Register now to try the demo account and access the tools you need to make a profit from crypto in 2022.

Tags

Exchange BTC

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Join StormGain

the most comprehensive platform for investing in crypto. Buy, store, trade, exchange, earn and learn about crypto in a single tap.

Register Now